Overview of Bitcoin Aml Laws in Ireland 🌍

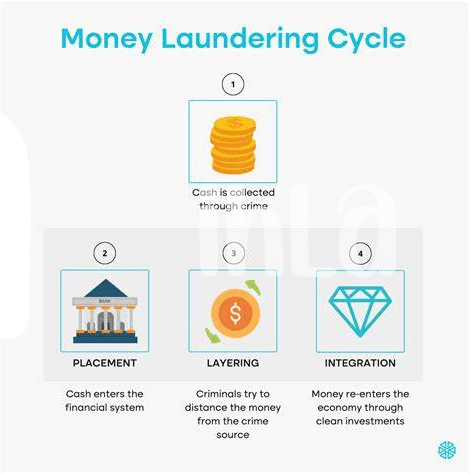

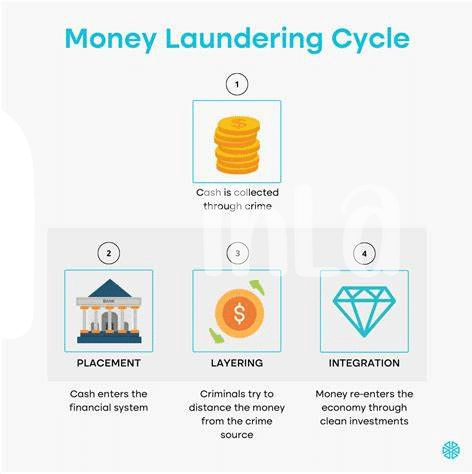

Ireland has established a regulatory framework for Anti-Money Laundering (AML) laws concerning Bitcoin, aiming to mitigate risks and enhance transparency within the cryptocurrency sector. These laws require virtual asset service providers operating in Ireland to adhere to strict AML/CFT (Combating the Financing of Terrorism) regulations, including customer due diligence, record-keeping, and reporting of suspicious activities. By aligning with international standards, Ireland seeks to promote a secure environment for cryptocurrency transactions while combating illicit financial activities.

Comprehensive knowledge of Bitcoin AML laws in Ireland is essential for businesses and individuals involved in cryptocurrency activities to ensure compliance and build trust within the industry. Understanding the nuances of these regulations will not only safeguard against potential legal repercussions but also contribute to the credibility and sustainability of the evolving digital asset landscape in Ireland and beyond.

Key Regulatory Challenges Faced by Crypto Businesses 💼

Key Regulatory Challenges Faced by Crypto Businesses 💼: In navigating the complex landscape of cryptocurrency, businesses encounter regulatory hurdles that demand strategic responses. Compliance with evolving regulations while ensuring operational efficiency remains an ongoing challenge. Furthermore, the global nature of the crypto market complicates regulatory oversight, leading to uncertainties and varying requirements across jurisdictions. Maintaining transparency and accountability in financial transactions poses a significant regulatory challenge for crypto businesses, requiring a delicate balance between privacy and compliance. The need for robust security measures to prevent illicit activities adds another layer of complexity to regulatory compliance in the cryptocurrency sector.

Compliance Strategies for Navigating Aml Laws 💡

Navigating the landscape of AML laws in the cryptocurrency space requires a deep understanding of regulatory requirements and a proactive approach to compliance. Implementing robust KYC (Know Your Customer) procedures is crucial in verifying the identities of individuals engaging in cryptocurrency transactions. Utilizing advanced transaction monitoring tools can help identify suspicious activities and ensure adherence to AML regulations. Additionally, establishing clear internal policies and procedures, along with conducting regular training for employees, can enhance awareness and compliance within crypto businesses. Building strong relationships with regulatory bodies and staying abreast of evolving AML guidelines are essential components of effective compliance strategies in the dynamic world of cryptocurrency.

Impact of Aml Regulations on Cryptocurrency Adoption 📉

The impact of AML regulations on cryptocurrency adoption is significant. As these regulations become more stringent, many individuals and businesses may feel hesitant to get involved in the crypto space due to compliance concerns. This could potentially slow down the rate at which cryptocurrencies are adopted on a wider scale. However, by implementing effective compliance strategies and staying informed about the regulatory landscape, the crypto community can work towards ensuring that AML regulations do not hinder the growth and acceptance of digital currencies. Staying ahead of these regulations is crucial to fostering a secure and compliant environment for all participants in the cryptocurrency ecosystem. To learn more about best practices in combating money laundering in Bitcoin, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Haiti.

Case Studies Highlighting Aml Compliance Best Practices 📊

– Description of case studies showcasing effective AML compliance strategies within the cryptocurrency industry will provide valuable insights for businesses aiming to navigate regulatory requirements successfully. By analyzing real-world examples of best practices, readers can gain a practical understanding of key principles and approaches that have yielded favorable outcomes. These case studies offer a glimpse into the challenges faced by various crypto companies and how they have addressed AML concerns proactively. Through a narrative lens, these examples serve as educational tools that illustrate the importance of robust compliance measures and the tangible benefits they can bring in terms of regulatory adherence and business sustainability. Overall, delving into specific instances of successful AML compliance elucidates the nuances of regulatory processes and the significance of tailored approaches for mitigating risks effectively within the dynamic landscape of digital assets and financial regulations.

Would you like me to assist with anything else?

Future Trends in Bitcoin Aml Laws and Enforcement 🚀

In the rapidly evolving landscape of Bitcoin Aml laws and enforcement, staying ahead of emerging trends is crucial for cryptocurrency businesses. As regulatory authorities adapt to the dynamic nature of virtual assets, future trends are expected to focus on enhancing transparency, strengthening compliance measures, and fostering international cooperation. The convergence of technology and regulatory frameworks will likely shape the implementation of more robust AML practices, requiring industry players to proactively adapt and innovate. Embracing cutting-edge solutions and frameworks will be essential for navigating the increasingly complex regulatory environment with confidence and agility. For further insights into global AML regulations, explore the bitcoin anti-money laundering (AML) regulations in Iraq with the anchor “bitcoin anti-money laundering (AML) regulations in Hungary.”