What Is Bitcoin Halving? 🤔

Imagine you’re playing a video game where, as you progress, the rewards for your achievements get cut in half. This is a bit like what happens with Bitcoin every few years – a process known as Bitcoin halving. Simply put, it’s an event where the reward for mining new blocks is halved, meaning miners receive 50% less bitcoins for verifying transactions. This might sound like bad news for miners, but there’s a silver lining.

This halving isn’t just a random occurrence; it’s baked into the very code of Bitcoin to ensure the cryptocurrency remains scarce and valuable. Think of it as akin to reducing the supply of new cars made every year, which might make the existing models more valuable if the demand stays the same or grows. Halving happens every 210,000 blocks, or roughly every four years, making it a much-anticipated event across the crypto world.

| Event | Description |

|---|---|

| Bitcoin Halving | The process where the reward for mining new Bitcoin blocks is halved. |

| Impact | Miners receive 50% less bitcoin for their efforts, potentially increasing Bitcoin’s value due to reduced supply. |

| Frequency | Every 210,000 blocks, or approximately every four years. |

Why Halving Matters to Bitcoin’s Value 📈

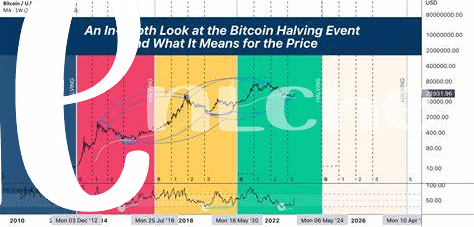

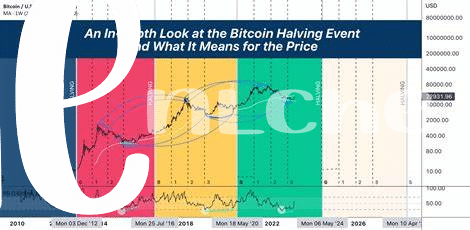

Imagine a world where digital gold gets more precious every few years. That’s pretty much the magic behind Bitcoin halving, an event intricately designed to add a sparkle to Bitcoin’s value. Halving slashes the reward for mining Bitcoin in half, making it harder to earn them. This scarcity is similar to finding fewer gold nuggets in a riverbed over time, making the existing ones more valuable. But why does this matter? It’s all about supply and demand. With fewer new Bitcoins being created, the existing ones become more sought after, especially as more people learn about and want to use Bitcoin. This increased demand, coupled with a capped supply, can lead to a price increase. The dance between supply and demand is a delicate one, but historical halvings have shown a trend of rising prices post-event, acting as a beacon for both new and seasoned investors circling the potential for profit. For an in-depth dive, consider here. This cycle of halving thus not only ensures the longevity of Bitcoin but also keeps the financial wheels greased, making every halving event a milestone in Bitcoin’s journey to becoming a deflationary currency.

The History of Bitcoin Halvings 📚

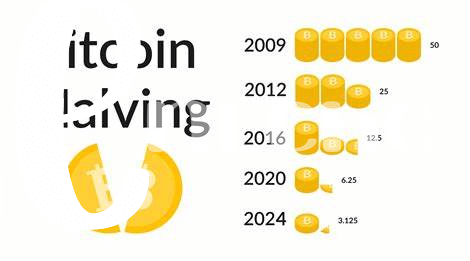

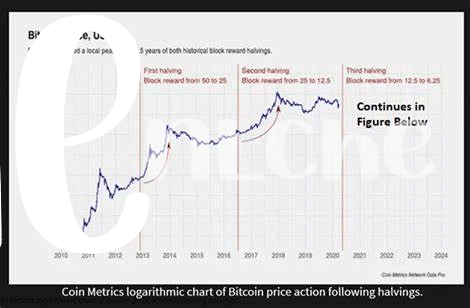

Imagine a world where every four years, a magic event makes gold twice as hard to dig up. That’s a bit like what happens with Bitcoin, a digital treasure. Since its creation in 2009, Bitcoin has had this special ceremony called “halving” occur three times already – in 2012, 2016, and 2020. 📚 Each time, the reward that bitcoin miners get for adding a new block to the Bitcoin blockchain is cut in half. Initially, miners received 50 bitcoins per block. After the first halving, this reward dropped to 25, then to 12.5, and in the latest halving, to just 6.25 bitcoins. This clever trick is part of why Bitcoin can be so valuable; it’s designed to be scarce, just like gold, but digital.

This journey through Bitcoin’s past halvings is not just a trip down memory lane; it helps us understand why each halving event gets the crypto world buzzing. 🐝 Reduction in mining rewards means that fewer new bitcoins are created, making existing ones more scarce, and historically, the value of Bitcoin has risen after these events, capturing the imagination of both beginners and experts. It’s a cycle of anticipation, reaction, and reflection, showing how innovation intertwined with scarcity can drive value. As we look towards the 2024 halving, the past gives us clues about its potential impact, serving not just as a historical record but as a map for the future. ⏳🔮

Predictions for the 2024 Halving Event 🔮

As we inch closer to the 2024 event, excitement and speculation bubble up in the Bitcoin community. Many foresee this halving as a pivotal moment, potentially catapulting Bitcoin’s value to new heights. This optimism is grounded in the past, where each halving event historically led to a significant upswing in Bitcoin’s price after a period. The precise impact remains a subject of lively debate, with some enthusiasts predicting a surge likened to a moonshot, while skeptics urge caution, pointing out the increasing market maturity and outside economic factors that could temper explosive growth.

Delving into the 2024 halving, it’s crucial to consider the broader context, such as countries where bitcoin is recognized as legal tender in 2024, which could play a significant role in shaping Bitcoin’s post-halving landscape. Moreover, as the global economy evolves and new cryptocurrencies emerge, the way Bitcoin interacts with the wider financial ecosystem could influence its trajectory post-halving. Amid these discussions, valuable strategies and insights emerge, preparing enthusiasts and investors for a range of possibilities. As always, the only certainty is Bitcoin continues to capture the imagination and spark lively debate.

How Halving Influences Bitcoin Mining 🛠️

Imagine a world where every four years, the rewards for one of the most popular digital treasure hunts are slashed in half. This is exactly what happens in the Bitcoin ecosystem during a phenomenon known as ‘halving.’ Think of Bitcoin miners as digital gold miners, navigating complex puzzles to unlock new Bitcoins. When a halving occurs, the reward for solving these puzzles is cut down by 50%. This not only makes mining more challenging but also less immediately rewarding.

The effects ripple through the Bitcoin economy. Initially, miners might feel the pinch, as their hard-earned rewards diminish. However, this reduction in supply can lead to an increase in Bitcoin’s value if demand continues to grow. Moreover, the halving encourages miners to become more efficient, seeking out cheaper and more sustainable energy sources or optimizing their mining rigs. The table below summarizes the impact of halving on mining:

| Aspect of Mining | Impact of Halving |

|———————————-|————————————————————————————————————|

| Reward for Mining | Rewards for mining new blocks are reduced by 50%, making each Bitcoin harder to earn. |

| Operational Costs | With reduced rewards, the importance of low operational costs and high efficiency becomes more pronounced. |

| Mining Hardware Efficiency | There’s a push towards more efficient mining hardware to maintain profitability. |

| Environmental Impact | Potential for reduced environmental impact if miners move towards greener energy sources. |

As we navigate towards the 2024 halving, miners and enthusiasts alike are bracing for these changes, knowing they might redefine the mining landscape once again.

Preparing for the Next Halving: Tips & Strategies 💡

As the next Bitcoin halving approaches, everyone from beginners to experts can take steps to navigate this exciting event. It’s a time of anticipation, as the rewards for mining Bitcoin essentially get cut in half, pushing many to rethink their strategies. Staying informed 📚 and planning ahead becomes crucial. For miners, this might mean upgrading equipment to maintain profitability in a more competitive landscape, while investors should keep a keen eye on market trends, as halvings have historically led to price increases over time 📈. Diversification of assets and not putting all your eggs in one basket can also help manage risk and leverage potential opportunities the halving brings. Furthermore, for those curious about the bigger picture, including Bitcoin’s role in global finance, a deep dive into controversies surrounding bitcoin explained in 2024 can provide valuable insights, shedding light on how these events contribute to financial inclusion worldwide. Whether you’re mining, investing, or simply observing, arming yourself with knowledge and a plan is key 🔑 to making the most of the halving event.