📉 Understanding How Rules Change Bitcoin’s Rollercoaster Ride

Imagine a thrilling rollercoaster, twisting and turning unpredictably – that’s a bit like the ride Bitcoin buyers and sellers are on. What makes this ride especially wild, though, are the rules of the game – imagine if every twist in the track could suddenly change based on new signs posted by those in charge. This is much like how various regulations worldwide can impact Bitcoin’s price, making it either dive or surge. Different countries have their own set of rules, each influencing Bitcoin in unique ways. For example, when a country announces stricter control over Bitcoin trading, prices might tumble as people worry about future restrictions. Conversely, if a country embraces Bitcoin, giving it the green light, prices can soar as excitement kicks in. It’s a complex dance between what regulators say and how people react, driving the ups and downs in Bitcoin’s value.

| Regulatory Change | Typical Impact on Bitcoin Price |

|---|---|

| Stricter regulation announcements | Price tends to drop |

| Adoption or positive regulation | Price tends to rise |

🌍 a World Tour of Bitcoin Regulations and Prices

Imagine hopping on a plane and taking a trip around the world, not just to see the sights but to see how different places treat Bitcoin. In some spots, it’s like Bitcoin is a superstar, welcomed with open arms. In others, it’s more like a cautious handshake, where people are a bit wary but still curious. This journey shows us the colorful mosaic of rules and attitudes that influence Bitcoin’s ups and downs. As each country draws its line in the sand, Bitcoin’s price reacts, sometimes soaring into the sky like a rocket, other times taking a dive. It’s a thrilling ride, not just for those buying and selling but for anyone curious about this digital currency’s adventure across the globe. For more insights, consider exploring https://wikicrypto.news/navigating-crypto-taxes-tips-for-global-investors, where the journey into Bitcoin’s relationship with the world continues.

🚦 Red Lights and Green Lights: Compliance Impacts

Navigating the world of Bitcoin can sometimes feel like being a car on a busy street, dodging traffic lights. When governments step in and set rules, it’s like hitting a red light; everyone has to stop and think about what to do next. These rules can make the price of Bitcoin slow down, drop, or even come to a screeching halt because they can make it harder for people to buy or sell. On the flip side, when there’s a green light, such as a government saying, “We’re cool with Bitcoin,” it can act like a boost, sending prices zooming up. This happens because people feel safer and more confident about investing their money into Bitcoin.

It’s fascinating how much power these regulations have, isn’t it? 😲 Just like in a game, where certain moves can either speed you up or slow you down, the world of Bitcoin reacts similarly to the thumbs-up or thumbs-down from authorities. 🌎 Every time a country announces a new standpoint on Bitcoin, investors around the world hold their breath, waiting to see if it’s time to hit the gas pedal or brake. These decisions shape how everyone from big businesses to the average Joe feels about dipping their toes into the Bitcoin pool, thereby influencing the currency’s value like a never-ending tug-of-war. 📊

💬 Public Perception: the Voice Behind Bitcoin’s Value

When it comes to Bitcoin, what people think and say about it can really shake things up. Imagine a bustling market, where the buzz of conversation can make the prices of fruits and veggies soar or drop. Bitcoin works a bit like that too. When folks are positive about Bitcoin, seeing it as a safe treasure chest or the future of money, its value can shoot up. On the flip side, if there’s a lot of worry or bad news, the value might take a dive. It’s all about confidence. If people believe in it, they’re more likely to buy in, pushing the price up.

Now, staying informed is key. In a world where new stories pop up every minute, knowing the ins and outs can help you understand why Bitcoin’s value changes the way it does. For those looking to dive deeper into how the current market feels about Bitcoin and what that means for potential investors, checking out assessing the risks of investing in bitcoin today market trends can offer some fresh insights. Remember, the world’s view on Bitcoin is like a powerful wave: it can carry you to exciting new heights, but it’s always wise to know how to ride it safely.

🛠 Tools of Control: What Governs Bitcoin’s Flow?

Imagine a river flowing smoothly until a series of gates are installed along its course. Each gate, designed to control and regulate the water’s flow, can cause ripples, waves, or even calm the waters, depending on how it’s operated. That’s a bit like how Bitcoin moves in the digital world, with various “gates” or regulations shaping its journey. Governments and institutions around the globe act as gatekeepers, setting rules that Bitcoin must navigate through. These rules can range from strict limitations, such as bans on trading or heavy taxation, to supportive measures like clear legal frameworks that encourage investment and growth. The impact of these regulations can be immediate – for instance, a new law might suddenly make it harder to buy Bitcoin in one country, causing a dip in its price, while another country’s decision to embrace Bitcoin could send its value soaring. But it’s not just about the laws themselves; it’s also about how these rules are applied. Sometimes, the mere announcement of potential regulation can cause a stir among investors, influencing Bitcoin’s price even before any formal steps are taken. This interplay between regulation and Bitcoin’s value is like a dance, where each step by the regulators leads to a calculated move by the market. Understanding this dynamic is key for anyone looking to navigate the ebbs and flows of Bitcoin’s price.

| Factor | Impact on Bitcoin Flow |

|---|---|

| Government Bans | Negative |

| Clear Legal Frameworks | Positive |

| Heavy Taxation | Negative |

| Investment Encouragement | Positive |

| Announcement of Regulations | Varied |

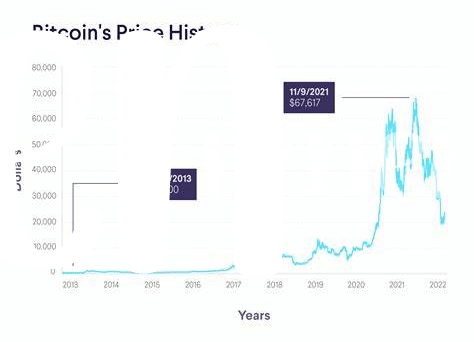

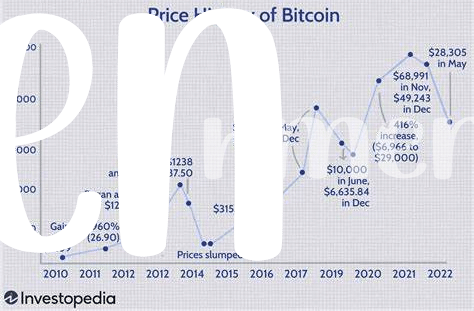

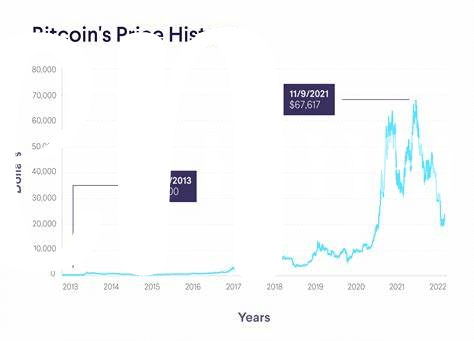

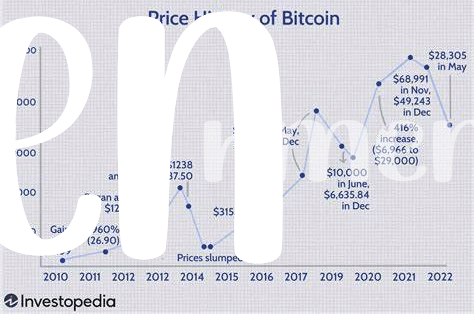

🔍 Deep Dive: Recent Regulations Rocking the Boat

Lately, the waters of Bitcoin regulation have been more turbulent than ever, drawing everyone’s attention to the latest changes and their impact on the market. Governments and financial watchdogs across the globe are putting their heads together to come up with rules that could either make or break the future of this digital treasure. For anyone trying to navigate these choppy waters, understanding how these new guidelines shape the future of Bitcoin is akin to finding a treasure map. It’s not just about the highs and lows; it’s the why’s and how’s that matter. Among these developments, some countries are waving a flag of caution while others set out the welcome mat, creating a patchwork of regulations that affect Bitcoin’s price in ways more intricate than most can imagine. For a closer look at how these regulations are influencing Bitcoin’s journey, swinging its value in unexpected directions, take a deep dive into the role of bitcoin in bolstering emerging market economies market trends. From this viewpoint, it’s clear that the path Bitcoin travels is heavily influenced by the regulatory winds blowing across the globe, making it a fascinating study of adaptation in the face of ever-changing rules.