🚀 Bitcoin’s Journey: from Obscurity to Mainstream

Once upon a time, Bitcoin was just a whisper on the fringes of financial conversations, a bit like the mysterious new kid on the block that everyone is curious about but few really understand. It all started in 2009, when an unknown person or group under the pseudonym Satoshi Nakamoto introduced Bitcoin to the world. Back then, it was an outlandish concept—digital money that you can’t touch, backed by no government or gold. Fast forward to today, and it’s a whole different story. Bitcoin has surged onto the global stage, capturing the imagination of millions, from tech enthusiasts to big-time investors.

The transformation from an obscure digital novelty to a mainstream financial asset is nothing short of remarkable. It’s like watching a small indie movie go on to win big at the Oscars. Everyone, from your next-door neighbor to major corporations, is now talking about Bitcoin. It’s not just for buying a coffee or shopping online; it’s become a new way for people to think about and use money. Through its ups and downs, Bitcoin has proven it’s more than just a passing trend. Here’s a quick look at its journey:

| Year | Event | Significance |

|---|---|---|

| 2009 | Creation of Bitcoin | The start of a new digital currency era. |

| 2010 | First transaction | Bitcoin is used to buy two pizzas, illustrating its potential as a means of exchange. |

| 2017 | Price surge | Bitcoin’s value skyrocketed, grabbing mainstream attention. |

| 2021 | Widespread adoption | Companies and countries start recognizing Bitcoin as a payment method. |

💵 Understanding Traditional Currencies: a Quick Dive

Before Bitcoin made waves, the world’s money was all about coins, paper, and the promises of governments, known as traditional currencies. Think of the dollars, euros, or yen you have in your wallet or at the bank. These are currencies issued by countries, meaning their value and trust come from the governments themselves. Over time, these currencies have been the backbone of global trade and economy, evolving from physical exchanges of goods to digital transactions. Banks play a huge role here, keeping our money safe and moving it around as needed. But, as we know, the digital age is bringing new players to the field, promising to shake things up. Traditional currencies, despite their long history, are now facing a high-tech challenge. For more insights into how the digital wave is reshaping our financial landscape, take a peek here: https://wikicrypto.news/the-benefits-of-bitcoin-lightning-network-for-transactions. This blend of history and technology makes for a fascinating journey into what keeps the world’s economy spinning.

💻 Technology Showdown: Blockchain Vs. Banking Systems

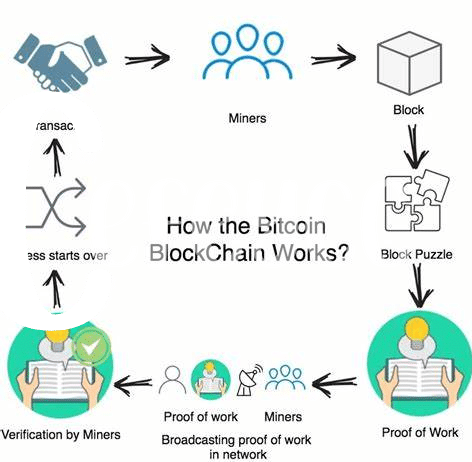

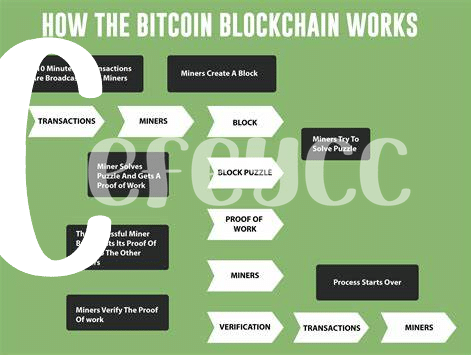

Imagine walking into a store with only two ways to pay – one with a shiny, digital key that everyone’s talking about, and the other with the familiar, crisp bills from your wallet. This is a bit like the choice between using blockchain technology, the magic behind Bitcoin, and sticking with our traditional banking systems. On one hand, blockchain is like a digital ledger that’s open for anyone to see, making transactions transparent and hard to tamper with. On the other, banking systems feel more like a private book kept under lock and key, where transactions are processed behind closed doors.

🚀 On the surface, the battle seems like the future against tradition. Blockchain brings the promise of faster and cheaper transactions without the need for the middlemen, shaking up how we think about money’s flow. Meanwhile, our traditional banks, with their established systems, offer a sense of security and reliability that’s been built over centuries.🏦 But, as we sail into the future, it’s clear this showdown isn’t just about who wins or loses but how they can work together to redefine financial services. With each side holding pieces to the puzzle, their convergence could forge a system that combines the best of both worlds – speed, efficiency, and security. 🤝

🌍 Impact on Global Economy: Bitcoin Vs. Dollars

In the vast playground of global economy, Bitcoin and traditional dollars play very different games. Bitcoin, with its digital footsteps across borders, is redefining how we think about money’s value and transfer. Unlike the physical cash and the familiar ways of banking, Bitcoin operates on a system that doesn’t rely on middlemen, making transactions potentially faster and cheaper on a global scale. Yet, for all its flair, it still faces the hurdles of acceptance and regulation, factors that traditional dollars navigate with the ease of long-established pathways. This change in dynamics suggests a future where financial power could shift, influencing countries, businesses, and individuals in profound ways.

For a deeper exploration of this subject, consider bitcoin versus fiat currency and the blockchain. Here, readers can dive into how innovations in technology, such as multi-signature wallets, are not just changing the game for Bitcoin users but are setting the stage for a significant transformation in the global economy. As we stand on this precipice, looking toward the horizon, it’s clear that the conversation around security, efficiency, and accessibility in finance is only just beginning. The coming years promise exciting developments, as the digital and the traditional vie for the spotlight in shaping the economic futures of people around the world.

🛡️ Security Matters: How Safe Is Your Money?

When we talk about keeping our money safe, it’s like choosing between a trusty old safe and a new, high-tech security system. Traditional banks have been our financial guardians for ages, shielding our cash behind heavy vault doors and complex security protocols. They’re like the trusty old safes – familiar and reliable. But every now and then, we hear about a bank getting robbed or falling victim to a scam, reminding us that no system is perfect.

On the flip side, enter Bitcoin with its shiny armor, the blockchain. This technology is like a transparent, untouchable vault that keeps our digital coins safe. Every transaction is recorded and verified by a network of computers, making it extremely difficult for hackers to tamper with. However, the cyber world has its own breed of bank robbers. Phishing attacks, wallet thefts, and exchange hacks are the new heists. So, while Bitcoin promises cutting-edge security, it’s not without its dangers. Here’s a quick comparison to put things into perspective:

| Aspect | Traditional Banking Security | Bitcoin Security |

|---|---|---|

| Protection Mechanism | Physical and digital safeguards, FDIC insurance (in the US) | Blockchain technology, cryptographic encryption |

| Common Threats | Robbery, fraud, operational risks | Hacking, phishing, private key theft |

| User Control | Limited, reliant on bank’s policies and security measures | High, users have full control over their security practices |

In the grand scheme of things, whether you choose the traditional vault or the digital fortress to safeguard your treasure, staying informed and vigilant is key.

📈 Future Predictions: Where We’re Headed

As we gaze into the crystal ball of finance, one thing seems clear: the landscape is about to change in a big way, and digital currencies like Bitcoin are leading the charge. In this shifting world, the tug-of-war between Bitcoin and traditional currencies will not only influence how we think about money but also how we use it. Innovations such as the bitcoin wallet types and the blockchain are hinting at a future where transactions are faster, cheaper, and more secure. Imagine sending money across the globe in seconds without hefty fees or waiting periods, all thanks to breakthroughs like the Bitcoin Lightning Network.

Yet, the road ahead is not without its bumps. As digital currencies grow in popularity, they face challenges including regulatory hurdles and market volatility. Despite these obstacles, the potential for Bitcoin and its peers to revolutionize financial transactions and empower individuals worldwide is immense. Will traditional currencies adapt quickly enough to keep up, or will we witness a new era where digital money becomes king? One thing is for certain: the financial world of tomorrow will look vastly different from today, and it’s a change we should all be ready for.