Growing Interest in Bitcoin Banking 💰

As Bitcoin continues to gain momentum globally, its presence in the Dominican Republic’s banking sector is also on the rise. Individuals and businesses are increasingly showing interest in utilizing Bitcoin for their financial transactions, attracted by its potential for decentralized and secure banking solutions. This growing interest signals a shift towards exploring alternative financial avenues and adapting to the evolving digital economy landscape. With more awareness and understanding, Bitcoin banking is gradually becoming a compelling option in the Dominican Republic’s financial ecosystem.

Regulatory Challenges and Opportunities 📜

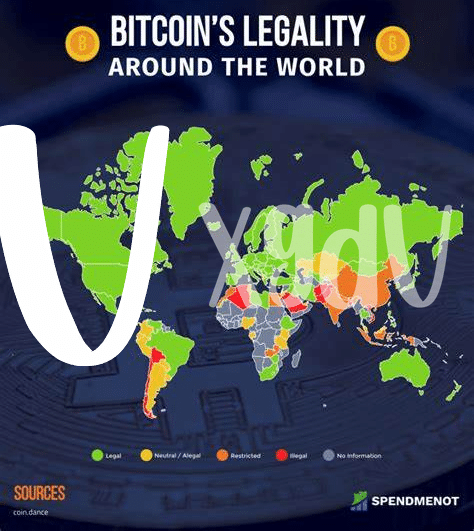

The landscape of Bitcoin banking in the Dominican Republic is poised for significant evolution, marked by both regulatory challenges and opportunities. As the interest in cryptocurrency grows, authorities are faced with the task of creating a conducive environment for innovation while ensuring consumer protection. This delicate balance between fostering industry growth and safeguarding against potential risks presents a unique set of challenges and opportunities for the future of Bitcoin banking in the country. The regulatory framework will play a pivotal role in shaping the trajectory of digital currency adoption within the financial sector, paving the way for a more inclusive and dynamic banking landscape.

Mainstream Adoption in the Finance Sector 📈

With the rise of digital currencies like Bitcoin, the finance sector in the Dominican Republic is witnessing a shift towards mainstream adoption. More and more individuals and businesses are recognizing the potential benefits of using Bitcoin for financial transactions, investments, and remittances. This growing acceptance within the finance sector is reshaping the traditional notions of banking and paving the way for a more inclusive and technologically advanced financial landscape in the country.

Impact on Traditional Banking Institutions 💼

Bitcoin’s disruption of traditional banking institutions is palpable, with established players having to adapt to this new digital landscape. As cryptocurrency gains momentum, banks face the pressure to reassess their services and explore innovative strategies to stay relevant. The competition is pushing traditional banks to enhance their offerings and improve customer experiences in response to the evolving financial landscape. This evolution marks a pivotal moment in the history of banking, where adaptability will be key to survival and success. To delve deeper into the regulatory aspects of Bitcoin banking, check out bitcoin banking services regulations in costa rica.

Potential for Financial Inclusion and Empowerment 🌍

The integration of Bitcoin banking in the Dominican Republic holds promise for expanding financial inclusivity and empowerment across diverse communities. By leveraging the decentralized nature of cryptocurrencies, individuals who were previously excluded from traditional banking services can now access financial tools and resources. This shift has the potential to transform the landscape of financial services, offering a new avenue for individuals to participate in economic activities and secure their financial futures. Through embracing these innovative solutions, communities can foster greater financial independence and drive economic growth.

Looking Ahead: Innovations and Challenges 🔮

In the realm of Bitcoin banking, the future holds a blend of innovative advancements and inherent challenges. As technology continues to evolve, so do the opportunities for enhancing security measures alongside ensuring seamless user experiences. Moreover, the ever-changing regulatory landscape poses both obstacles and prospects for the industry’s growth and legitimacy. Navigating these uncharted waters will require a delicate balance of adaptability and foresight to drive Bitcoin banking into a new era of financial services.

Bitcoin banking services regulations in Cyprus with anchor bitcoin banking services regulations in Democratic Republic of the Congo.