Impact of Technology 🌐

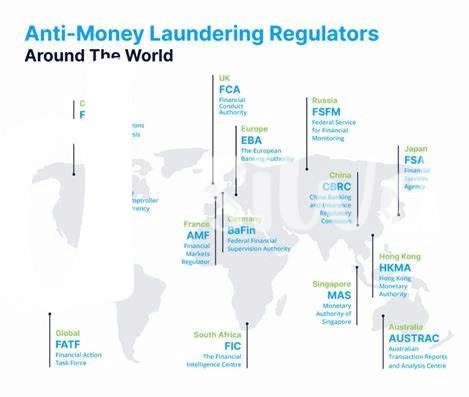

Technology has revolutionized the way Anti-Money Laundering (AML) rules are enforced globally, including in Iran. The utilization of advanced tools and software has significantly enhanced the tracking and monitoring of financial transactions involving Bitcoin. This technological advancement has provided regulators with greater visibility and control over potential illicit activities, contributing to a more secure and compliant financial ecosystem. The implementation of innovative technologies has played a crucial role in strengthening AML measures and ensuring the integrity of Bitcoin transactions in Iran.

Aml Regulations in Iran 💼

In Iran, the landscape of AML regulations continues to evolve, driven by the increasing integration of technology in financial oversight. The framework aims to enhance transparency in financial transactions, particularly in the realm of digital currencies like Bitcoin. Regulations are designed to mitigate the potential risks associated with money laundering and illicit activities, ensuring compliance and accountability across the board. Embracing technology enables authorities to monitor and enforce these regulations effectively, ushering in a new era of financial integrity and security in the digital age.

Bitcoin Transactions 📊

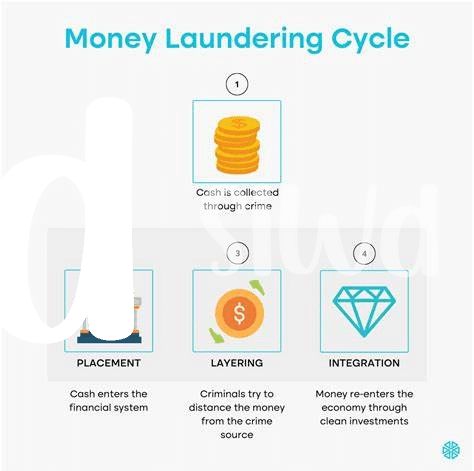

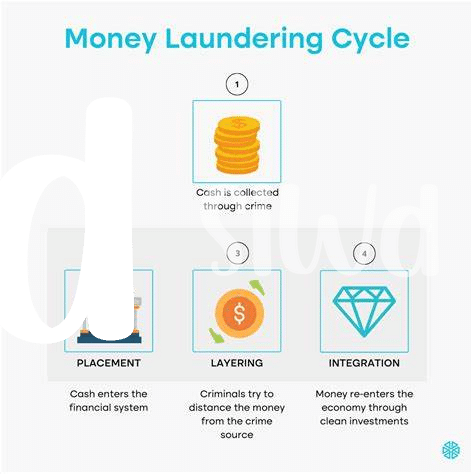

Bitcoin transactions play a significant role in the digital economy, offering a decentralized and secure way to transfer value across borders.

The anonymity and autonomy associated with Bitcoin transactions have both positive and negative implications, making it a popular choice for individuals seeking financial privacy but also raising concerns about its potential misuse for illicit activities. Despite these challenges, the transparency of the blockchain technology underlying Bitcoin enables regulators to trace and analyze transactions, helping to combat money laundering and other financial crimes. The evolving landscape of digital currencies necessitates continuous adaptation of anti-money laundering measures to ensure the integrity of financial systems.

Challenges in Enforcement 🛑

The enforcement of Anti-Money Laundering (AML) regulations in Iran faces significant challenges, particularly when it comes to monitoring and regulating Bitcoin transactions. The decentralized nature of cryptocurrencies makes it harder for authorities to trace and track illicit activities, leading to gaps in enforcement efforts. Additionally, the rapid evolution of technology complicates the task of staying ahead of innovative money laundering techniques. These challenges highlight the need for enhanced collaboration between regulatory bodies and technology experts to develop more robust systems for AML compliance in the evolving landscape of digital currencies. To learn more about similar regulatory frameworks in other regions, you can explore the bitcoin anti-money laundering (aml) regulations in Ghana.

Role of Blockchain Analysis 🧐

Blockchain analysis plays a crucial role in monitoring Bitcoin transactions, allowing authorities to trace the flow of funds and identify potential illicit activities. By utilizing sophisticated algorithms and data analytics, blockchain analysis firms can provide insights into the origins and destinations of digital assets, enhancing the ability to enforce AML regulations effectively. This technology empowers regulatory bodies to detect suspicious transactions, flag high-risk activities, and ultimately safeguard the integrity of financial systems. In the evolving landscape of cryptocurrency regulation, blockchain analysis stands out as a valuable tool in combating financial crime and ensuring compliance with AML rules.

Future Prospects 🔮

In the evolving landscape of technology and regulatory frameworks, the future prospects for enforcing AML rules on Bitcoin in Iran appear promising. With advancements in blockchain analysis and monitoring tools, authorities are gaining an enhanced ability to track and identify illicit activities within the cryptocurrency space. This increased proficiency not only strengthens AML efforts but also contributes to a more transparent and secure environment for Bitcoin transactions in the region.

The utilization of innovative technologies is expected to play a pivotal role in shaping the efficacy of AML regulations moving forward. As regimes continue to adapt and refine their approaches, collaborations between government entities and tech experts could drive substantial improvements in detecting and deterring money laundering activities involving Bitcoin. These developments signal a positive trajectory towards a more robust regulatory framework that safeguards against financial crimes in the digital realm.

bitcoin anti-money laundering (aml) regulations in indonesia with anchor bitcoin anti-money laundering (aml) regulations in guinea