Overview of Bitcoin and Aml Regulations 🌐

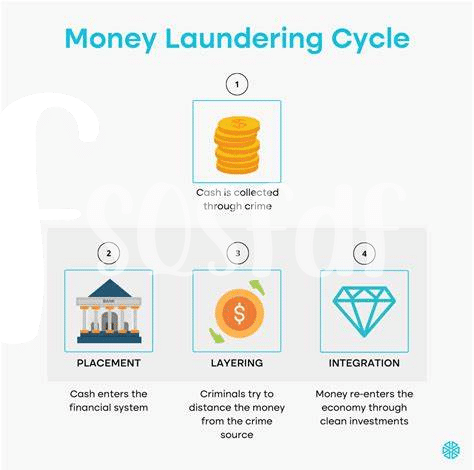

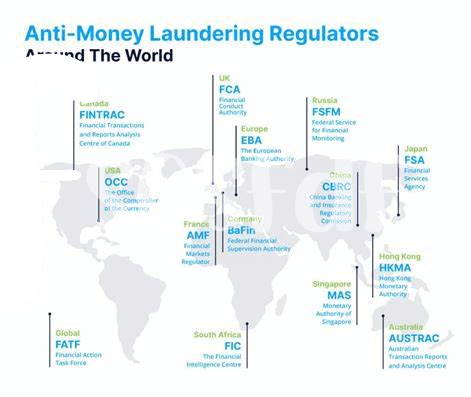

Bitcoin, the digital currency that has garnered significant attention in recent years, operates in a decentralized environment, making it challenging to regulate. When it comes to Anti-Money Laundering (AML) regulations, the landscape becomes even more complex. AML laws aim to prevent illicit activities, such as money laundering and terrorism financing, in the realm of cryptocurrencies like Bitcoin. Understanding the interplay between Bitcoin and AML regulations is crucial for individuals and businesses navigating the evolving financial landscape.

Understanding Regulatory Landscape in Burkina Faso 🇧🇫

The regulatory landscape in Burkina Faso shapes the way Bitcoin and AML measures intersect within the country. It is essential to understand the specific laws and guidelines set forth by the government to ensure compliance and mitigate risks effectively. The dynamic nature of regulations in Burkina Faso necessitates a keen eye on updates and changes to adapt promptly and maintain a transparent and secure environment for Bitcoin transactions and AML practices.

When navigating the regulatory landscape in Burkina Faso, individuals and businesses engaging in Bitcoin transactions must stay informed and proactive. Compliance with AML regulations is not just a legal requirement; it is a crucial step towards fostering trust and legitimacy in the evolving financial ecosystem of the country. Embracing transparency and best practices is key to navigating the regulatory framework successfully and fostering a thriving Bitcoin environment in Burkina Faso.

Implications of Aml Laws on Bitcoin Transactions 💰

Bitcoin transactions in Burkina Faso are significantly impacted by Anti-Money Laundering (AML) laws, which aim to prevent illegal activities in the financial sector. These laws require individuals and businesses involved in Bitcoin transactions to adhere to strict guidelines for verifying customer identities and monitoring transactions. Failure to comply with AML regulations can result in severe penalties, making it crucial for stakeholders to prioritize transparency and due diligence in their Bitcoin dealings. Despite the challenges posed by AML laws, they play a vital role in enhancing the integrity of the financial system and safeguarding against illicit financial activities in the cryptocurrency space.

Challenges Faced by Individuals and Businesses 🤔

1) The realm of digital currencies like Bitcoin presents unique challenges for individuals and businesses operating in Burkina Faso. From navigating uncertain regulatory landscapes to ensuring compliance with AML laws, stakeholders often grapple with complexities that traditional financial systems do not encounter. This can lead to difficulties in conducting transactions smoothly and securely, as well as establishing trust and credibility within the market. Overcoming these hurdles requires a strategic approach that prioritizes education, proactive risk management, and collaboration with regulatory bodies.

Insert link to https://wikicrypto.news/understanding-aml-requirements-for-bitcoin-transactions-in-cameroon with anchor: bitcoin anti-money laundering (aml) regulations in chile

Best Practices for Compliance and Risk Mitigation 🔒

When it comes to navigating regulatory frameworks in Burkina Faso in the realm of Bitcoin and AML, it is crucial for individuals and businesses to implement robust compliance measures and risk mitigation strategies. One key aspect is conducting thorough due diligence on counterparties to ensure compliance with AML regulations. Additionally, employing transaction monitoring tools and staying abreast of regulatory updates can enhance overall compliance efforts. Collaborating with regulatory bodies and industry peers for insights and best practices is also essential to effectively navigate the evolving regulatory landscape.

Future Trends and Potential Developments in Burkina Faso 📈

As Burkina Faso continues to navigate the evolving landscape of Bitcoin AML regulations, the future trends and potential developments in the country are of paramount importance. The increasing integration of digital currencies like Bitcoin into the financial ecosystem raises various considerations for regulatory bodies and stakeholders. Looking ahead, the adoption of innovative technologies and frameworks to monitor and enforce AML regulations in the cryptocurrency space is expected to play a crucial role in shaping the landscape in Burkina Faso. Collaborative efforts between government entities, financial institutions, and technology providers will be essential in addressing emerging challenges and fostering a secure environment for Bitcoin transactions.

To further explore the regulatory environment surrounding Bitcoin AML in neighboring countries, one can refer to the Bitcoin Anti-Money Laundering (AML) Regulations in Chad with a specific focus on compliance measures. Understanding the nuanced differences in regulatory frameworks across the region can provide valuable insights into building robust AML strategies and ensuring effective risk mitigation in the digital asset space.