Understanding Bitcoin and Its Market 🌐

Imagine stumbling upon a digital treasure in the form of digital coins called Bitcoin. These coins are quite special because, unlike the money in your bank, no single group controls them. They’re like pieces of digital gold that anyone can send through the internet. The place where people buy and sell these digital coins is called the “market.” It’s a bit like a giant online store, but instead of buying toys or clothes, people are trading bits of digital gold.

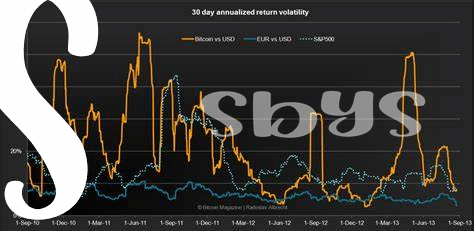

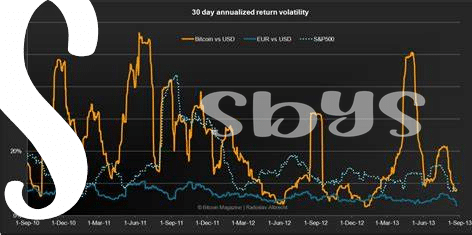

The price of these bits of gold, or Bitcoin, changes a lot—sometimes it’s up, and other times it’s down. This happens because the market is like a big conversation where everyone’s trying to guess what these coins will be worth in the future. It’s exciting and a bit nerve-wracking because, just like in a game, you’re trying to make the best move with what you know. And everyone’s looking around, trying to figure out what will happen next.

| Term | Definition |

|---|---|

| Bitcoin | Digital or virtual currency that uses cryptography for security |

| Market | Where buyers and sellers trade Bitcoin |

| Price Fluctuations | Changes in the value of Bitcoin over time |

How Governments Influence Bitcoin Value 🏛️

Imagine a seesaw in a playground, but instead of kids, on one side, we have Bitcoin—the digital gold everyone’s buzzing about—and on the other, we have governments and their hefty rulebooks. When a government decides to tighten its grip on Bitcoin, through laws or regulations, that side of the seesaw goes down. This might make the price of Bitcoin tumble because people might feel it’s less free, less like the cyber wild west they signed up for. Then again, when a government nods in approval, maybe by setting clear rules that make people feel safe to invest, that side goes up, and so does the confidence in Bitcoin, potentially hiking up its price. It’s like a game of balance. The magic lies in the anticipation of a country’s next move and how players—big and small—in the Bitcoin market react to it. Speaking of safety and anticipation, securing your digital gold is paramount. For those interested, there’s a treasure trove of information on beefing up your Bitcoin’s security here.

The Ripple Effect of Regulation Announcements 📢

When governments speak up about Bitcoin, it’s like tossing a stone into a pond; ripples spread out, touching everything in their wake. 🌊 Imagine waking up to news that a big country plans to crack down on Bitcoin use. Suddenly, everyone’s trying to guess what will happen next. Some folks might rush to sell their Bitcoin, worried about what comes next, while others might buy more, thinking it’s a temporary dip. This back-and-forth creates waves in Bitcoin’s price, making it jump up and down like a yo-yo. 🪀 Meanwhile, investors glued to their screens watch every move, ready to make their next play. It’s a whole drama unfolded from just a few words by the government, showing how mighty the effect of announcements can be in the invisible tug-of-war that decides Bitcoin’s value.

Case Studies: Countries Shaping Bitcoin Prices 🌍

Across the globe, countries have had a significant impact on the waves Bitcoin rides in the financial market. Take China, for example; when it announced new regulations on cryptocurrency, we saw Bitcoin’s value take a steep dive, showing just how much government actions can sway this digital currency. Meanwhile, over in the US, the hint of more Bitcoin-friendly laws has had the opposite effect, sending its value upwards. This dance between government regulations and Bitcoin’s value isn’t just a tale of ups and downs—it’s a clear signal that where governments stand on digital currency can directly affect your digital wallet. It’s why understanding and keeping up with these changes is crucial for anyone involved in the Bitcoin space. For those looking to keep their investments safe amidst these fluctuations, following best practices for securing your bitcoin against theft explained can offer valuable guidance. As we navigate through this landscape, watching how different countries interact with Bitcoin provides not just insights into its current value but also into where it might be headed next.

Regulation: a Double-edged Sword for Bitcoin 🔪

When we talk about governments stepping in to set rules for Bitcoin, it’s like having a referee in a soccer game. On one hand, these rules can help protect people from getting hurt. For example, if a country decides Bitcoin is a safe way to handle money, more people might start to use it, pushing its value up, kind of like a player who gets better with a good coach. But, here’s the tricky part – sometimes, these rules can also make things tough for Bitcoin. Imagine waking up to news that a big country has decided to put strict rules on Bitcoin or even says it’s not allowed. This can scare a lot of people, making them sell their Bitcoin quickly, which can make its value drop fast.

| **Regulation Impact** | **Effect on Bitcoin** |

|———————–|———————————-|

| Positive | Increases trust and value |

| Negative | Can cause uncertainty and drops |

It’s like walking on a tightrope, where balance is key. Finding that sweet spot where Bitcoin is protected but not held back takes a lot of work. Looking ahead, it’s like trying to predict the weather. We can guess based on patterns, but surprises are always possible. The goal is to keep the game fair and exciting, keeping everyone on their toes, waiting to see what comes next.

Predicting the Future: Regulation Trends and Bitcoin 💡

Thinking about what’s next for Bitcoin in terms of government rules can feel a bit like trying to guess where a leaf will land in a strong wind. Governments around the world are waking up to the fact that digital currencies aren’t just a passing trend. As they start to lay down the law, we can expect some big changes. Some folks say tighter rules might make Bitcoin more stable, as it could weed out risky moves and make the whole scene a bit more predictable. On the other hand, too much control could take the adventure out of Bitcoin, making it less appealing to those who were drawn to its wild, untamed nature. If you’re new to this and want to dip your toes into how it all works, especially in making things cheaper when you send Bitcoin around, take a peek at this understanding bitcoin transaction fees and how to minimize them explained. It’s a handy guide that clears up a lot of the confusion.

Looking ahead, the big question isn’t so much if regulations will impact Bitcoin, but how. Countries are taking notes from each other, learning what works and what doesn’t. This could lead to a kind of global playbook for digital currency regulation. If countries start singing from the same hymn sheet, we could see a more unified approach to Bitcoin. However, it’s also possible that differences in how countries see Bitcoin – as a currency, a commodity, or something else entirely – could lead to a patchwork of rules. This uncertainty makes it all the more crucial for anyone interested in Bitcoin to stay informed and agile. Keeping an eye on regulation trends is not just about avoiding pitfalls; it’s about spotting opportunities in a landscape that’s always changing.