Understand Your Bitcoin 🌐 – Why It Matters

Jumping into Bitcoin investing or trading feels a bit like exploring a new galaxy. But, just like astronauts need maps, you need to really grasp what you’re dealing with. Think of Bitcoin not just as digital cash but as a unique asset that lives and breathes online. 🌐 Why does this matter, you ask? Because the way you see and understand Bitcoin can dramatically shape your decisions – from buying and selling to safeguarding your digital treasure. Knowing its characteristics, such as how it can be split into smaller pieces (did you know the smallest Bitcoin unit is called a Satoshi, named after its mysterious creator?) and how its value swings like a pendulum, is crucial for any savvy investor or trader.

To track your Bitcoin journey, consider keeping a simple diary or log. Yep, something as straightforward as a table can do the trick. For instance:

| Date | Activity | Amount (BTC) | Value (USD) |

|---|---|---|---|

| 01/01/2021 | Bought Bitcoin | 2 | 30,000 |

| 02/02/2021 | Sold Bitcoin | 1 | 40,000 |

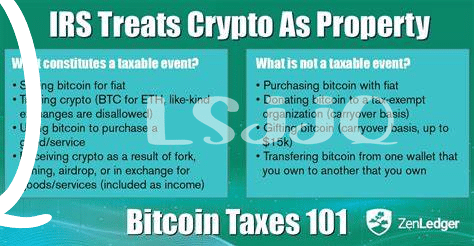

This simple step not only helps you keep track of your investments but also prepares you for tax time 💼. Think of it as keeping a map of where you’ve been to predict where you’re going. In the world of Bitcoin, information is power, and understanding your Bitcoin deeply means you’re better equipped to navigate its volatile seas. ⚓ By doing so, you’re not just investing or trading; you’re becoming a Bitcoin whisperer, tuning into its digital heartbeat and making informed moves.

Tracking Your Trades 💼 – the Simple Way

Imagine you go on a treasure hunt but keep forgetting where you’ve put your map every time you find a clue. That’s a bit like trading Bitcoins without keeping track of your trades. It may sound daunting with all the numbers and dates, but here’s a nifty secret: you can make it simple. Just like jotting down notes in a diary, keep a log of when you buy or sell your digital coins. This can be as easy as using a spreadsheet or an app designed for tracking investments. Not only does this help you stay organized, but it also gives you a clear picture of your financial journey with Bitcoin.

Now, why is this important? When the time comes to file your taxes, having a detailed record makes it much easier to report your investments accurately. And let’s not forget about spotting trends in your trading behavior – invaluable insights that could help you make smarter decisions in the future. Plus, should you ever need more detailed info on the evolving world of Bitcoin, resources like https://wikicrypto.news/smart-contracts-transforming-agreements-with-blockchain-tech are just a click away, offering deep dives into scalability challenges and innovative solutions in the crypto space.

Use Losses to Your Advantage 📉 – Really!

Imagine seeing your Bitcoin investment numbers going down and feeling a bit blue. But, what if I told you that sometimes, a dip isn’t all bad news? Yep, it’s true. In the world of taxes, those less-than-stellar moments can actually work in your favor. It’s all about turning lemons into lemonade—or in this case, turning your losses into potential tax benefits. When you report your investment losses, you might reduce how much you owe in taxes, effectively cushioning the blow a bit.

Now, it sounds a bit complex, but it’s all about keeping good records and knowing when to play your cards. By strategically recognizing your losses, you can lower the overall amount of taxes you might need to pay on your wins. It’s like telling the tax world, “Hey, it wasn’t all sunshine, but I’m smart about it.” This approach requires a bit of savvy, but it leverages those down days in a way that could help your wallet when tax time rolls around.

Choosing the Right Tax Tools 🔧 – Simplify!

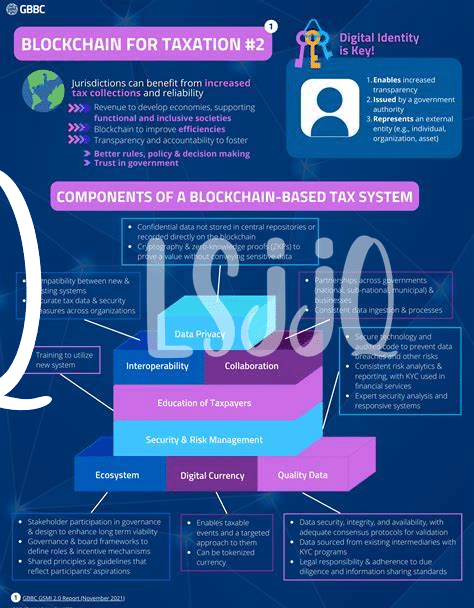

When diving into the world of Bitcoin investing and trading, having the right set of tools can make all the difference. Just like a carpenter needs a hammer and nails, you need tax tools that are easy to use and designed for the twists and turns of crypto finance. The market is packed with apps and software that promise to keep your transactions in check, but not all are created equal. Imagine a toolbox that not only keeps your trades in line but also offers insights and tips to maximize your returns. This isn’t just about keeping records; it’s about making those records work for you.

Navigating tax season can be smoother when you incorporate technology that understands the unique challenges of crypto. For instance, tools that offer insights into bitcoin scalability solutions and the blockchain can provide an edge over traditional tax software. The right software should simplify the complex, turning what feels like a chore into a straightforward task. It’s not just about crunching numbers; it’s about finding opportunities to save and even making informed decisions for future trades. Engaging with a tool that resonates with your needs can transform tax planning from a dreaded task into a strategic part of your investment journey.

Timing Sales for Tax Benefits ⏰ – Secrets Revealed

Selling your Bitcoin at the right time can feel a lot like a secret mission where timing is everything. Imagine you’re a spy in a movie, sneaking through the shadows, waiting for the perfect moment to act. That’s you, waiting for the right time to sell your Bitcoin to pay less tax. The secret? It’s all about holding onto your Bitcoin for a certain period. If you keep it for over a year, it’s like moving from the shadows into the spotlight gracefully – you pay less tax because it’s considered a long-term investment. This is amazing because you get to keep more money in your pocket!

Now, let’s break this down 🕵️♂️. If you sell your Bitcoin before a year passes, it’s like you’ve been caught on your secret mission – you pay more tax, just like how short-term gains are taxed more heavily. It’s like choosing between walking away with a briefcase full of cash or just a few notes. But timing isn’t the only trick; knowing when you’re in a lower tax bracket can also reduce what you owe. Let’s say your mission has you earning less one year; selling some Bitcoin could mean you pay less tax on the gain. Here’s a simple table to show how this works:

| Investment Duration | Tax Impact |

|---|---|

| Less than a year (Short-term) | Higher tax rate |

| More than a year (Long-term) | Lower tax rate |

| Low income year | Potentially lower tax |

By planning the perfect moment to make your move, like a seasoned agent waiting in the darkness, you can keep more of your hard-earned money away from the clutches of taxes. It’s all about being smart, patient, and a little bit sneaky. 🕰️💸

Engage a Crypto-savvy Tax Professional 👩💼 – Smart Move

Navigating the maze of crypto taxes can be as tricky as finding your way through a dense forest. That’s where the expertise of a crypto-savvy tax professional comes in handy. Think of them as your guide, someone who knows the twists and turns and can help you avoid potential pitfalls. Their knowledge isn’t just about numbers; it’s also about staying up-to-date with the ever-changing tax laws that apply to digital currencies. With their help, you can optimize your tax situation, ensuring you only pay what you’re legally required to. Plus, they can offer personalized advice that aligns with your investment goals.

Seeking professional advice might feel like an extra step, but it’s a strategic move that could save you time and money in the long run. These professionals not only prepare your tax filings but also help you plan a strategy for the future. By understanding the intricacies of bitcoin market analysis and the blockchain, they can guide you through decisions that enhance your investments while keeping you compliant. So, whether you’re a seasoned trader or new to the bitcoin scene, the right tax professional can be a valuable ally in your journey toward financial success.