What Are Atomic Swaps? a Simple Guide 🔄

Imagine standing in an ice cream shop, eyeballing your dream flavor on the other side of a glass barrier. You’ve got the cash, but eh, they only accept payment in puzzle pieces. Odd, right? Here’s where atomic swaps step in, acting like a magical bridge. Think of them as a smart, tech-savvy friend who knows exactly how to trade your cash for the right amount of puzzle pieces, ensuring you get your ice cream without any hassle.

Atomic swaps work like a charm between different kinds of digital money, like Bitcoin and Ethereum. Simply put, they let you exchange one cryptocurrency for another, without needing a middleman to hold onto the funds during the transaction. It’s like swapping toys with a friend directly, without having to ask someone else to hold onto them first. Here’s a quick breakdown:

| Step | Description |

|---|---|

| 1. Create Swap | Two parties agree on the amount and currencies to be swapped. |

| 2. Lock Funds | Both lock their funds in a digital safe that nobody can open without agreement. |

| 3. Swap | Once both parties are happy, the digital safe opens simultaneously, swapping the funds. |

| 4. Confirm | Both check their digital wallets to confirm they received the right amount of new currency. |

By letting you directly exchange one cryptocurrency for another, atomic swaps not only save time but also increase security and reduce the need for extra fees. It’s all about making things smoother and faster for everyone involved.

The Problem: Bitcoin’s Liquidity Struggle Explained 💧

Imagine you want to buy a toy from a store, but they only accept a special kind of money that’s hard to get. You have plenty of money, but it’s not the right kind. This problem is similar to what happens with Bitcoin when people try to use it for buying things or trading. Bitcoin, while being very popular, sometimes faces a challenge called ‘liquidity struggle’. This means that even though many people want to use Bitcoin, turning it into other types of money or even different cryptocurrencies can be slow or difficult. This situation can be frustrating because it’s like having a wallet full of cash but no shops around that accept it. This struggle is particularly noticeable when you want to move quickly to take advantage of changing prices in the market or when you need to convert your Bitcoin into local currency to use in everyday life. The result? A bottleneck that slows everything down, making both buying and selling more complicated than it needs to be. This liquidity problem is not just inconvenient for individual users but poses a significant challenge for the broader adoption and usefulness of Bitcoin in the global economy.

How Atomic Swaps Offer a Seamless Solution 💡

Imagine wanting to trade apples for oranges directly with someone who has oranges but doesn’t want apples. Now, think of Bitcoin and other cryptocurrencies as these fruits, each unique in its kind. Atomic swaps are like a magical fruit basket that lets both parties swap their fruits seamlessly, without needing a third party to confirm that both sides have what they promised. This process not only makes exchanges quick and easy but also opens the door for anyone with different kinds of cryptocurrencies to trade directly with one another. 🔄🛠️

With atomic swaps, the need for a middleman is completely eliminated. This means no more waiting for someone else to okay the trade or worrying about trust in the transaction. It’s like handing over your apples directly to the person with oranges, and both receiving what you agreed upon at the same instant. This direct swap capability significantly reduces the time and fees usually associated with traditional exchanges, making it a smoother and more cost-effective way to trade. 💡🌟

Step-by-step: How Atomic Swaps Work 🛠️

Imagine you want to trade your old comic books with a friend for their baseball cards, but you both want to make sure no one backs out once someone has shown their goods. That’s where the idea of atomic swaps kicks in, but for digital currencies. It works like a magic box where both parties put their items in. If both items are in the box, it opens; if not, the box stays locked. This ensures that either both trades go through, or none at all, making the exchange fair and square.

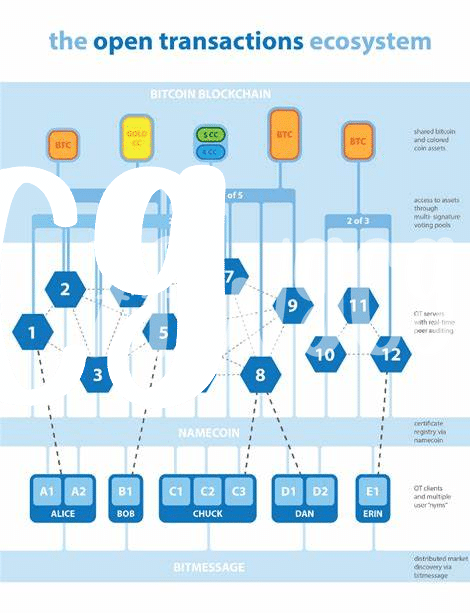

To understand a bit more about digital currencies and their importance in the world, including how they’re changing the market, you might want to look at the role of bitcoin in bolstering emerging market economies explained. So, when two people decide to use atomic swaps, they create these special boxes (smart contracts) in the digital realm. They agree on the amount and type of cryptocurrency to exchange. Each person has a key to open the box, but they can only unlock it when the agreed conditions are met, ensuring a secure and fair transaction. This not only makes the process simpler and more direct but also opens up a world where exchanging different types of digital money becomes hassle-free, promoting fluidity in the digital market space.

The Benefits of Using Atomic Swaps 🌟

Imagine exploring a vast network of stores where you can trade your apples directly for oranges without needing a middleman to tell you the value of your apples or take a slice of your trade. That’s essentially what atomic swaps do for Bitcoin owners. This direct exchange method lights up the world of digital currencies by making trades swift, safe, and simple. 🔄💡 Users no longer have to rely on secondary services to convert their Bitcoin into other forms of digital currency, which often comes with high fees and the risk of price fluctuations during the transaction process.

The beauty of atomic swaps lies not just in the smooth trade but also in the doors it opens for increased connectivity within the digital currency ecosystem.

| ✨ Advantages ✨ | Details |

| Security | Trades are direct and secure, reducing the risk of fraud. |

| Cost Efficiency | Eliminates high fees from traditional exchanges. |

| Flexibility | Enables the exchange of different cryptocurrencies without the need for a common intermediary. |

| Accessibility | Makes the digital currency market more accessible to newcomers. |

Essentially, this innovation not only makes Bitcoin more liquid, meaning it’s easier to trade without losing value, but also fosters a more interconnected and less fragmented digital currency landscape. 🌟💫 Through atomic swaps, the dream of a truly decentralized financial world inches closer, promising a future where freedom in digital currency trading is the norm, not the exception.

Future of Atomic Swaps and Bitcoin’s Liquidity 💫

Imagine a world where swapping digital currencies is as easy as sending a text message, where Bitcoin’s liquidity, or how easily it can be bought and sold without affecting its price, is no longer a riddle wrapped in a mystery. That’s the bright future atomic swaps are carving out. Think of it as the digital world’s answer to bartering, but instead of trading wheat for sheep, you’re swapping Bitcoin for another cryptocurrency without needing a middleman. This innovation not only simplifies transactions but promises to make trading between different digital currencies smoother and faster. As these swaps become more common, we could see a massive shift in how cryptocurrencies are traded, making the market more fluid and accessible for everyone. For those looking to dive deeper into how this could change the game for Bitcoin, especially in handling smaller transactions more efficiently, check out this insightful piece on optimizing bitcoin payment channels for small transactions market trends. This evolving technology might just be the key to solving the puzzle of liquidity in the crypto world, lighting up a path towards a future where digital currencies are as easy to trade as sending a message or posting on social media. 🚀🌐💼