🚀 Understanding Inflation and Your Money

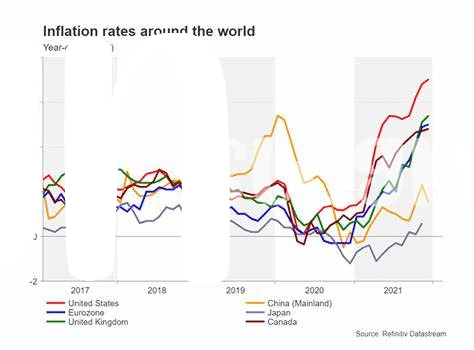

Imagine you’ve worked hard to save a nice little nest egg, but year after year, you notice that the things you could buy easily are now stretching your budget. This sneaky thief is called inflation, and it’s like an invisible force that slowly but surely eats away the value of your money. When inflation is high, your savings don’t have the same buying power they used to, making it harder to afford things without dipping more into your savings.

| Year | Purchasing Power of $100 |

|——|————————–|

| Now | $100 |

| 1 Year Later | $98 |

| 2 Years Later | $96 |

This table shows how inflation can decrease the value of your money over time, assuming a 2% inflation rate, which is quite common. It’s like giving a piece of your cake away each year, and there’s less for you to enjoy. That’s why it’s essential to find ways to protect your savings from this invisible threat. By understanding inflation, you’re taking the first step towards safeguarding your hard-earned money and ensuring it retains its value over time.

💡 What Is Bitcoin? a Simple Explanation

Imagine a world where money is not just pieces of paper with famous faces on them, but also a form of digital currency that’s as easy to send as an email. That’s Bitcoin for you – a type of money that exists only online. Created over a decade ago, Bitcoin offers a new way to think about what money can be. Instead of being controlled by a single government or organization, it’s maintained by a network of people’s computers worldwide. Think of it as a digital ledger, where all transactions are recorded for everyone to see, making it not just transparent, but incredibly difficult to tamper with. This revolutionary approach not only challenges the traditional banking system but also presents an exciting opportunity for individuals looking to safeguard their financial future against inflation. To delve deeper into how it’s making waves beyond just finance, consider exploring how innovations in blockchain are enhancing corporate security with Bitcoin at https://wikicrypto.news/bitcoin-a-beacon-of-hope-for-the-unbanked-in-2024, highlighting its growing influence.

🛡️ How Bitcoin Fights Against Inflation

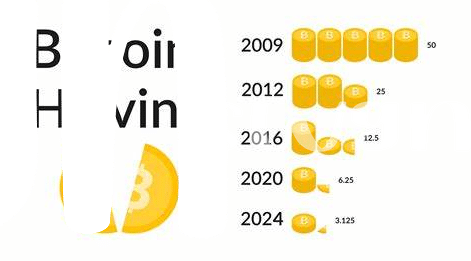

Imagine your money is a scoop of ice cream on a sunny day; inflation is the heat that causes it to melt away, bit by bit. Now, enter Bitcoin, a digital form of money, but unlike your daily currency, it has a unique shield against this melting effect. Built on a foundation of limited supply, with only 21 million Bitcoins ever to be created, it stands as a bulwark against the usual culprits of inflation. Traditional money can be printed without limit, leading to its value dropping over time. Bitcoin, on the other hand, sticks to its 21 million cap, making it akin to digital gold, a haven from the inflation heat wave.

This scarcity feature is like having an ice cream that refuses to melt under the sun, preserving its value over time. As more people and countries treat it as a store of value, akin to how gold has been seen for centuries, Bitcoin provides an interesting option for those looking to diversify. Diversification is key in any portfolio, especially in turbulent times, acting like sunscreen for your investments. Including Bitcoin, with its anti-inflation qualities, could be like adding a little umbrella over your ice cream, giving it protection against the economic heat and preserving your financial well-being in the long run.

📊 Diversifying Your Portfolio: Bitcoin’s Role

Imagine your investment basket filled with different financial fruits. Just like you wouldn’t want only apples in there, diversifying means adding oranges, bananas, and maybe a few bitcoins too. Why? Because bitcoin, a digital currency that’s been around since 2009, is like the exotic fruit that doesn’t follow the performance of traditional stocks or bonds. This unique character comes in handy, especially during times of inflation when the value of money drops and prices for everyday goods climb up. By having bitcoin in your portfolio, you’re not putting all your eggs in one basket. It’s a way to protect your investments from losing their purchasing power entirely. However, it’s also wise to think about how the digital currency world is maturing. With more businesses and investors hopping aboard, understanding bitcoin and corporate adoption in 2024 is crucial. This move isn’t just about bandwagoning; it’s about recognizing a shift towards digital finances that could shape how we think about money in the future. But remember, balance is key. While bitcoin offers a hedge against inflation, it’s one part of a broader strategy to safeguard your financial well-being.

🧐 Risks and Rewards: a Balanced View

Investing in Bitcoin is like riding a roller coaster with both thrilling highs and stomach-churning lows. On one hand, Bitcoin offers a unique opportunity to hedge against inflation, as its supply is capped, meaning that, unlike traditional currency, it can’t be devalued by simply printing more. This scarcity can drive up its value, making it an attractive addition to your investment mix. On the other hand, Bitcoin’s journey is marked by volatility. Its price can swing wildly based on market sentiment, regulatory news, or technological advancements.

| Risks | Rewards |

|---|---|

| High Volatility | Hedge Against Inflation |

| Regulatory Changes | High Potential Returns |

| Technical Vulnerabilities | Increased Portfolio Diversification |

Furthermore, keeping an eye on technological vulnerabilities and regulatory shifts is crucial, as these factors can significantly impact your Bitcoin holdings. However, for those who navigate the waters wisely, taking informed risks, the rewards can be substantial, offering impressive returns and diversification that insulates your portfolio against inflation’s erosive effects on your purchasing power. Remember, a balanced view emphasizes not just the exciting potential of Bitcoin, but also the need for caution and thorough research.

💬 Staying Informed: Bitcoin Trends in 2024

As we journey through the dynamic landscape of 2024, staying on top of Bitcoin trends becomes essential for anyone looking to inflation-proof their investments. Understanding the ebbs and flows of this digital currency can seem like reading tea leaves, but it’s simpler when you keep an eye on how Bitcoin is making strides in inclusivity, particularly with the unbanked. Imagine Bitcoin not just as a high-flyer in the investment world, but as a beacon of hope for those without traditional banking services. The narrative of bitcoin for small businesses in 2024 paints a vivid picture of a future where financial barriers are lowered, opening up new avenues for growth and stability in markets often overlooked.

This inclusivity brings fresh air to economies worldwide, making it not just a story about wealth, but about empowerment and opportunity. As we navigate through 2024, the interplay between Bitcoin, small businesses, and those previously on the financial sidelines showcases a trend towards a more democratized financial future. Watching these trends closely not only equips you to make informed decisions about your portfolio but also offers a glimpse into the transformative power of Bitcoin. The risk-reward balance, while always a consideration, leans into exciting territory when you consider the broader social impacts accompanying financial gains.