Bitcoin Basics: What Makes It Tick? 🌐

Imagine a world where instead of using traditional money from banks, you use digital coins for buying your morning coffee or your next gadget online. That’s where Bitcoin steps in, a digital currency that lives on the internet. It’s like having your wallet on your computer or phone, but instead of dollar bills or coins, you have Bitcoin. What makes it special is there’s no one in charge, like a bank or government. It’s run by a big network of computers talking to each other, which is pretty cool because it means you can send Bitcoin to anyone in the world without asking permission from a bank.

| Feature | Description |

|---|---|

| Decentralized | No single entity controls Bitcoin; it operates on a peer-to-peer network. |

| Global | Bitcoin can be sent or received anywhere with internet access, bypassing traditional banking systems. |

| Limited Supply | Only 21 million Bitcoins will ever exist, making it a deflationary asset compared to traditional fiat currencies that can be printed endlessly. |

| Security | Backed by cryptography, making it secure and nearly impossible to counterfeit. |

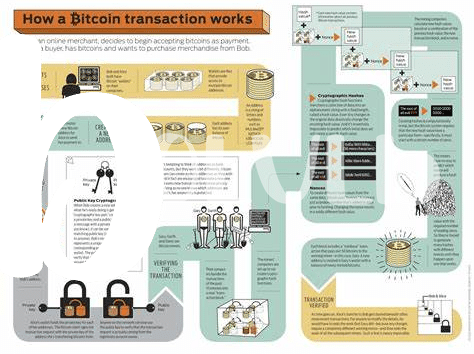

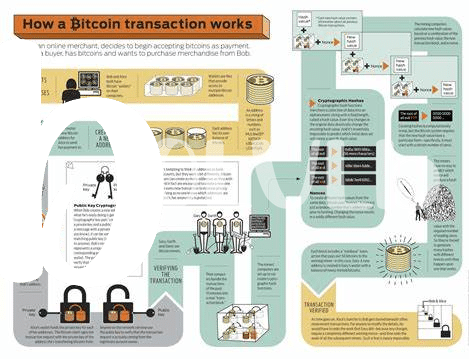

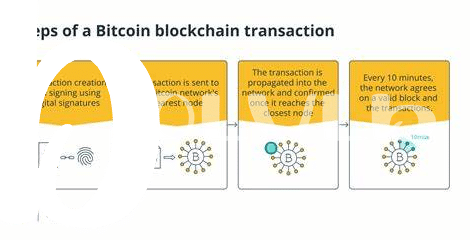

This digital money relies on a technology called blockchain, a ledger that records all transactions. Think of it like an indestructible digital book where every time someone sends or receives Bitcoin, it’s written down. This book isn’t hidden away; it’s copied on computers all around the world, making sure everyone agrees on who owns what. It’s this system that keeps Bitcoin safe and lets it operate without needing any central control.

Cracking the Code: How Transaction Fees Work 💰

Imagine Bitcoin as a giant ledger where all transactions need to be recorded. But unlike a bank, there’s no central authority to keep track of everything. Instead, users called miners use their computers to process and confirm transactions. For their trouble, they get paid in transaction fees. These fees aren’t set in stone; they fluctuate based on how busy the network is. If lots of people are moving Bitcoin around, the fee goes up because the miners’ “workload” increases. It’s a bit like shipping costs going up during the holiday season because everyone is sending packages.

Now, why pay a fee at all? Well, it’s all about speed. The higher the fee you’re willing to pay, the faster your transaction gets processed. Miners will prioritize transactions with higher fees because, like anyone, they want to maximize their earnings. It’s a supply-and-demand dance, where users compete to get their transactions confirmed quickly by offering attractive fees to miners. This back-and-forth can lead to some surprising fee spikes, especially during times of high demand. https://wikicrypto.news/tax-planning-strategies-for-bitcoin-investors-and-traders

The Dance of Demand: Bitcoin Value Fluctuations 💃

Imagine a dance floor where the music never stops, and the dancers are the ever-changing values of Bitcoin. Like any party, the number of people wanting to join can change from one song to the next. Sometimes the floor is packed when the tunes (or in our case, the value of Bitcoin) are just too good to resist. Other times, there’s more space as the crowd thins when the music doesn’t hit quite right. This ebb and flow reflect the constant shifts in how much people are willing to pay for Bitcoin, driven by news, events, or even just collective mood swings. 🎶🚀

Every change in the tune reflects a decision by someone, somewhere, to buy or sell Bitcoin, affecting its price. Just like a rare vinyl can suddenly become everyone’s must-have, causing a surge in its price, Bitcoin can experience spikes in value when it becomes the digital asset everyone wants to hold. Conversely, if the tune changes and sentiment shifts, you might find fewer dancers on the floor, mirroring a drop in Bitcoin’s value. It’s this dance of demand, influenced by a mix of logic, emotion, and external factors, that keeps the Bitcoin market so captivating and unpredictable. 🌍💫

Fees and Value: a Two-way Street 🛣️

Imagine a bustling market where the price of apples rises and falls based on how many people want them and how many apples are available. Think of Bitcoin in a similar way. Its value dances to the tune of supply and demand – more buyers and higher demand often mean a higher price. Now, enter transaction fees, the cost to participate in this bustling market. These fees aren’t fixed; they vary, much like a taxi fare that changes with the distance or a crowded route. When Bitcoin’s value skyrockets, more people want to buy, sell, or move their digital apples around, leading to busier traffic on the blockchain road. This increased activity can cause transaction fees to rise as people are willing to pay more for faster service. Conversely, when the value dips, the blockchain road gets a bit quieter, and fees can drop. Thus, the relationship between Bitcoin’s value and transaction fees is a dynamic one – each influencing the other in an endless dance. For those interested in the environmental aspect of this digital phenomenon, understanding the bitcoin environmental impact and the blockchain is crucial as it outlines the challenges and innovations shaping its future.

Real Stories: When Fees Surged, What Happened? 📈

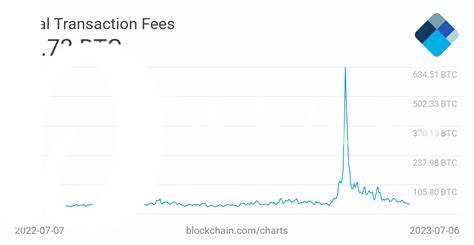

Imagine a time when the buzz around Bitcoin was so loud almost everyone wanted a piece of it. This rush wasn’t just talk; it drove a significant spike in transactions. But here’s the twist: with more people wanting to make transactions, the network got super busy. Think of it as a busy day at your favorite coffee shop, where more people equals a longer wait. In the Bitcoin world, though, you can “tip” to jump ahead in line. This “tip” is the transaction fee, and during these bustling times, everyone started tipping a bit more to get their transactions processed faster. Suddenly, these tips surged to heights never seen before. To put numbers to the story, let’s glance at a simple chart:

| Date | Average Transaction Fee (USD) |

|---|---|

| December 2017 | $55 |

| April 2021 | $62.79 |

These peaks in fees painted a vivid picture of supply and demand in action: the higher the demand for transactions, the higher the fees soared. It was a clear signal of Bitcoin’s growing pains but also of its undeniable allure. The real kicker, though, was the aftermath: as the dust settled, discussions on scalability and efficiency took center stage, pushing the community to innovate.

Looking Ahead: Predicting the Future Landscape 🔮

Peering into the crystal ball to predict the future of Bitcoin feels a bit like trying to forecast the weather in a land far, far away. Yet, everyone wants to know: where are we heading? As Bitcoin continues to ride the rollercoaster of valuation, many wonder if transaction fees will follow suit or chart their own path. It’s like watching two dance partners moving to their own beat yet somehow staying in sync. Will higher transaction fees scare people away or become just another part of the Bitcoin adventure? Future regulations, technology advancements such as scalability solutions, and evolving public perception will play starring roles. And let’s not forget, guidelines on taxation will either make this journey smoother or throw a few more bumps on the road. In the end, the landscape of tomorrow is shaped by the actions and decisions of today, creating a story we’re all part of writing. 🌟🔍💡