🌍 a Global Overview: Who Are the Unbanked?

Imagine a world where, despite the flashy ads for digital wallets and credit cards, millions of people can’t enjoy these luxuries because they simply don’t have access to a bank. This isn’t the plot of a movie; it’s the everyday reality for about 1.7 billion adults globally. These folks are known as the “unbanked,” a term that might sound a bit technical, but it just means people who don’t use banks or banking services. It’s like being in a bustling market with no wallet to carry your money. The reasons range from not having enough money to open an account, to living too far away from a bank, or not having the necessary paperwork. It’s a tough spot to be in, especially when trying to save for the future or send money to loved ones. This scenario isn’t just numbers and statistics; it’s about real people facing real challenges in accessing basic financial services.

| Reasons for Being Unbanked | Estimated Impact |

|---|---|

| Lack of Money | High |

| Distance to Banks | Medium |

| Paperwork and Requirements | Variable |

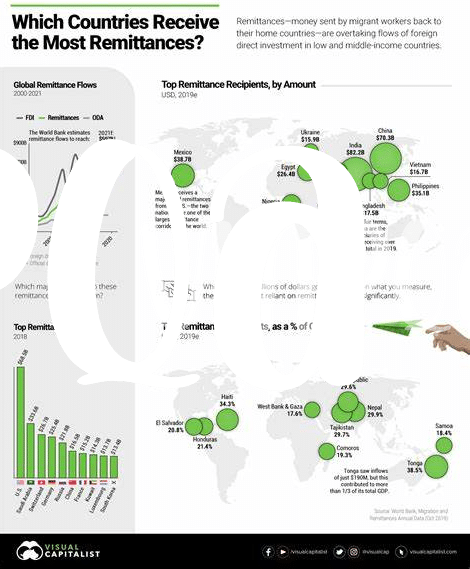

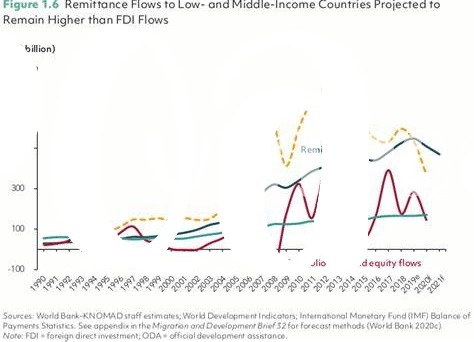

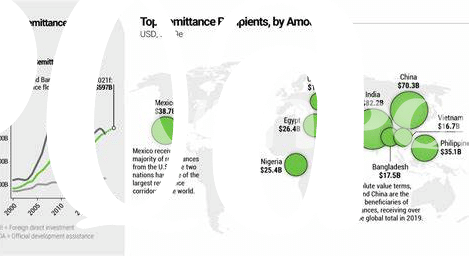

💸 High Fees & Slow Processes: the Remittance Problem

Imagine trying to send money back home to your family, but almost a tenth of what you send gets eaten up by high fees. Sadly, for many people around the world, this isn’t just imagination—it’s reality. Traditional ways of sending money across borders are not just costly but are also painstakingly slow. Often, it takes days for the money to arrive, adding stress and uncertainty to already hard situations.

Now, imagine there’s a way to send money that doesn’t care where you or the recipient are located, and it works without the need for a physical bank. This is where the discussions about using digital currencies, like Bitcoin, come into the spotlight. The promise of lower fees and quicker transactions is enticing, offering a beacon of hope for those who feel left behind by the traditional banking system.

💡 Bitcoin Basics: Understanding the Technology

Imagine you have a digital piggy bank, but instead of coins, you put in digital money called Bitcoin. Now, this isn’t like the money you see in your wallet or bank account. Bitcoin lives on the internet and is powered by something called blockchain technology. Think of blockchain as a magical book that records every single “digital coin” (bitcoins) move. Everyone can see this book, but no one can erase anything from it. That means if you send some Bitcoin to a friend, that transaction is recorded in the book for everyone to see, making it super safe and secure.

Now, sending Bitcoin to someone is like sending an email. You just need their Bitcoin address, and voila, it doesn’t matter if they are next door or on the other side of the world. Plus, it’s speedy and can happen anytime, taking away the need to wait for the bank to open or for a transfer to clear. This is a game-changer for people who need to send money home but find traditional ways too slow or expensive. And just like using email became second nature to us, understanding and using Bitcoin is getting easier, making it a real helper for people without access to usual banking services.

🚀 Bitcoin in Action: Sending Money Across Borders

Imagine a world where sending money to your family in another country is as easy as sending a text message. That’s the promise of Bitcoin, a digital currency that doesn’t care about borders or bank holidays. For folks who’ve never had a bank account, Bitcoin offers a simple way to move money across the globe. Instead of waiting days for a transfer to go through, and paying hefty fees for the privilege, Bitcoin transactions can be lightning-fast and a lot cheaper. It’s like finally having a superpower to zip money across oceans and mountains without the usual hurdles.

This new way of moving money isn’t just faster; it’s opening doors to financial services for people who were left out of the traditional banking system. But embracing this change isn’t without its challenges. For a closer look at how Bitcoin is shaking things up and why it’s not just about sending money but reshaping financial identities, check out the future of digital identity verification with bitcoin explained. These advancements might seem like small steps, but they’re giant leaps for the unbanked, providing a glimpse into a future where everyone has access to the financial tools they need to thrive.

💪 Empowering the Unbanked: Real Stories of Change

Imagine a world where sending money to your family doesn’t mean losing a chunk of it to fees or waiting days for it to arrive. For many without access to traditional banking, Bitcoin has turned this dream into reality. Consider Maria in the Philippines, who used to pay steep fees and wait in long lines to send her hard-earned money home. Now, with just a few taps on her smartphone, she sends Bitcoin directly to her family. The process is quick, and the fees are a fraction of what they once were. Then there’s John in Nigeria, who struggled to find work abroad because he couldn’t open a bank account. With Bitcoin, he now receives his salary instantly from overseas, without the need for a bank account at all. These stories highlight a significant shift, showing how digital currencies are leveling the playing field for those traditionally left out of the financial system.

| Country | Traditional Remittance Fee | Bitcoin Remittance Fee |

|---|---|---|

| Philippines | 7.2% | 2-3% |

| Nigeria | 9% | 1-2% |

This table showcases the difference Bitcoin makes. It’s not just about saving money; it’s about empowerment, giving people control over their finances in a world that’s rapidly going digital.

🚧 Roadblocks: What’s Stopping Widespread Adoption?

Imagine a world where sending money is as simple as sending a message on your phone, with Bitcoin that’s becoming more possible every day, especially for people who don’t use traditional banks. However, this digital revolution has its own set of speed bumps on the road to becoming a common choice for everyone. One big challenge is understanding and trust; not everyone knows how Bitcoin works, which can make them hesitate to use it. There’s also the matter of Internet access – to use Bitcoin, you need to be online, and in many places around the world, getting on the web isn’t as easy as it sounds. Another hurdle is that the price of Bitcoin can go up and down very quickly, which makes some people nervous about using it to send money. Plus, governments and banks are still figuring out how to deal with Bitcoin, leading to rules that can change quickly and make it hard for people to keep up. Lastly, for Bitcoin to reach its full potential in making sending money cheaper and faster, it needs to overcome technical challenges, like how to handle lots of transactions at once without slowing down or costing too much. For a deeper dive into how privacy on the Bitcoin network is getting better and what’s being done about these technical challenges, check out privacy in the bitcoin network: enhancements and challenges explained. These steps are crucial for Bitcoin to truly become a friend to everyone, including those who are unbanked, giving them more power over their own money.