🌍 the Journey of Bitcoin Becoming Legal Tender.

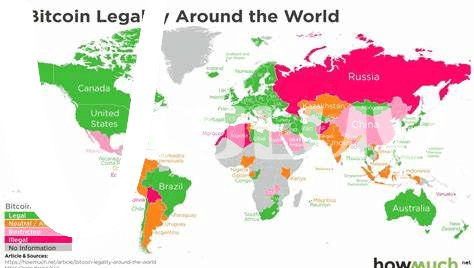

Bitcoin’s fascinating journey towards recognition as legal tender has been something akin to a rollercoaster ride, with thrilling highs and nerve-wracking lows. It all started as a revolutionary idea, allowing folks to carry out transactions without needing a traditional bank. Over the years, as people around the globe began to notice this digital currency, a few daring countries took the first steps to officially accept Bitcoin, making it possible to buy your morning coffee or even pay taxes with it. This bold move piqued the interest of other nations, sparking discussions and debates on its feasibility and security. Despite skepticism from some corners, the snowball effect of adoption began, spurred on by a desire for financial inclusion and efficiency. Below is a quick glance at how far we’ve come:

| Year | Milestone |

|---|---|

| 2009 | Bitcoin’s creation |

| 2017 | First significant spike in value, drawing global attention |

| 2021 | First country adopts Bitcoin as legal tender |

| 2024 | Countries continue debating and joining the Bitcoin wave |

The dialogue around Bitcoin’s place in our financial systems is growing louder and more diverse, with every year bringing us closer to potentially seeing it accepted on a global scale. Adopting Bitcoin as legal tender is not just about embracing a new form of currency but also about opening doors to innovation, financial freedom, and possibly a new economic era.

📈 Countries Leading the Bitcoin Adoption Charge.

Around the world, a handful of countries are stepping boldly into the future, embracing Bitcoin as part of their financial landscape. Imagine walking through the streets of San Salvador, where you can buy your morning coffee using Bitcoin, thanks to El Salvador’s pioneering move to adopt Bitcoin as legal tender. This bold step has inspired a ripple effect, with nations like the Central African Republic following suit. These trailblazers are crafting a new narrative for Bitcoin, no longer just a digital curiosity but a legitimate medium for daily transactions.

The shift towards Bitcoin legality is reshaping how businesses operate, with many jumping on the bandwagon to accept Bitcoin payments. From local cafes to major corporations, the embrace of Bitcoin is breaking down traditional financial boundaries, creating a world where digital currency moves seamlessly across borders. This evolving landscape points to a future where Bitcoin’s presence in our wallets might become as common as the coins and notes we carry today. For a deeper dive into how this trend is influencing global finance and the energy implications of Bitcoin mining, check out this insightful piece: https://wikicrypto.news/bitcoin-mining-in-2024-the-energy-crisis-escalates.

🚦 the Impact of Bitcoin on Everyday Transactions.

Picture this: you’re grabbing your morning coffee, and instead of fishing out cash or a card, you simply send some Bitcoin from your digital wallet. This is becoming a reality in places around the globe where Bitcoin steps up as legal tender. Now, buying daily essentials with Bitcoin isn’t just a tech-savvy move; it’s becoming as normal as using any traditional money. This change is making waves in how we think about and use money in our everyday lives. It’s turning the concept of “money” on its head, with transactions that can happen lightning-fast and without the fees that come with international transfers. Plus, it’s not just about buying your coffee or groceries. Paying for services, from your morning taxi ride to getting your house painted, can now be done with Bitcoin. This leap towards digital currency is shaping a future where the lines between traditional and digital money blur, promising a smoother, more connected global marketplace.

💼 How Businesses Are Reacting to Bitcoin Legality.

With the legal recognition of Bitcoin in various corners of the globe, businesses both big and small are navigating the new reality with mixed feelings of excitement and caution. On the one hand, there’s the allure of tapping into a global market without the constraints of traditional banking. Imagine a local online retailer reaching out to customers halfway across the world without worrying about exchange rates or hefty transaction fees. On the other hand, the volatile nature of Bitcoin presents a unique challenge, especially when it comes to pricing products and managing revenue.

Moreover, the move towards digital currency opens up a realm of possibilities for innovation in payment systems. Forward-thinking companies are integrating Bitcoin payments into their operations, not just as a marketing gimmick but as a genuine effort to enhance customer experience. This adoption is underpinned by a growing recognition of bitcoin’s contribution to financial inclusion worldwide in 2024, which highlights the currency’s potential to democratize financial services. However, the journey isn’t without its hurdles. Regulatory uncertainty and cybersecurity concerns are just a few of the roadblocks that businesses must navigate. Yet, the promise of a borderless, efficient, and inclusive payment system keeps the momentum going, suggesting a transformative impact on the commercial landscape as we know it.

🛑 Challenges and Roadblocks in Global Bitcoin Adoption.

Navigating the path to widespread Bitcoin acceptance isn’t without its bumps. Imagine standing at a crossroads where one path is paved with shiny digital prospects and the other is riddled with obstacles. Some of these hurdles include people’s hesitation to switch from familiar paper money to digital coins for their daily coffee purchase. Similarly, governments around the globe are scratching their heads, trying to figure out how to fit this digital puzzle piece into their traditional financial regulations. The concern about Bitcoin’s merry dance with market values – soaring high one day and dipping the next – also makes people and businesses think twice. It’s not just about the logistics; there’s a hefty dose of skepticism and uncertainty clouding the air. Here’s a snapshot of the core challenges:

| Challenge | Details |

|---|---|

| Volatility | Frequent and unpredictable price changes make it hard for everyday transactions. |

| Regulatory Hurdles | Lack of unified regulations across countries creates confusion and uncertainty. |

| Technological Barriers | Not everyone has access to the necessary technology or understands how to use it. |

| Skeptical Public Perception | Misinformation and lack of understanding lead to distrust in digital currencies. |

Despite these challenges, the journey towards Bitcoin’s global adoption is an ongoing adventure, filled with both promise and peril.

🚀 Future Predictions: What’s Next for Bitcoin?

As we gaze into the digital crystal ball, it’s clear that Bitcoin’s journey is far from over. The cryptocurrency world is buzzing with anticipation about what the future holds for Bitcoin, especially after its rollercoaster of adoption and valuation. Firstly, it’s expected that more countries will join the Bitcoin bandwagon, recognizing it as legal tender. This move is not just about catching up with trends but also about embracing a financial revolution that promises to make transactions simpler and more global than ever before. Alongside, businesses, large and small, are gearing up to make Bitcoin transactions smoother, integrating blockchain technologies that enhance security and speed. However, as Bitcoin takes on the world, it won’t be a smooth ride. Regulatory challenges and volatile markets could present significant hurdles. Yet, the spirit of innovation and community might just be strong enough to overcome these obstacles. To understand the controversies and the thrilling highs and lows of Bitcoin’s value, dive into controversies surrounding bitcoin explained in 2024. This exploration might provide insights into the resilience and adaptability of Bitcoin, hinting at a future where digital currencies reshape our financial landscapes in unimaginable ways.