What Are Bitcoin Transaction Fees? 🤔

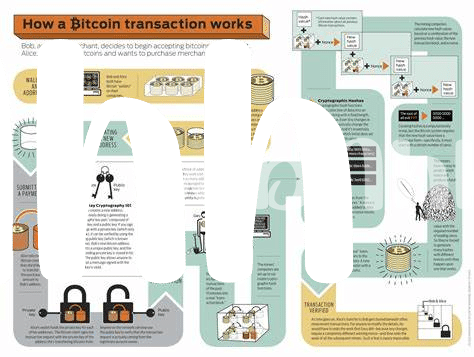

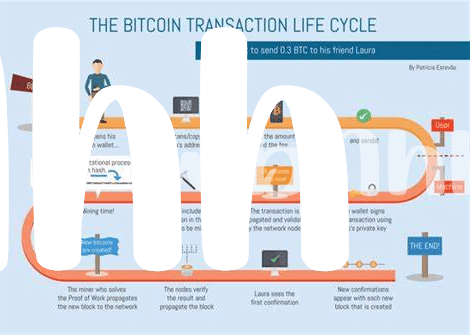

Imagine you’re sending a letter and you stick a stamp on it; that’s basically how Bitcoin transaction fees work but in the digital world. Whenever you make a Bitcoin transaction, like sending coins to a friend or buying something, you need to pay a small fee. This isn’t just a random charge; it’s crucial for making sure your transaction gets picked up by a network of computers (called miners) and added to the blockchain, which is a public ledger of all transactions.

These fees aren’t fixed and can fluctuate based on a few factors, which might sound complicated, but it’s similar to how a taxi charges you based on how far you want to go and how busy the roads are. Below is a simple breakdown to give you a clearer picture:

| Factor | Description |

|---|---|

| Transaction Size | Larger transactions take up more space on the blockchain, leading to higher fees. |

| Network Activity | More transactions in line to be confirmed can push fees up, as they compete to be included in the next block. |

| Urgency | If you need your transaction confirmed quickly, you can choose to pay a higher fee. |

This fee system ensures that the Bitcoin network remains robust, secure, and able to process transactions for everyone around the globe, all without needing a central authority to manage it.

Why Do We Pay Fees for Transactions? 💸

Imagine you’re sending a letter across the country, and you pay for postage to make sure it gets there quickly and safely. In the digital world of Bitcoin, transaction fees work similarly. They’re small payments made to the network’s miners, the folks who use their computing power to process and verify transactions, keeping the whole system secure. These fees don’t go to any central authority—instead, they support this network of miners who make Bitcoin’s decentralized magic happen. It’s like tipping your hat to the guards who keep the treasure safe. The interesting part? You often have a say in how much you pay in fees, which can get your transaction processed faster, especially during busy times. This is just one part of the broader Bitcoin ecosystem, where understanding the mechanisms, like transaction fees, can make a big difference in how you use and benefit from cryptocurrency. For more insights into the crypto world, including the difference between empowering the unbanked with real-world Bitcoin adoption stories, knowing the ins and outs can truly enhance your crypto journey.

How Are Transaction Fees Calculated? 🧮

Imagine going to your favorite coffee shop, where the time it takes to get your coffee depends on how busy the shop is. Sometimes, you might decide to tip a bit more to get your coffee faster on a busy day. In the world of Bitcoin, transaction fees work a bit like that. When you send Bitcoins, you’re essentially asking miners, the folks who process and confirm transactions, to add your transaction to the blockchain, which is like a public ledger. The fee isn’t set in stone; it’s more like a bid. You offer a fee to make your transaction attractive enough for miners to pick it up and include it in the next block. When the network is bustling, just like a busy coffee shop, offering a higher fee can help your transaction get processed faster. Conversely, during quieter times, you won’t need to tip as much to get your transaction confirmed. This dynamic approach helps keep the network efficient, but it also means fees can fluctuate based on demand.

Impact of Market Conditions on Fees 📈

Just like the weather can change, so can the cost of sending Bitcoin. Imagine you’re at a theme park on a sunny day, and suddenly everyone wants an ice cream. The price might go up because everyone is buying at the same time. This is similar to what happens in the Bitcoin world. When lots of people are sending Bitcoin, the network gets busy, and fees can go up because there’s a lot of competition to get transactions confirmed quickly. On quieter days, when fewer transactions are happening, it’s like the theme park on a rainy day – fewer people buying means the price might drop. Seasoned traders keep a keen eye on this, understanding that timing can be everything. For those looking to get a deeper understanding of how to choose the right tools for managing their Bitcoin, this guide on comparing bitcoin wallet types: which is best for you? explained could be a treasure trove of information, helping you navigate through the highs and lows of transaction fees with ease.

Tips to Pay Less in Fees 💡

If you’re looking to keep a little more coin in your digital pocket, there are a few savvy ways to reduce what you spend on Bitcoin transaction fees. First off, consider the timing of your transaction. The Bitcoin network can get busy, and the busier it is, the higher the fee. If your transaction isn’t urgent, try sending it during off-peak times. Think of it like avoiding rush hour traffic. Another tip is to understand that not all wallets calculate fees in the same way. Some let you choose the speed of your transaction, which affects the cost. Opting for a slower transaction time can save you bucks. Also, newer technologies and updates, like the Lightning Network, offer ways to make transactions more cost-effective. Last but not least, always double-check the fee suggested by your wallet; sometimes, they overestimate how much you need to pay.

Here’s a quick look at the options for optimizing your fees:

| Strategy | Description |

|---|---|

| Time Your Transaction | Send funds during less busy periods to potentially lower fees. |

| Adjust Transaction Speed | Choose a slower transaction speed for lower fees in wallet settings. |

| Use Fee-Efficient Technologies | Explore options like the Lightning Network for smaller fees. |

| Manual Fee Adjustment | Manually adjust the fee in your wallet if it overestimates the cost. |

By keeping these tips in mind, you can ensure that you’re not overpaying and instead, making the most out of your Bitcoin transactions.

Common Myths about Transaction Fees Debunked 🚫

When diving into the world of Bitcoin transaction fees, it’s easy to get tangled in a web of misconceptions. One popular myth is that higher fees guarantee faster transactions. While it’s true that miners, the folks who process and validate transactions, prioritize those with higher fees, the network isn’t always congested. During off-peak times, even transactions with lower fees can be processed quickly. Another common misunderstanding is that fees are set in stone, but they fluctuate based on network demand. Tools and resources, such as the insights provided in empowering the unbanked with bitcoin: case studies market trends and corporate giants investing in bitcoin: a trend analysis market trends, can help demystify these fluctuations and offer strategic guidance for minimizing fees.

Furthermore, there’s a narrative that suggests small transactions aren’t worth it due to high fees, leading many to believe that Bitcoin is only for large transactions. This isn’t the case. With the advent of solutions like the Lightning Network, users can now efficiently process small transactions with minimal fees, promoting Bitcoin’s use for everyday purchases. Debunking these myths is crucial in fostering a more informed and inclusive Bitcoin community, encouraging participation from a wider range of users.