Always Verify Counterparties’ Identities to Prevent Fraud 🕵️♂️

When engaging in Bitcoin transactions in India, one crucial aspect to prioritize is verifying the identities of your counterparties. This step is essential in preventing fraudulent activities and ensuring the legitimacy of the transactions you are involved in. By thoroughly vetting the identities of those you are dealing with, you can mitigate the risk of falling victim to scams or illegal activities within the cryptocurrency space. Taking the time to verify counterparties’ identities demonstrates a commitment to upholding AML compliance standards and safeguarding your financial transactions.

Stay Updated on Aml Regulations Specific to Bitcoin Transactions 💼

Staying informed about the ever-evolving AML regulations specific to Bitcoin transactions is crucial in navigating the cryptocurrency landscape. This proactive approach ensures compliance with legal requirements and enhances the overall security of transactions. By keeping abreast of the latest developments and changes in AML laws pertaining to Bitcoin, companies can adapt their operational practices accordingly, safeguarding against potential pitfalls and regulatory issues.

It is essential to continuously educate oneself and the team on AML best practices within the crypto industry. This ongoing learning process equips businesses with the knowledge and tools necessary to identify and address AML risks effectively. Furthermore, staying ahead of the curve in understanding AML regulations specific to Bitcoin transactions strengthens an organization’s compliance framework, fostering a culture of diligence and responsibility in combating financial crimes.

Implement Robust Transaction Monitoring and Reporting Systems 📊

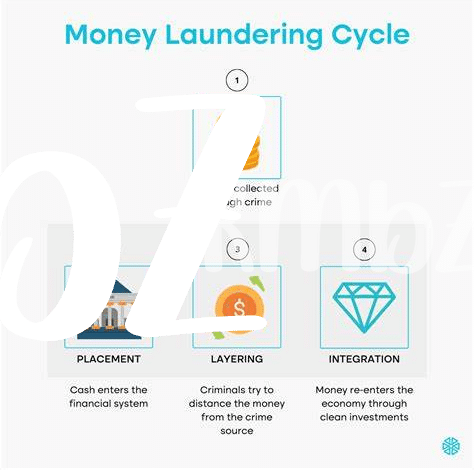

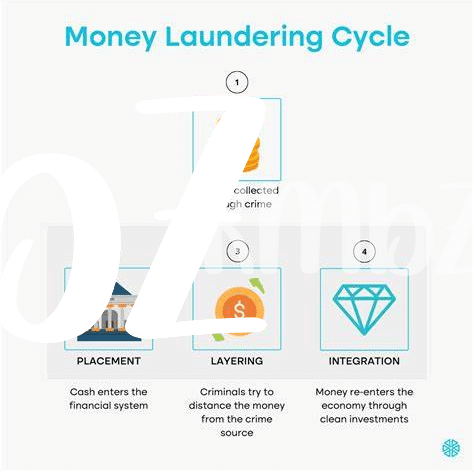

To effectively maintain AML compliance when dealing with Bitcoin transactions in India, it is crucial to establish robust transaction monitoring and reporting systems. These systems should be designed to continuously track and analyze all incoming and outgoing transactions, flagging any suspicious activities for further investigation. By implementing such a system, companies can proactively detect and prevent money laundering and other illicit activities within their Bitcoin operations, ensuring a higher level of regulatory compliance and protection against financial crimes.

Educate Staff on Aml Best Practices in the Crypto Industry 📚

When it comes to navigating the complexities of AML compliance within the crypto industry, educating your staff on best practices is crucial. By providing comprehensive training on recognizing suspicious activities and understanding the unique challenges of AML in the realm of Bitcoin transactions, you empower your team to be vigilant in safeguarding against illicit financial practices. Ensuring that every member is well-versed in AML guidelines specific to cryptocurrencies not only enhances your company’s compliance efforts but also cultivates a culture of accountability and integrity within your organization.

To delve deeper into the key considerations for implementing AML policies in the Bitcoin sector, particularly in Ireland, check out this informative resource on bitcoin anti-money laundering (AML) regulations in Ireland. It provides invaluable insights that can further enrich your approach to AML compliance in the evolving landscape of digital currencies.

Conduct Regular Aml Audits to Ensure Compliance ⚖️

Regular AML audits are essential in the cryptocurrency industry to maintain compliance and safeguard against potential risks. By conducting these audits on a consistent basis, companies can ensure that their AML processes are effective and up-to-date. This proactive approach not only helps in identifying any potential gaps in the system but also demonstrates a commitment to transparency and regulatory compliance. Engaging in regular AML audits not only satisfies regulatory requirements but also contributes to building trust with customers and stakeholders, showcasing a dedication to ethical business practices in the rapidly evolving landscape of digital currencies.

Collaborate with Aml Experts for Guidance and Support 🤝

Collaborating with AML experts for guidance and support can be instrumental in navigating the complexities of compliance in the Bitcoin space. These professionals bring a depth of knowledge and experience that can help your organization stay ahead of regulatory changes and emerging risks. By working closely with AML experts, you can ensure that your compliance efforts are aligned with industry best practices and tailored to the unique challenges of dealing with Bitcoins in India.

Bitcoin Anti-Money Laundering (AML) regulations in Haiti with anchor Bitcoin Anti-Money Laundering (AML) regulations in Iraq.