Bitcoin: the Key to Financial Empowerment? 🗝️

Imagine a world where everyone can manage and grow their wealth, no matter where they live or how much they earn. That’s the promise of Bitcoin, a digital currency that’s opening up new opportunities for financial empowerment across the globe. Unlike traditional money tied to specific countries and rules, Bitcoin operates on a decentralized system. This means it’s not controlled by any single government or institution, making it a universal tool for financial freedom.

For many people in emerging markets, access to financial services is limited. Banks might be too far away, or they require so much paperwork and fees that it’s just not worth it. Here is where Bitcoin shines 🌟. It’s like having a bank in your pocket, as long as you have a smartphone and an internet connection. It allows people to save, send, and invest money in ways that were not possible before. Let’s take a quick look at the change Bitcoin is driving:

| Aspect | Traditional Banking | Bitcoin |

|---|---|---|

| Accessibility | Limited by location and requirements | Accessible anywhere with internet 🌐 |

| Control | Controlled by institutions | User-controlled 💪 |

| Fees | Often high and unpredictable | Lower and more transparent 💸 |

This simple comparison shows why Bitcoin is not just a new kind of money, but a new hope for millions to unlock their financial potential.

Why Traditional Banks Aren’t Enough Anymore 🏦➡️💔

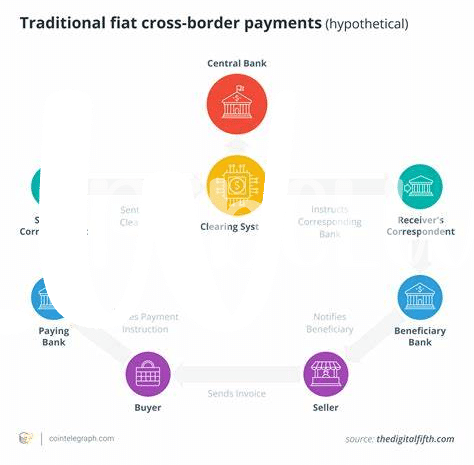

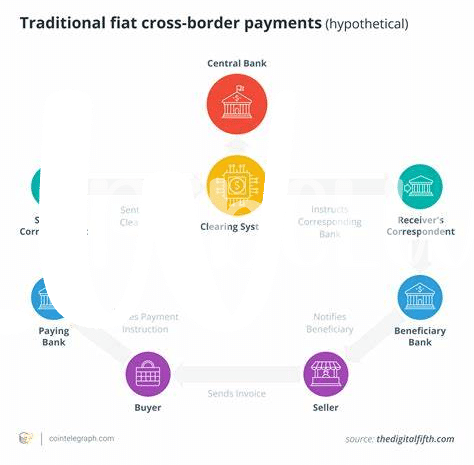

Imagine a world where your bank account is more than just a place to keep your money safe but also a tool that empowers you financially. However, as our world changes, the traditional banking system seems to be lagging behind, especially in areas that need it the most. For many, the dream of financial inclusion remains just that—a dream. Long lines, piles of paperwork, and services that don’t quite meet their needs make banking more of a hassle than a help. In response, people are looking towards alternatives that promise not only to store their money but also to give them the financial freedom they’ve been craving. Enter Bitcoin—a digital currency that operates beyond the reach of traditional banking systems, offering a glimmer of hope to those left out by the conventional financial ecosystem. Through its decentralized nature, Bitcoin presents a unique opportunity for financial empowerment, especially in emerging markets where access to banking services can be limited. For more insights, visit https://wikicrypto.news/innovations-in-blockchain-enhancing-corporate-security-with-bitcoin.

Overcoming Hurdles: Bitcoin’s Accessibility in Emerging Markets 🌍

In many parts of the world, getting your hands on Bitcoin isn’t as easy as one might think. Picture trying to grab a cloud from the sky with your bare hands – it seems nearly impossible, right? But folks in emerging markets are finding creative ways to make this dream a reality. They use everything from mobile apps that work on even the simplest phones, to informal groups that teach each other how to trade safely. This spirit of innovation shows that, regardless of the challenge, there’s always a path forward if the community pulls together. 🌐🤝

Imagine a place where traditional banks are few and far between, making the digital leap to Bitcoin not just a matter of convenience, but a necessity for financial inclusion. There are stories of small business owners who, for the first time, can sell their goods worldwide because they now have a way to receive money from far-off lands. This isn’t just about technology; it’s about opening doors to opportunities that were previously out of reach, proving that with enough determination and adaptability, barriers can be broken. 💡🚀

Real Stories: How Bitcoin Changes Lives 🔄

Imagine a world where your ability to save, spend, and secure your money isn’t tied down by where you live or the nearest bank branch. That’s the world Bitcoin is helping to create for many in emerging markets, offering a digital handshake to financial freedom 🌐✨. Traditional banking systems often fall short, unable to reach or meet the needs of countless individuals. But where these systems lag, Bitcoin sprints ahead, bringing banking right to people’s pockets through their smartphones. It’s a game-changer. Stories abound of small business owners who can suddenly tap into global markets, or families sending money across borders without losing chunks of it to hefty fees. It’s more than just convenience; it’s a lifeline. And as discussed in a comprehensive analysis at bitcoin and inflation in 2024, the positive impact of Bitcoin is only set to grow, promising a future where financial inclusion isn’t just a dream but a reality. However, it’s not without its challenges. The bumps on this transformative journey highlight the need for awareness and education to navigate the risks involved, ensuring that the path to empowerment doesn’t lead to unforeseen pitfalls 🚀🔍.

The Dark Side: Risks of Bitcoin in New Markets 🚨

While Bitcoin opens doors to financial inclusion, it’s not without its shadows. Imagine a world where digital coins can leap over traditional banking barriers, but in this new realm, the risks are as real as they are virtual. For starters, price swings can make hearts race; what’s worth a small fortune today might not be tomorrow. Then, there’s the matter of digital security. Without the right know-how, folks might find their virtual wallets pilfered by savvy hackers. It’s not just about losing money; these risks can shake the very trust we’re trying to build in emerging markets. Plus, there’s a learning curve. Understanding Bitcoin isn’t always easy, and without guidance, it’s like navigating a maze in the dark. It’s essential we shine a light on these shadows, addressing risks while harnessing Bitcoin’s power to unlock financial inclusion.

| Risk Factor | Description |

|---|---|

| Price Volatility | Unexpected and sharp changes in Bitcoin’s value. |

| Digital Security | Risks of theft by hackers targeting digital wallets. |

| Understanding Bitcoin | The challenge of learning how Bitcoin works. |

Looking Ahead: Bitcoin’s Future in 2024 and Beyond 🔮

As we gaze into the crystal ball, the future of Bitcoin by 2024 holds a shimmering promise of financial freedom and inclusion for many. Around the world, particularly in places where traditional banks have fallen short, Bitcoin is not just a buzzword but a beacon of hope 🌐✨. Its digital wings are spreading wider, making it more accessible to the unbanked and underbanked, those who’ve been left out of the financial system’s warm embrace. This journey isn’t just about numbers skyrocketing on charts; it’s about real people finding a new way to save, spend, and secure their future. However, as we march forward, it’s crucial to consider the balance between embracing innovation and mitigating risks. Just as a coin has two sides, the widespread adoption of Bitcoin comes with its own set of challenges. Yet, the resilience and adaptability of Bitcoin have shown us time and again that it’s more than just a fleeting trend. By 2024, we anticipate a world where corporate giants recognize its potential not just for profit, but for paving the way towards a more inclusive economy. Similarly, the narrative of empowering the unbanked will evolve from hopeful stories to tangible realities. As we look ahead, let’s not lose sight of the human stories behind the numbers, for they are the true measure of Bitcoin’s success.