Current Bitcoin Aml Regulations 🌐

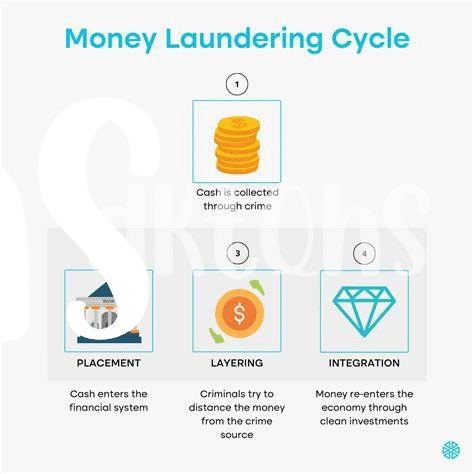

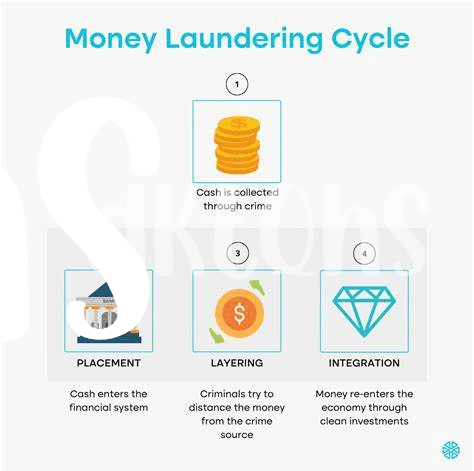

Bitcoin AML regulations are undergoing constant evolution, mirroring the dynamic digital landscape they govern. Striking a delicate balance between protecting against illicit activities and fostering innovation, these regulations seek to bring clarity to the often murky world of cryptocurrency transactions. As governments and financial institutions seek to adapt to the decentralized nature of Bitcoin, regulatory frameworks are being refined to ensure compliance without stifling growth in this rapidly expanding sector.

Impact of Regulations on Bitcoin Value 💰

Regulations play a significant role in shaping the value of Bitcoin. The implementation of Anti-Money Laundering (AML) regulations can impact the perception of Bitcoin as a legitimate asset. Stricter regulations may lead to increased transparency and trust, potentially boosting the value of Bitcoin in the long run. Conversely, overly stringent regulations could stifle innovation and adoption, causing fluctuations in Bitcoin’s value. Finding the right balance is crucial to ensuring a stable and thriving Bitcoin ecosystem.

Challenges Facing Haiti’s Financial Stability 🇭🇹

Haiti faces significant challenges in maintaining financial stability due to a combination of factors such as political instability, natural disasters, and lack of access to basic financial services for a large segment of the population. Additionally, the country struggles with high levels of poverty and a reliance on remittances as a crucial source of income. The lack of comprehensive financial infrastructure further complicates efforts to establish stability, making it harder to attract investment and spur economic growth. Addressing these challenges will require a multifaceted approach that includes improving governance, enhancing financial literacy, and fostering greater institutional capacity to effectively manage and regulate the financial sector.

Innovations in Aml Technology 🔒

In the realm of combating financial crimes, advancements in anti-money laundering (AML) technology are crucial for staying ahead of illicit activities. These innovations not only enhance the efficiency of AML processes but also bolster the overall security measures in place. By incorporating sophisticated technological solutions, regulators can more effectively monitor and prevent money laundering activities within the Bitcoin ecosystem. To delve deeper into the role of technology in enforcing AML regulations, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Iraq.

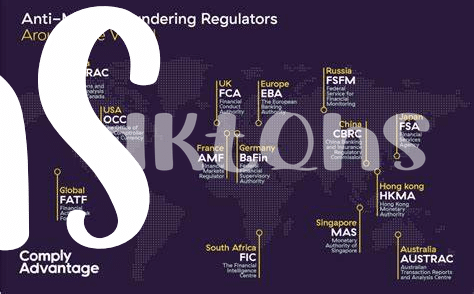

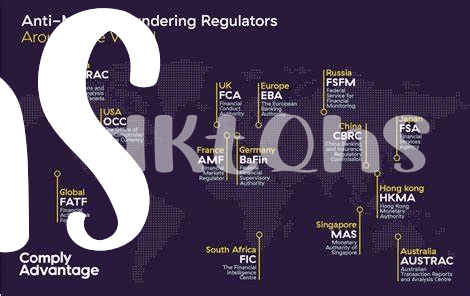

Global Collaboration for Better Regulation 🤝

In a rapidly evolving digital landscape, the call for global collaboration stands as a cornerstone in shaping effective regulations for the future of cryptocurrencies like Bitcoin. By fostering partnerships across nations and regulatory bodies, the potential to create standardized frameworks and guidelines for Anti-Money Laundering (AML) measures gains momentum. This collaboration not only enhances the transparency and security of transactions but also instills greater confidence among users and investors in the cryptocurrency space. Furthermore, by sharing best practices and insights, countries can collectively address emerging challenges and ensure a more robust regulatory environment that adapts to the dynamic nature of digital assets. Ultimately, this unified effort towards better regulation sets the stage for a more sustainable and inclusive financial ecosystem for all stakeholders involved.

Opportunities for Economic Growth in Haiti 📈

In Haiti, embracing opportunities for economic growth holds the promise of transforming the nation’s financial landscape. By implementing policies that foster innovation and entrepreneurship, Haiti can create a more robust and sustainable economy. Encouraging investment in key sectors such as technology, agriculture, and infrastructure can pave the way for job creation and increased prosperity for the country’s citizens. Additionally, fostering a culture of financial literacy and inclusion can empower individuals to participate more actively in the economy, driving growth from the grassroots level up. Through strategic partnerships with global entities and leveraging emerging technologies, Haiti has the potential to unlock new avenues for development and ensure long-term economic stability.

For more information on Bitcoin anti-money laundering (AML) regulations in Hungary, visit bitcoin anti-money laundering (AML) regulations in Iran.