Early Regulations 🕰️

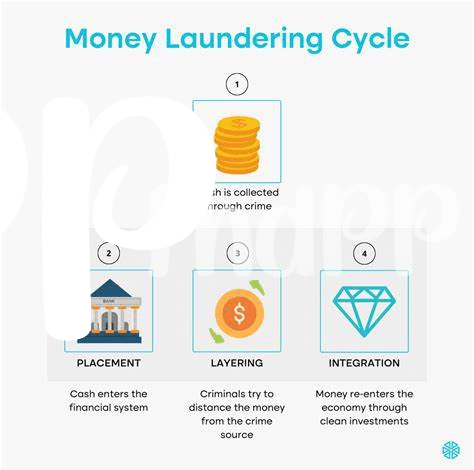

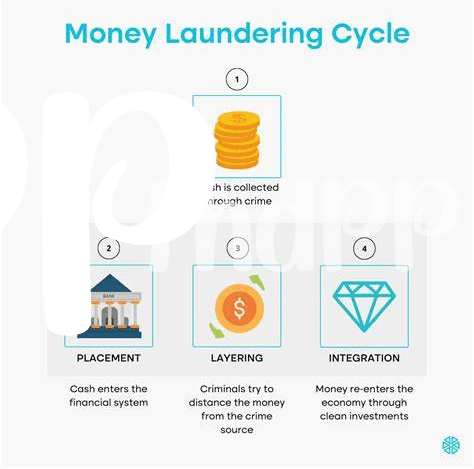

In the early stages of Bitcoin’s journey, regulatory frameworks were virtually non-existent, leaving a gray area for its use and exchanges. This lack of oversight raised concerns about potential misuse and financial risks. As the digital currency gained traction, authorities began recognizing the need for clearer guidelines to protect consumers and prevent illicit activities. The evolving landscape of early regulations set the foundation for future legal frameworks, shaping the course of Bitcoin’s integration into traditional financial systems.

Impact of Eu Directives 🇪🇺

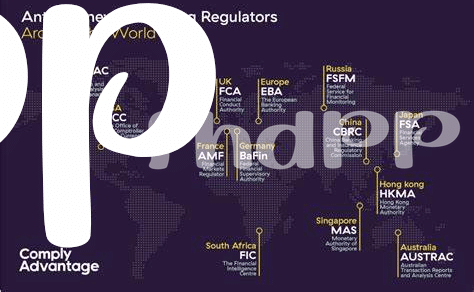

The European Union directives have played a significant role in shaping the landscape of Bitcoin AML laws in Italy. These directives have brought about a more cohesive approach to combating money laundering and terrorist financing activities within the cryptocurrency space. By harmonizing regulations across member states, the EU directives have provided a framework for Italy to align its AML laws with broader European standards. This alignment has not only enhanced the effectiveness of AML measures but has also fostered greater cooperation and information sharing among EU countries, ultimately strengthening the overall integrity of the financial system.

Italian Legislative Responses 🇮🇹

In response to the evolving landscape of cryptocurrency transactions, Italy has been actively updating its legislative framework to address the challenges posed by Bitcoin and other digital assets. The Italian authorities have recognized the need for clear regulations to combat illicit activities while fostering innovation in the blockchain space. These legislative responses aim to strike a balance between ensuring consumer protection and enabling the growth of the digital economy.

By enacting laws tailored to the specific nature of virtual currencies, Italy is positioning itself as a proactive player in shaping the future of financial regulations in the digital age. The country’s efforts in establishing a robust legal framework for cryptocurrencies reflect a commitment to staying ahead of the curve in adapting to the changing dynamics of the global financial system.

Challenges in Implementation 🤔

Challenges in implementing Anti-Money Laundering (AML) laws in the context of Bitcoin present a unique set of obstacles. The decentralized and pseudonymous nature of cryptocurrency transactions complicates traditional AML monitoring methods, requiring innovative solutions to effectively track and trace illicit activities. Compliance with complex regulatory frameworks such as the EU directives adds another layer of challenge for authorities and businesses alike, demanding a delicate balance between privacy concerns and regulatory requirements. Ensuring seamless integration of AML measures across different sectors and technologies is crucial for combating financial crimes in the rapidly evolving landscape of digital assets.

To delve deeper into the intricacies of Bitcoin AML regulations in various jurisdictions, including Ireland, check out this comprehensive guide on navigating the complexities of compliance: bitcoin anti-money laundering (aml) regulations in iceland.

Recent Updates and Amendments 🔄

In Italy, recent updates and amendments concerning Bitcoin AML laws reflect a growing awareness of the evolving nature of digital currencies. The regulatory landscape has been adapting to address emerging challenges and risks associated with the use of cryptocurrencies. These changes seek to strike a balance between enabling innovation in the financial sector and ensuring compliance with anti-money laundering requirements.

With a focus on enhancing transparency and security in the digital asset ecosystem, Italy has been proactive in updating its AML laws to keep pace with the advancements in blockchain technology. These developments signal a commitment to fostering a robust regulatory framework that fosters trust and confidence in the use of Bitcoin and other virtual currencies.

Future Outlook and Possibilities 🔮

In the realm of digital currencies, the future of Bitcoin AML laws in Italy holds a myriad of possibilities that are set to shape the landscape of financial regulations. As technology advances and global trends evolve, there is a growing emphasis on enhancing compliance measures to combat illicit activities in the crypto space. Italy’s regulatory framework is expected to undergo further refinements to adapt to the changing dynamics of the digital economy, fostering innovation while safeguarding against financial crimes. Collaborative efforts within the EU and insights from neighboring countries like India and Ireland’s Bitcoin anti-money laundering regulations can offer valuable perspectives for Italy to boost its AML capabilities and stay ahead of emerging challenges.

Please refer to the bitcoin anti-money laundering (AML) regulations in India for a comparative analysis with the bitcoin anti-money laundering (AML) regulations in Ireland.