🚀 Bitcoin’s Journey: from Niche to Mainstream

Imagine a world where we all play a giant game of digital hide and seek, but instead of hiding ourselves, we’re hiding bits of digital gold. That’s kind of what Bitcoin was when it first started. A lot of people thought of it as a hobby or a small experiment. Only a few tech enthusiasts were into it, thinking it might be the future of money. They believed in a system where everyone could send and receive money, anywhere in the world, without having to go through banks or pay hefty fees. It was like a secret club where the only membership requirement was believing in the power of technology.

Fast forward to today, and Bitcoin has exploded onto the mainstream stage. It’s no longer just for computer wizards. Everyone from your neighbor to big companies is talking about it. Its value has gone up and down like a rollercoaster, making some people overnight millionaires and leaving others wishing they had joined the ride earlier. The journey from being a niche project to a household name wasn’t easy, and it involved a lot of ups and downs. And yet, here we are, in a world where digital currency is a real thing that people use, talk about, and even build businesses around.

| Year | Milestone | Impact |

|---|---|---|

| 2009 | Bitcoin Creation | Begins as a niche experiment |

| 2010 | First Real-world Transaction | Bitcoin gains practical value |

| 2017 | Price Hits $20,000 | Attracts mainstream attention |

| 2021 | Price Peaks Over $60,000 | Establishes as a significant financial asset |

🧱 Understanding the Wall: Bitcoin’s Scalability Issue

Imagine a highway, bustling and full of cars. This highway is Bitcoin, a revolutionary way of sending and receiving money that’s caught the world’s eye. But here’s the catch – this highway has only one lane. As more cars (users) jump on, traffic slows to a crawl. This is the heart of Bitcoin’s challenge: its scalability issue. In essence, Bitcoin can only process a small number of transactions per second, leading to delays and higher fees, much like our single-lane highway jammed with cars. This bottleneck has sparked a critical question: how can Bitcoin grow if it can’t handle the traffic?

In addressing this, visionaries and tech whizzes are like town planners working on solutions. They’re exploring various avenues to widen the highway without losing the essence of what makes Bitcoin unique. From technological tweaks to entirely new protocols, these innovations aim to let Bitcoin handle more transactions efficiently, making it ready for the future. It’s an exciting time, as these developments not only promise to scale Bitcoin but also strengthen it against competitors. For an in-depth look at how these advancements compare to traditional financial systems, check out this article.

⚙️ Innovations Knocking: Solutions to Scale Bitcoin

Imagine a world where Bitcoin can serve millions more without slowing down. That’s the vision pushing forward some pretty cool improvements. One smart solution is called the Lightning Network. Picture it as a speedy express lane beside the regular, slower Bitcoin highway. It allows for quick transactions that settle back on the main road later, helping Bitcoin zoom ahead without traffic jams.

Another exciting development is called SegWit, short for Segregated Witness. It’s a bit like repacking your suitcase to make more room. By organizing transaction data more efficiently, Bitcoin can handle more transactions at once. These innovations are like opening new lanes and optimizing traffic flow for Bitcoin’s journey, making the ride smoother and faster for everyone. As Bitcoin continues to grow, these enhancements are crucial in making sure it can keep up with the demand, ensuring its place in the future of money.

🌍 Impacts on Global Economy: a Bitcoin Future

Imagine a world where buying a coffee in Tokyo, a car in Toronto, and a house in Paris is all done using the same digital currency – Bitcoin. This isn’t just a dream; it’s a powerful vision that could reshape our global economy. By making transactions faster, cheaper, and more accessible to everyone, Bitcoin has the potential to change how we think about money. It can make our financial systems more inclusive, giving people who’ve been left out of the banking system a way to save and spend. But to fully step into this future, we need to tackle bitcoin security practices and the blockchain, ensuring that our digital gold is not only valuable but also secure and easy for everyone to use.

However, this bright future comes with its own set of challenges. As Bitcoin grows, it’ll need to handle millions of transactions quickly and affordably, a big step from where we are today. If we manage to do this, we could see countries with unstable currencies turn to Bitcoin as a safer store of value, leading to increased stability and prosperity. Small businesses around the world could flourish with lower transaction fees and access to a global marketplace. The dream is big, but the journey is just beginning.

🚧 Roadblocks Ahead: Challenges in Implementing Solutions

As we peek over the horizon at the future of Bitcoin, it’s clear that not everything is smooth sailing. The journey towards solving Bitcoin’s scalability puzzle is dotted with hurdles. One major bump on the road is the consensus requirement. In simpler terms, for any change to be made in how Bitcoin operates, most people who use and manage it need to agree. This is tough because people have different views and interests. Imagine trying to decide on a movie with a huge group of friends; it can take a while to find one that everyone will enjoy.

Here’s a breakdown of the top challenges faced when implementing scaling solutions for Bitcoin:

| Challenge | Description |

|---|---|

| Consensus Building | Getting a majority of the network to agree on changes. |

| Technical Hurdles | Upgrading the Bitcoin network without compromising security. |

| Regulatory Uncertainty | Navigating laws that vary by country and may affect adoption. |

| Network Fragmentation | Avoiding splitting the network into incompatible versions. |

These roadblocks make the path forward a bit tricky. While the end goal is clear, making sure everyone moves in the same direction needs patience, diplomacy, and a bit of tech wizardry. The dream of a scalable Bitcoin is bright, but it requires navigating these challenges with care and innovation.

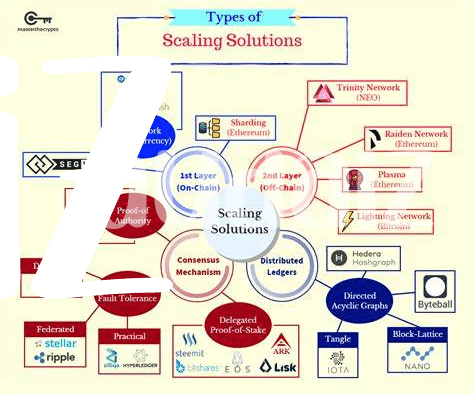

📈 Beyond Bitcoin: Scalability Lessons for Other Cryptos

As Bitcoin paves the way, diving into the world of cryptocurrencies reveals a sea of opportunities and challenges alike for other digital currencies. The journey of scaling Bitcoin – from brainstorming through bottlenecks to embracing groundbreaking solutions – serves as a treasure trove of insights for its counterparts. Imagine a world where these lessons in scalability are shared across the board; altcoins could leverage this wisdom to fast-track their own growth, avoiding potential pitfalls. This spirit of innovation and collective learning could not only accelerate the adoption of cryptocurrencies but also enhance their efficiency and effectiveness. Such advancements would empower other cryptos to handle more transactions, serve more users, and ultimately, contribute more significantly to the digital economy. For an in-depth exploration, the intricate dance between competition and collaboration in this space highlights the essential role of scalability solutions. Discover more about the fine balance between bitcoin market analysis and the blockchain, where we delve deeper into how Bitcoin’s journey is sculpting a robust path for the entire cryptocurrency ecosystem.