Growth 📈

One of the key aspects shaping the future landscape of Bitcoin in the Dominican Republic is the trajectory of its growth. The increasing adoption of Bitcoin and other cryptocurrencies in the country is indicative of a burgeoning trend towards digital assets. This growth is fueled by a growing awareness and acceptance of Bitcoin as a legitimate form of digital currency in various sectors, including e-commerce, remittances, and investment. As more individuals and businesses in the Dominican Republic embrace Bitcoin, its presence in the local economic ecosystem continues to expand, paving the way for new opportunities and challenges in the evolving financial landscape.

Innovation in the cryptocurrency space, coupled with the rising demand for alternative financial systems, is expected to further drive the growth of Bitcoin in the Dominican Republic. As the cryptocurrency market matures and regulatory frameworks evolve to accommodate digital assets, Bitcoin’s role as a viable investment and payment option is likely to increase. The future growth of Bitcoin in the Dominican Republic hinges on how effectively industry players, regulators, and the public collaborate to harness its potential benefits while mitigating associated risks.

Regulatory Challenges 🛑

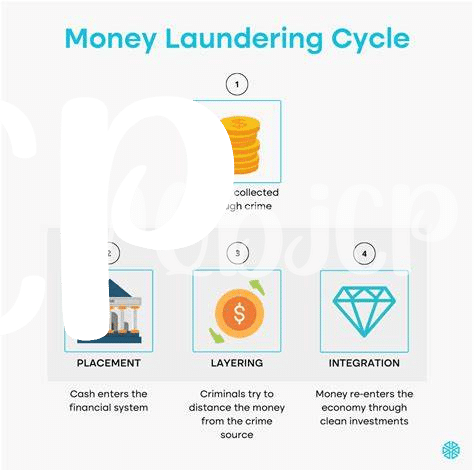

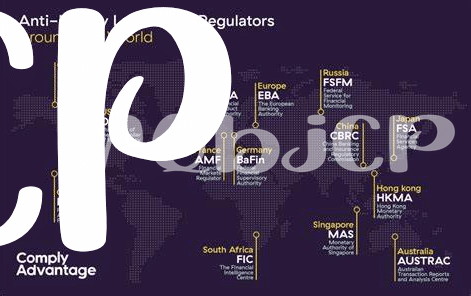

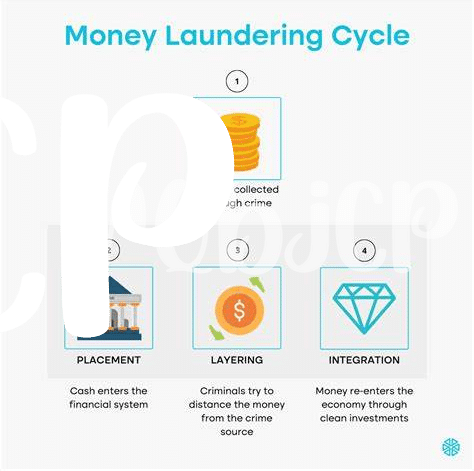

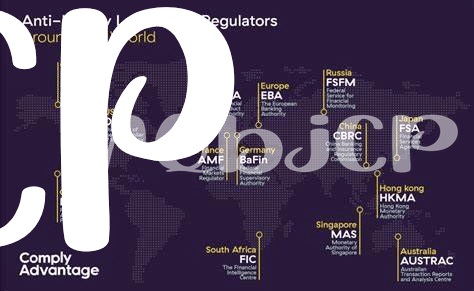

Amidst the evolving landscape of Bitcoin in the Dominican Republic, navigating regulatory challenges poses a critical concern for stakeholders. The intersection of Anti-Money Laundering (AML) oversight and cryptocurrency transactions presents unique obstacles that require a delicate balance between compliance and innovation. As regulatory bodies strive to adapt to the complexities of the digital asset space, issues such as customer identification, transaction monitoring, and reporting requirements emerge as focal points for ensuring transparency and security within the ecosystem. Understanding and effectively addressing these regulatory hurdles will be pivotal in shaping the future trajectory of Bitcoin adoption in the country.

Embracing regulatory challenges as opportunities for growth and development can foster a more robust and sustainable framework for the integration of cryptocurrencies within the financial sector. By proactively engaging with regulatory authorities and industry stakeholders, mechanisms for enhancing compliance standards and mitigating risks can be collaboratively established. Adherence to AML guidelines not only safeguards against illicit activities but also instills confidence among users and investors in the legitimacy and resilience of Bitcoin as a viable asset class.

Innovation 💡

As the world of Bitcoin continues to evolve, new and exciting developments in technology are fueling innovation within the industry. From the creation of more user-friendly platforms to the integration of advanced security measures, the drive for innovation is reshaping how we interact with cryptocurrencies. These advancements not only enhance the overall user experience but also pave the way for a more secure and efficient Bitcoin ecosystem. With each new innovation, Bitcoin is solidifying its position as a transformative force in the financial landscape, offering unparalleled opportunities for growth and development.

Market Trends 📉

Market trends in the cryptocurrency space are constantly evolving, with significant fluctuations in value and adoption rates being key indicators. Understanding these trends is crucial for investors and stakeholders alike. Keeping an eye on how Bitcoin is being traded and used in the Dominican Republic can provide valuable insights into the overall health of the market and its potential growth prospects. By analyzing patterns in buying and selling behavior, as well as regulatory changes impacting the industry, one can better anticipate future movements and make informed decisions. For more information on staying compliant with Bitcoin anti-money laundering (AML) regulations in Dominica, you can refer to this informative guide: [bitcoin anti-money laundering (aml) regulations in Dominica](https://wikicrypto.news/compliance-strategies-for-bitcoin-exchanges-under-costa-rican-aml-laws).

Public Perception 🧐

Public perception plays a crucial role in shaping the future of Bitcoin in the Dominican Republic. As more individuals and businesses become familiar with this digital currency, attitudes and beliefs about its reliability and security will influence its adoption rate. Education and awareness campaigns will be key in addressing misconceptions and building trust among the general public. Additionally, media coverage and government messaging can sway public opinion and acceptance of Bitcoin as a legitimate form of payment. Monitoring and responding to public sentiment will be essential for the continued growth and sustainability of Bitcoin within the country.

Future Perspectives 🔮

The future of Bitcoin in the Dominican Republic holds exciting possibilities as the digital currency continues to gain traction in various sectors. With evolving technology and growing acceptance, the potential for Bitcoin remains vast. As regulatory frameworks adapt to address emerging challenges and ensure compliance, the landscape for cryptocurrencies is expected to mature. Innovations in blockchain technology are likely to drive further adoption and offer new opportunities for users. Understanding market trends and public sentiment will be crucial in navigating the dynamic environment. Looking ahead, the future perspectives for Bitcoin in the Dominican Republic are optimistic, with continued growth and integration into mainstream financial systems.

Please find more information on Bitcoin anti-money laundering (AML) regulations in the Czech Republic by clicking on bitcoin anti-money laundering (AML) regulations in Costa Rica.