Regulatory Hurdles 🚧

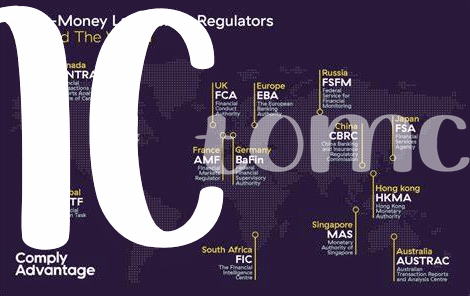

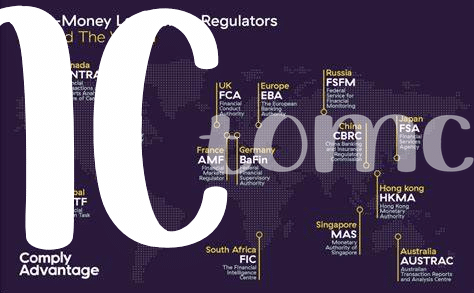

Navigating the complex web of regulations surrounding Bitcoin transactions in Iceland can often feel like trying to find a path through a maze. The ever-evolving landscape of regulatory hurdles 🚧 presents a significant challenge for businesses and individuals looking to engage in cryptocurrency transactions. Understanding and complying with these regulations is crucial to avoid legal pitfalls and ensure the smooth operation of Bitcoin activities in the country. It requires a combination of diligence, expertise, and adaptability to overcome these hurdles and establish a secure and compliant framework for cryptocurrency transactions.

Compliance Struggles 💸

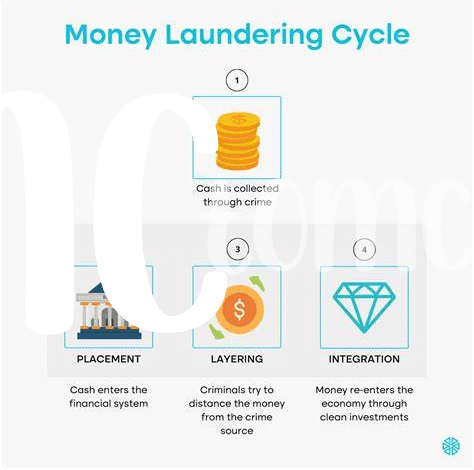

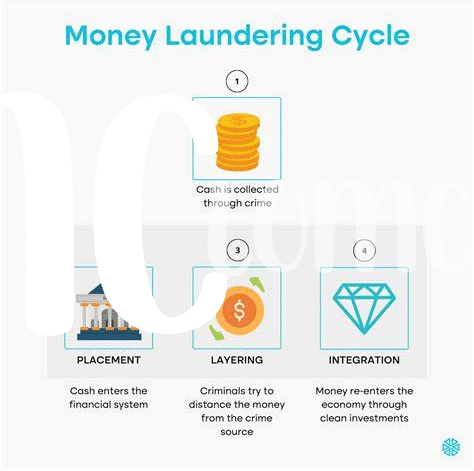

Navigating the landscape of AML compliance within the realm of Bitcoin transactions can be a challenging endeavor for many entities operating in Iceland. With evolving regulations and shifting requirements, businesses often find themselves grappling with the complexities of staying compliant. This struggle is further exacerbated by the decentralized nature of cryptocurrencies, making it crucial to implement robust compliance processes to mitigate risks.

One of the key focal points revolves around transaction monitoring, which plays a pivotal role in identifying and addressing potential risks associated with money laundering and illicit activities. Establishing a comprehensive framework for transaction monitoring is essential to ensure adherence to AML regulations and enhance the overall integrity of the Bitcoin ecosystem. By proactively addressing compliance struggles and investing in effective monitoring mechanisms, organizations can fortify their AML efforts and uphold regulatory standards.

Transaction Monitoring 👀

Transaction monitoring is a vital component of ensuring the integrity and security of Bitcoin transactions. By actively tracking and analyzing the flow of funds, suspicious activities can be quickly identified and addressed, bolstering the overall effectiveness of anti-money laundering measures. This proactive approach empowers financial institutions and regulatory bodies to stay ahead of potential risks and maintain trust within the cryptocurrency ecosystem. Implementing robust monitoring systems not only strengthens compliance efforts but also plays a crucial role in safeguarding against illicit activities.

As technology continues to evolve, the landscape of transaction monitoring faces new challenges and opportunities. Advancements in artificial intelligence and machine learning offer promising solutions to enhance the efficiency and accuracy of monitoring processes. By embracing these innovations and adapting to the dynamic nature of digital currencies, stakeholders can navigate the complexities of AML regulations more effectively. Looking ahead, ongoing collaboration between industry players and regulators will be key in establishing a comprehensive framework that upholds the integrity of Bitcoin transactions in Iceland and beyond.

Reporting Requirements 📋

When it comes to Reporting Requirements, staying on top of documenting and disclosing transactions is crucial to comply with anti-money laundering regulations. Ensuring accurate and timely reporting not only helps in monitoring suspicious activities but also aids in maintaining transparency within the cryptocurrency space. Proper record-keeping practices can assist in identifying potential risks and addressing them effectively to prevent illicit activities from taking place.

For more insights into the future of Bitcoin AML regulations and their impact on financial stability, especially in the context of India, check out this informative article on bitcoin anti-money laundering (AML) regulations in India. It sheds light on the evolving landscape of regulations and how they affect the crypto industry’s compliance measures.

Aml Training Needs 🎓

AML training needs play a crucial role in enhancing understanding and awareness among individuals involved in Bitcoin transactions. Comprehensive training programs enable professionals to grasp the evolving landscape of AML regulations and compliance requirements. Through effective training initiatives, individuals can identify suspicious activities, mitigate risks, and ensure adherence to regulatory standards. Investing in continuous AML training not only strengthens institutional integrity but also fosters a culture of compliance and responsibility within the cryptocurrency ecosystem. As the AML landscape evolves, tailored training programs are essential to equip stakeholders with the knowledge and skills needed to navigate regulatory challenges efficiently.

Future Outlook and Solutions 🌟

For the future outlook and solutions of AML challenges in Bitcoin transactions in Iceland, it is crucial to emphasize the importance of staying updated with evolving regulatory landscapes. Moreover, the integration of advanced technologies such as blockchain analytics can enhance transaction monitoring efficiency and accuracy, thereby strengthening AML compliance efforts. By fostering collaboration between regulatory authorities, industry stakeholders, and technology experts, innovative solutions can be developed to address emerging AML challenges effectively. This proactive approach not only ensures regulatory compliance but also promotes the sustainability and transparency of the cryptocurrency ecosystem.

To delve deeper into Bitcoin AML regulations, explore the bitcoin anti-money laundering (AML) regulations in Haiti and discover how regulatory frameworks shape the future of AML compliance in the digital asset landscape.