🌍 Why Emerging Markets Are Eyeing Crypto

Imagine a place where the usual ways of saving and spending money seem a bit old-fashioned or simply don’t work well for everyone. That’s the reality in many emerging markets, where the traditional banking system can feel out of reach for a lot of people. Enter cryptocurrencies – digital money that lives on the internet. For many in these parts of the world, crypto offers a new and exciting way to think about and handle money. It’s not just about being new or trendy; it’s about offering solutions to real problems. For starters, sending money to someone else, even if they’re far away, becomes as easy as sending a text message. This is super handy in places where it’s not so easy to pop into a bank or the fees for sending money are high. And with more folks getting their hands on smartphones and internet access, the idea of digital wallets holding cryptocurrencies makes even more sense. It’s a game-changer for how people manage their money, providing options that were simply not possible before.

| Key Points | Explanation |

|---|---|

| Accessibility | Cryptocurrencies provide an accessible option for financial services in emerging markets, where traditional banking might be out of reach for many. |

| Remittances | Sending money across borders becomes cheaper and faster, benefiting individuals in countries with high remittance inflows. |

| Financial Inclusion | Crypto offers opportunities for financial inclusion, catering to unbanked populations by enabling digital transactions. |

🚀 the Surge of Mobile Payments and Cryptocurrency

In the digital age, the way we handle money is transforming right before our eyes. Imagine being able to send money to a friend in another country right from your phone, without worrying about hefty bank fees or long waiting times. That’s where mobile payments and cryptocurrencies come into play. They’re like digital money; you can use them to buy stuff online or even in some stores and markets. What’s really interesting is how popular these have become in places where it’s harder to access traditional banking services. People are finding that using their phones to manage their money is not just convenient but also a game changer.

Moreover, the rise of mobile payments and digital currencies is shaking things up for good. With just a few taps on a smartphone, anyone can pay for their groceries, settle bills, or invest in digital currencies like Bitcoin. It’s pretty cool, especially in parts of the world where banks are few and far between. And for those interested in the ups and downs of Bitcoin prices, following global events can provide insights. A helpful resource in this area is https://wikicrypto.news/fibonacci-retracement-enhancing-bitcoin-trading-in-uncertain-times, which dives deep into understanding how international happenings can impact Bitcoin’s value. It’s this blend of technology and accessibility that’s paving the way for a financial revolution, making it easier for everyone to be part of the global economy.

💡 Blockchain: More Than Just Crypto

Imagine a big, limitless playground where everyone can play, create, and share. That’s sort of what blockchain is like. Beyond the buzz of bitcoin and its cousins, this tech is a game-changer all on its own. It’s like a giant, open book where every page is connected, making it super hard for sneaky changes to go unnoticed. This special feature is great for more than just money stuff. It’s paving the way for safer food tracking from farm to table, making sure your sneakers are the real deal, and even helping artists keep track of who owns their work. 🌐🔍 In some parts of the world, it’s even making it easier for folks to prove they own their land, a big deal in places where paperwork often goes missing. So, while the crypto craze continues to grab headlines, the real superstar might just be the blockchain technology itself, quietly revolutionizing how we trust and verify almost everything in our digital and physical worlds. 🌟📚

🏦 Traditional Banks Vs. Crypto: the Tug of War

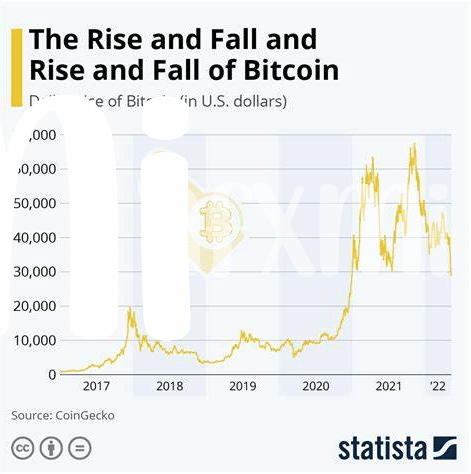

In the financial playground, a fascinating battle is unfolding as old-school traditional banks square off against the new kids on the block: cryptocurrencies. This isn’t just about saving or spending money; it’s a full-blown tug of war for the future of finance. On one side, banks come with decades, sometimes centuries, of history, trust, and a hefty rulebook backed by governments. Pop into a bank, and they’ll talk your ear off about security and stability. Flip the coin, and you’ll find the crypto world buzzing with excitement over the freedom it offers. No waiting in lines, no hefty fees for sending money across the border, and it never sleeps—it’s a 24/7 financial fiesta. But it’s not all sunshine and rainbows; this brave new world has its dark clouds. The wild swings in the value of cryptocurrencies can make you feel like you’re riding the world’s scariest rollercoaster—a concern you can dive deeper into by analyzing bitcoin price volatility and its causes market trends. This clash of titans is more than a squabble over customers; it’s shaping up to redefine what money means in the 21st century.

🛍️ Shopping and Sending Money Cross-border with Crypto

Imagine a world where sending money to family overseas or buying a unique hand-crafted item from another country is as simple as sending a text message. This is the power that cryptocurrency brings to our fingertips. Unlike traditional ways of moving money across borders, which often involve waiting for days and paying hefty fees, crypto transactions are swift and usually cost less. This advantage is especially crucial in places where access to banking services is limited, but mobile phones are widespread. People are increasingly using digital currencies for everyday transactions, making international shopping and remittances a breeze. What makes this even more interesting is the level of security and transparency offered by blockchain technology, the backbone of cryptocurrencies, ensuring that your money gets to where it needs to go safely.

Here’s a quick look at how traditional remittances compare with crypto-based ones:

| Method | Speed | Cost | Global Reach |

|---|---|---|---|

| Traditional Bank Transfers | 2-5 days | High fees | Limited to bank networks |

| Cryptocurrency Transactions | Minutes | Low or no fees | Worldwide |

This paradigm shift is not just reshaping how we think about money; it’s tearing down barriers, making the global marketplace more accessible and inclusive for everyone, everywhere.

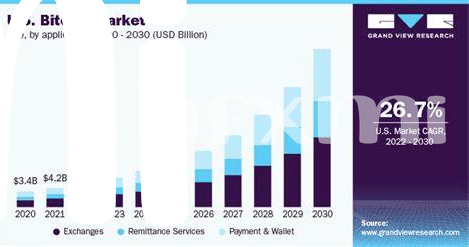

📈 Trends Shaping the Future of Crypto in These Markets

Emerging markets are buzzing with new ways to manage money, and cryptocurrencies are at the heart of this transformation. With every swipe on their smartphones, people are saying yes to digital money, showing how tech-savvy and eager they are for change. This excitement around crypto isn’t just about being part of a trend; it’s about solving real problems. Imagine sending money to another country without waiting days for it to arrive or paying huge fees. That’s becoming normal thanks to crypto.

But what’s next on this journey? We’re seeing a surge in making micropayments feasible with bitcoin regulatory outlook, showing us a future where small, everyday transactions are easier and cheaper. This is big news for everyone, from the person selling handmade crafts online to friends splitting the bill at dinner. As these trends grow, they’re not just shaping how we use money; they’re redefining what money means in our lives and in markets hungry for innovation.