Early Days: Bitcoin’s Mysterious Beginnings 🌚

Imagine a world where a new kind of money exists – not coins or paper, but digital “cash” that lives on the internet. This is how Bitcoin started, in 2009, when a person (or group of people) using the name Satoshi Nakamoto introduced this groundbreaking idea. At the beginning, only a few tech enthusiasts and people curious about this digital money got involved. It was like a hidden gem tucked away in the vastness of the internet 🌐. These pioneers mined Bitcoin using their own computers, a process akin to solving complex puzzles to uncover new coins. Back then, the value of Bitcoin was just a few cents, and the idea of it becoming a real form of money seemed like a distant dream. It’s a bit like planting a tiny seed and watching it grow into a mighty tree 🌱➡️🌳. Satoshi’s vision was to create a decentralized currency, free from the control of governments and financial institutions. This radical idea set the stage for Bitcoin’s journey from obscurity to mainstream, marking the dawn of a new era in the financial world.

| Year | Significant Milestone |

|---|---|

| 2009 | Bitcoin’s creation by Satoshi Nakamoto |

| 2010 | The first real-world transaction (buying pizzas 🍕) |

| 2017 | Bitcoin’s price skyrockets, capturing worldwide attention 🚀 |

The First Real-world Bitcoin Transaction 🍕

In the early days of Bitcoin, it was like a mysterious digital token known only to a handful of computer geeks and futurists. Then, something interesting happened in 2010 that marked a turning point: a man in Florida managed to trade 10,000 bitcoins for two pizzas. This might sound like a simple food order today, but back then, it was groundbreaking. It was the first time anyone had used Bitcoin to buy something tangible in the real world. Imagine, thousands of bitcoins, which would be worth millions today, were exchanged for just a couple of pizzas! This event showed everyone that Bitcoin could have a real-world value, setting the stage for its journey from the digital shadows into the bright spotlight of mainstream attention. As we explore Bitcoin’s evolution and its growing acceptance, including how governments and big companies are starting to pay attention, we also delve into the importance of sustainability in Bitcoin mining. For those interested in how this digital currency is adapting to future challenges, including environmental concerns and regulatory landscapes, check out an insightful read on the topic at https://wikicrypto.news/future-proof-your-portfolio-against-2024s-bitcoin-regulations. This piece not only highlights the rollercoaster ride of Bitcoin’s value but also its potential to drive changes far beyond the financial world.

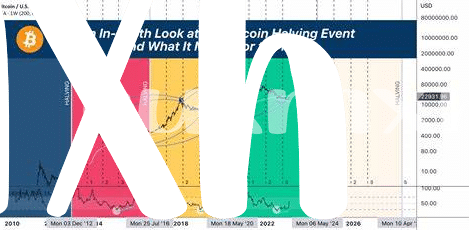

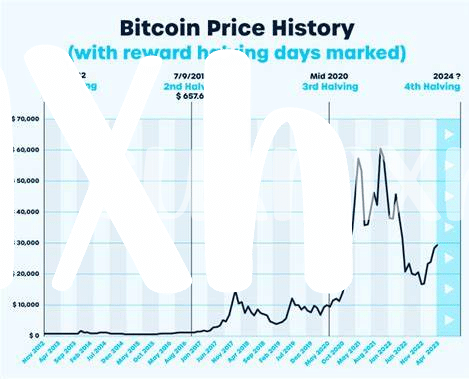

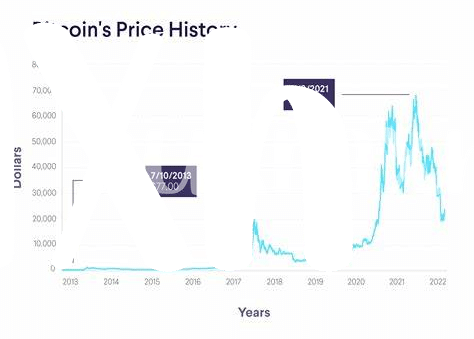

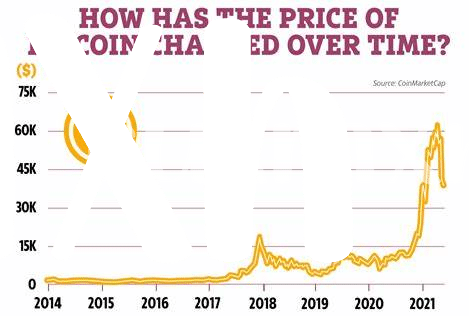

Surging into the Spotlight: 2017’s Wild Ride 🚀

2017 was a year unlike any other for Bitcoin, marking its grand entrance into the public eye. It started with whispers of a digital currency that could change everything we thought we knew about money, but soon those whispers turned into full-blown conversations across the globe. People everywhere were watching in awe as the value of Bitcoin skyrocketed, reaching heights that were once deemed impossible. It was like watching a rocket launch, not knowing where the final frontier was. Everyone wanted a piece of the action, from seasoned investors to curious newcomers, all hoping to ride the wave of this financial phenomena.

As the months rolled by, the excitement around Bitcoin transformed it from a secret shared among tech enthusiasts to a headline-dominating force. The value of Bitcoin soared, making millionaires overnight and drawing more eyes towards this mysterious digital gold. This surge wasn’t just about numbers on a screen; it was a signal of a shifting paradigm. People started rethinking the very essence of what money is and what it could be, spurred on by stories of incredible gains and, admittedly, tales of sudden losses. The 2017 climb wasn’t just a moment in Bitcoin’s history—it was a chapter in the story of how we view wealth, investment, and the future of currency. 📈🌐💰

The Rollercoaster: Peaks and Valleys of Value 🎢

Imagine hopping on a rollercoaster where the dips and climbs bring equal parts thrill and anxiety. This is what investing in Bitcoin has felt like for many. One moment, you’re scaling new heights as the value soars, feeling on top of the world. The next minute, your stomach drops as the value plunges, leaving you wondering what just happened. This up and down movement, often happening in the blink of an eye, hasn’t just tested the resolve of investors but also painted a vivid picture of an asset that’s as unpredictable as it is exciting.

As Bitcoin’s journey unfolded, each surge and dip began to tell its own story. Notably, amidst these fluctuations, a broader conversation started taking root. Concerns over the environmental footprint of Bitcoin mining led to discussions and actions worldwide. For those interested in how these concerns are shaping regulations and the future of digital currency, addressing environmental concerns of bitcoin mining in 2024 provides a thoughtful overview. Through the highs and lows, Bitcoin’s narrative is not just about the money; it’s about impacting the world on multiple fronts, compelling everyone to watch its journey with bated breath.

Gaining Legitimacy: Governments and Giants Take Notice 👀

Imagine a world where your digital dollars are just as real as the ones in your wallet. That’s the shift we’ve seen as big names and government bodies started turning their heads toward Bitcoin. It was like watching a new player being reluctantly invited to the cool kids’ table. First, you had companies who once looked at Bitcoin with a side-eye, now integrating it into their payment options. Then, governments began drafting regulations, giving it a nod of legitimacy. This wasn’t just a shadowy internet coin anymore; it was becoming a part of our financial landscape.

And here’s where it gets interesting. Some countries rolled out the red carpet, seeing Bitcoin as a way to boost their economy, while others eyed it with caution. The dialogue shifted from “Is this even legal?” to “How can we make this work for us?” This journey from the fringes of finance to the mainstream conversation shows just how much the perception of Bitcoin has transformed. Check out the table below to see some of the pivotal moments that marked Bitcoin’s shift toward legitimacy.

| Year | Event | Significance |

|---|---|---|

| 2014 | Major retailers start accepting Bitcoin | Bitcoin begins to be seen as usable currency for everyday purchases |

| 2015-2017 | Several countries start to lay down regulations | The legal landscape for Bitcoin starts to become clearer, gaining it legitimacy |

| 2018 | Big financial institutions begin offering Bitcoin services | Bitcoin’s acceptance as a legitimate asset class takes a huge step forward |

Beyond Currency: Bitcoin’s Broader Impact 🌍

Bitcoin’s adventure doesn’t stop at being a digital form of money. Its ripple effect across the globe is reshaping how we view and interact with the financial world. Beyond its wild price rides and headlines, Bitcoin is laying the groundwork for a financial revolution. Its technology, the blockchain, is offering new ways to secure and manage our online identities and assets, promising a future where transactions are faster, cheaper, and more secure. This futuristic currency has also awakened the interest of global leaders and financial giants, pushing them to think differently about money and privacy in the digital age. Meanwhile, communities worldwide are benefiting from Bitcoin’s ability to offer financial services to the unbanked, opening doors to global markets they were previously shut out from. For those keen on staying updated with how nations are adapting to this revolution, particularly in the realm of digital currency taxation, the latest insights can be found by navigating bitcoin taxation: a global perspective in 2024. As we journey forward, it’s clear that Bitcoin’s impact goes far beyond currency, promising a future reshaped by digital innovation. 🌍💡🔗