The Basics of Bitcoin Banking 🌍

In the world of Bitcoin banking, digital currencies like Bitcoin are transforming the landscape of traditional finance. Transactions are conducted peer-to-peer without the need for a central authority, offering users greater control over their funds and financial privacy. Bitcoin banks provide services similar to traditional banks, allowing users to store, send, and receive Bitcoin securely. Understanding how Bitcoin operates as a decentralized currency and the role of Bitcoin banks is essential for navigating the evolving financial ecosystem.

Regulatory Landscape in Denmark 🇩🇰

Denmark, known for its progressive approach to fintech, has established a robust regulatory framework for Bitcoin banking. With clear guidelines and oversight from financial authorities, the country ensures a secure environment for both consumers and businesses operating in the cryptocurrency space. This regulatory landscape fosters trust and transparency, contributing to the growing acceptance and integration of Bitcoin banking services within the Danish financial ecosystem. As the digital currency market continues to evolve, Denmark’s regulatory framework serves as a benchmark for other nations exploring Bitcoin banking regulations.

Compliance Requirements for Bitcoin Banks 📜

Bitcoin banks operating in Denmark must adhere to strict compliance requirements set forth by regulatory authorities. These standards encompass thorough KYC (Know Your Customer) procedures, AML (Anti-Money Laundering) checks, and ongoing monitoring of transactions to ensure transparency and prevent illicit activities. By implementing robust compliance measures, Bitcoin banks can maintain regulatory alignment and foster trust among customers and stakeholders.

Ensuring Customer Security 🛡️

Bitcoin banks prioritize customer security by implementing robust encryption protocols and multi-factor authentication measures. By safeguarding sensitive information and transactions, these institutions instill trust and confidence among users. Additionally, constant monitoring for suspicious activities and adherence to stringent data protection regulations further enhance the level of security provided to customers. Ultimately, ensuring customer security is a top priority for Bitcoin banks to foster a safe and secure environment for users to engage in digital currency transactions.

For more insights on global regulations impacting Bitcoin banking services, particularly in Djibouti, you can refer to this informative article: bitcoin banking services regulations in Djibouti.

Impact of Regulations on Market Innovation 💡

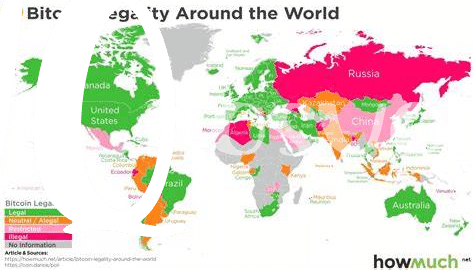

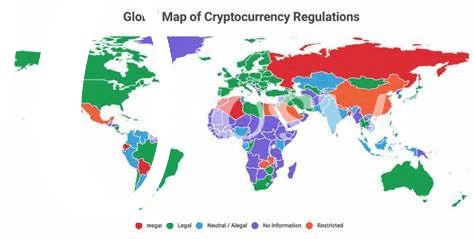

Regulations play a crucial role in shaping the landscape of market innovation within the Bitcoin banking sector. By establishing clear guidelines and frameworks, regulatory requirements can both foster and inhibit the development of new technologies and services. Striking a balance between promoting innovation and ensuring consumer protection is essential for the sustainable growth of the industry. How these regulations are implemented and enforced can greatly influence the level of creativity and competition within the market, ultimately shaping the future direction of Bitcoin banking.

Future Trends in Bitcoin Banking 🚀

The evolution of Bitcoin banking is paving the way for exciting future trends. With advancements in technology and increasing adoption, we can expect to see enhanced security measures, improved user experience, and more user-friendly interfaces. As regulations continue to shape the industry, collaborations between traditional financial institutions and Bitcoin banks may become more common, leading to a broader acceptance of digital currencies in mainstream finance. Bitcoin banking services regulations in the Czech Republic are also setting a precedent for other countries, such as the Dominican Republic, to follow suit in creating a conducive regulatory environment for the growth of this sector.