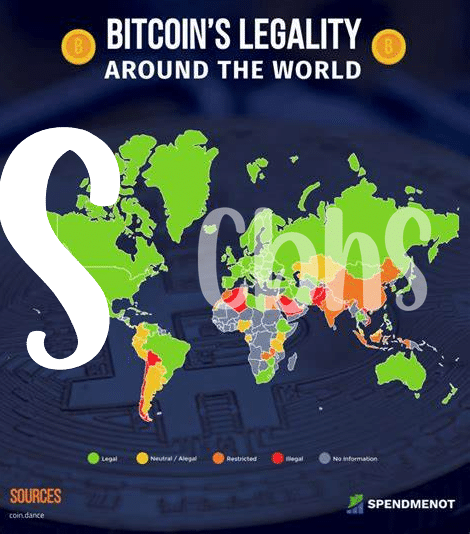

Legal Status of Bitcoin Funds in South Sudan 📜

Bitcoin operates in a legal gray area in South Sudan, where there is no specific legislation addressing its status. Despite the lack of clear regulations, the use of Bitcoin funds is not explicitly prohibited, allowing for potential opportunities in the emerging digital economy of the country. However, investors should exercise caution and stay informed about any developments in the legal landscape to ensure compliance with future regulatory changes. The evolving nature of Bitcoin’s legal status in South Sudan underscores the importance of vigilance and adaptability in navigating this decentralized financial landscape.

Compliance Requirements for Bitcoin Investors 📑

Bitcoin investors navigating the South Sudan market must understand and adhere to a set of compliance requirements to ensure regulatory alignment and protect their investments. These requirements encompass aspects such as KYC (Know Your Customer) verification, AML (Anti-Money Laundering) procedures, and transparency in reporting transactions. By adhering to these standards, investors can actively contribute to the legitimacy and growth of the Bitcoin ecosystem while safeguarding against potential risks.

Regulatory Authorities Overseeing Bitcoin Transactions 🕵️♂️

In South Sudan, the landscape of Bitcoin transactions is closely monitored by the relevant regulatory authorities who play a crucial role in overseeing the legality and security of such digital transactions. These authorities work to ensure that Bitcoin investors and users adhere to specified guidelines and regulations, thereby fostering a more transparent and secure environment for cryptocurrency exchanges. Their oversight helps to maintain the integrity of the financial system and protect consumers from potential risks associated with the decentralized nature of digital currencies.

Tax Implications and Reporting for Bitcoin Transactions 💰

For Bitcoin transactions in South Sudan, understanding the tax implications and reporting requirements is crucial. Investors must navigate the complexities of reporting their Bitcoin activities to ensure compliance with tax laws. Properly documenting transactions and following the guidelines for reporting will help investors stay on the right side of the law and avoid any potential penalties or fines related to tax obligations. Staying informed and proactive in understanding the tax implications can contribute to a smoother experience when engaging in Bitcoin transactions.

For more insights on regulatory challenges surrounding Bitcoin investment funds in South Sudan, check out this article on Bitcoin investment funds regulation in Suriname.

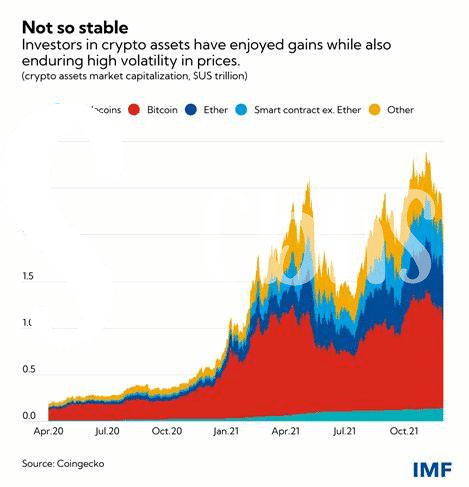

Challenges and Risks Associated with Bitcoin Funds 💥

Bitcoin presents a new frontier in finance, but with it comes a set of unique challenges and risks for investors and users. One primary concern is the volatility of Bitcoin prices, which can fluctuate significantly within short periods, exposing investors to potential losses. Security breaches and hacks targeting Bitcoin exchanges and wallets pose another risk, highlighting the importance of safeguarding digital assets. Moreover, the lack of traditional financial safeguards means that recourse for unauthorized transactions or fraud may be limited. Understanding and mitigating these risks are crucial for anyone involved in Bitcoin transactions.

Future Outlook and Trends for Bitcoin Regulation 🚀

As the landscape of digital currencies continues to evolve, the future outlook and trends for Bitcoin regulation in South Sudan are of increasing importance. Enhanced regulatory frameworks are anticipated to provide a more secure environment for Bitcoin investors, promoting transparency and trust in the market. With a focus on adaptation and innovation, the trajectory of Bitcoin regulation is poised to shape the financial sector in alignment with global standards. A comparison with regulations in countries like Switzerland, known for their progressive stance on Bitcoin investment funds regulation, could offer valuable insights for South Sudan’s regulatory approach.

For further information on Bitcoin investment funds regulation in Sudan, you can explore the regulations in Switzerland Bitcoin investment funds regulation in Sudan.