Overview of Bitcoin Aml Regulations in Colombia 🌎

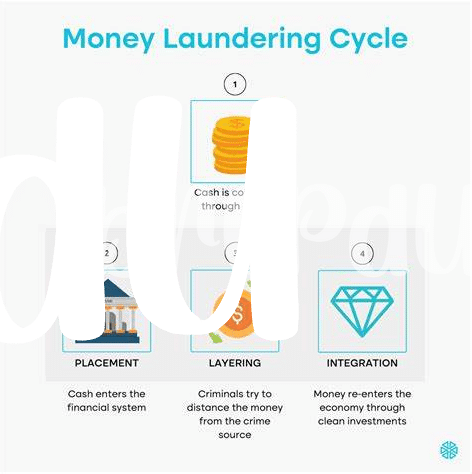

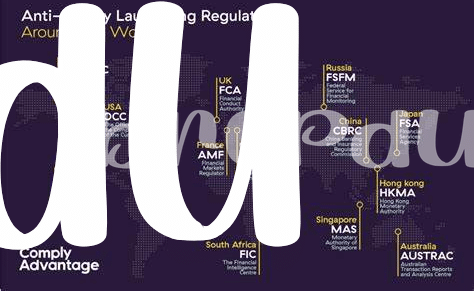

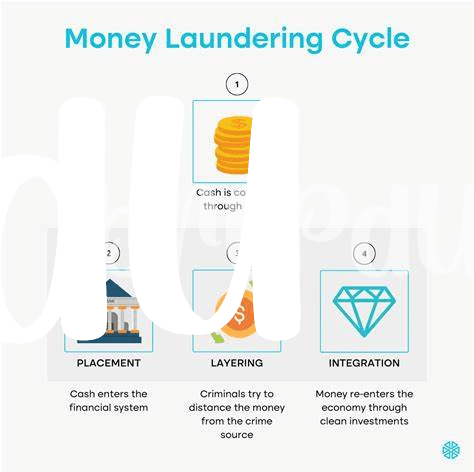

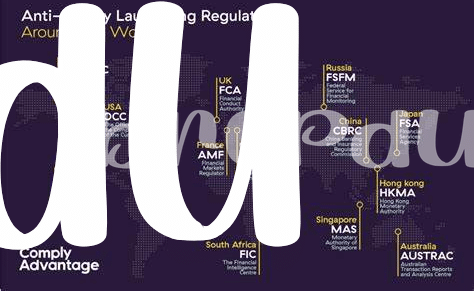

As the regulatory landscape surrounding cryptocurrencies continues to evolve globally, Colombia has also established its own set of Anti-Money Laundering (AML) rules specific to Bitcoin transactions. These regulations aim to ensure transparency, traceability, and compliance within the digital currency space, reflecting the government’s commitment to combating financial crimes. By outlining clear guidelines for cryptocurrency exchanges and users, Colombia is taking proactive steps to mitigate potential risks associated with illicit activities and promote a more secure environment for digital asset transactions.

Challenges Faced by Individuals and Businesses 💼

Individuals and businesses in Colombia encounter a myriad of challenges when it comes to navigating Bitcoin AML regulations. The complex and evolving nature of these regulations often leads to confusion and uncertainty among stakeholders. Compliance requirements can be overwhelming, especially for small businesses and individual users who may not have the resources or expertise to fully understand and adhere to the rules. Moreover, the lack of clear guidance and standardized procedures further exacerbates the challenges faced by those seeking to comply with AML regulations in the cryptocurrency space.

As the regulatory landscape continues to evolve, individuals and businesses must stay informed and proactive in their approach to AML compliance. Collaboration between industry stakeholders, regulatory bodies, and law enforcement agencies is crucial for developing effective strategies that address the unique challenges posed by Bitcoin transactions. By adopting best practices and leveraging innovative technologies, stakeholders can mitigate risks and ensure compliance with AML regulations in Colombia, fostering a more secure and transparent environment for cryptocurrency transactions in the country.

Implications of Non-compliance with Aml Rules 💰

Non-compliance with AML rules in Colombia can have far-reaching consequences for individuals and businesses involved in Bitcoin transactions. Failure to adhere to these regulations may result in hefty fines, legal penalties, and reputational damage. Moreover, non-compliance could lead to the freezing of assets, seizure of funds, or even criminal charges, posing a significant threat to financial stability and sustainability.

Ensuring adherence to Bitcoin AML regulations is not only a legal requirement but also a crucial step in safeguarding against potential financial risks and illicit activities. By proactively implementing robust AML compliance measures, individuals and businesses can protect themselves from regulatory scrutiny and enhance trust among stakeholders. Prioritizing compliance efforts not only mitigates the risk of penalties but also fosters a culture of transparency and accountability in the rapidly evolving landscape of cryptocurrency transactions.

Best Practices for Navigating Bitcoin Aml Regulations 💡

When navigating the complex landscape of Bitcoin AML regulations in Colombia, it is essential to implement a robust compliance framework that adapts to the evolving regulatory environment. Emphasizing transparency and due diligence in transactions can help mitigate the risks associated with money laundering and illicit activities. Additionally, staying informed about the latest regulatory updates and seeking guidance from compliance experts can ensure your business aligns with the regulatory requirements effectively.

For further insights on navigating regulatory frameworks for Bitcoin AML, you can explore the detailed guidelines provided by WikiCrypto News on Bitcoin anti-money laundering (AML) regulations in Bulgaria through this informative link: Bitcoin Anti-Money Laundering (AML) Regulations in Bulgaria.

Case Studies Highlighting Successful Aml Compliance Strategies 📊

In recent years, several businesses operating in Colombia have successfully implemented AML compliance strategies within their Bitcoin transactions. One notable case study involves a crypto exchange that introduced robust Know Your Customer (KYC) procedures and transaction monitoring systems. By collaborating with regulatory authorities and investing in training programs for their staff, the exchange managed to detect and report suspicious activities effectively. Another success story comes from a local startup that integrated blockchain analytics tools to enhance transparency in their operations. This proactive approach not only fostered trust with customers but also positioned them as a compliant player in the crypto space.

These real-world examples demonstrate the tangible benefits of prioritizing AML compliance in Bitcoin transactions. By adopting innovative technologies and fostering a culture of compliance, businesses in Colombia can navigate regulatory challenges while building credibility in the digital asset ecosystem.

Future Outlook for Bitcoin Aml Regulations in Colombia 🔮

The future outlook for Bitcoin AML regulations in Colombia involves a trajectory towards strengthening compliance measures and enhancing regulatory frameworks. As the cryptocurrency landscape evolves, Colombia is expected to continue refining its AML rules to address emerging challenges and technological advancements effectively. Combining proactive regulatory initiatives with increased collaboration between government bodies and industry stakeholders will be pivotal in promoting a robust AML environment. Embracing innovation while prioritizing security and transparency will likely shape the future direction of Bitcoin AML regulations in Colombia. The evolving regulatory landscape underscores the importance of staying informed and adaptable in navigating the dynamic terrain of digital currencies. Bitcoin Anti-Money Laundering (AML) regulations in Burkina Faso will also play a significant role in influencing global AML practices and standards.