Introduction 🌟

The story of Bitcoin banking regulations in Cuba is a tale that intertwines innovation, regulation, and the desire for financial independence. As the digital currency landscape evolves, so too do the regulatory frameworks shaping its use within the Cuban context. This article delves into the shifting tides of Bitcoin adoption in a country where traditional banking systems have long been the norm, exploring the complexities and implications of this digital revolution.

Early Regulations on Bitcoin Use 💡

The early days of Bitcoin in Cuba were marked by a lack of clear regulations, leaving many users uncertain about the legality and implications of using the cryptocurrency. This ambiguity led to a cautious approach among early adopters, who navigated the uncharted waters with a mix of curiosity and apprehension. As interest in Bitcoin began to grow, calls for regulatory clarity also intensified, prompting authorities to consider formal guidelines to govern its use within the country.

As discussions around Bitcoin regulation evolved, Cuban authorities sought to strike a balance between fostering innovation and addressing potential risks associated with unregulated digital assets. This phase of uncertainty laid the groundwork for future developments in the regulatory landscape, shaping the path that Cuban Bitcoin users would have to navigate in the years to come.

Rise of Cryptocurrency Exchanges in Cuba 📈

The rise of cryptocurrency exchanges in Cuba has sparked a new wave of financial possibilities for its residents. With the increasing adoption of Bitcoin and other digital assets, these exchanges serve as platforms where individuals can buy, sell, and trade cryptocurrencies securely. This emergence signifies a shift towards embracing innovative financial technologies in a country previously constrained by traditional banking systems. As more Cubans turn to cryptocurrency exchanges for their financial needs, it highlights a growing interest in decentralized forms of money within the region.

Challenges Faced by Cuban Bitcoin Users 🤔

Bitcoin users in Cuba face a range of challenges in navigating the evolving landscape of digital currency. Limited internet access and a lack of regulatory clarity create hurdles for individuals looking to participate in the global cryptocurrency market. Additionally, concerns around security and potential scams add another layer of complexity for Cuban Bitcoin users. Despite these obstacles, community support and a growing interest in decentralized finance offer hope for overcoming these challenges and maximizing the benefits of digital assets.

To learn more about the shifting regulatory environment surrounding Bitcoin banking services in other regions, check out this insightful article on bitcoin banking services regulations in Croatia.

Opportunities for Future Growth 🚀

In the rapidly changing landscape of Bitcoin banking regulations in Cuba, the potential for future growth is significant. As the country continues to explore and adapt to the use of cryptocurrencies, there are opportunities emerging for innovation and expansion. With a young population eager for technological advancements and a growing interest in digital assets, the adoption of Bitcoin presents a unique chance for Cuba to modernize its financial sector and participate more actively in the global economy. This evolution could potentially lead to increased financial inclusion and economic empowerment for Cuban citizens, paving the way for a more dynamic and resilient financial future.

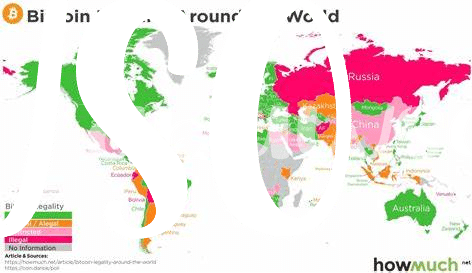

Impact of Global Trends on Cuban Regulations 🌎

Global trends play a pivotal role in shaping Cuban regulations. The interconnected nature of the world means that changes in the global landscape can have a direct impact on how countries like Cuba approach bitcoin banking regulations. For instance, developments in major economies regarding cryptocurrencies or financial technologies often influence the direction that smaller nations take. By staying attuned to these trends, Cuban policymakers can better navigate the evolving landscape of bitcoin banking regulations to ensure alignment with international standards and practices.

bitcoin banking services regulations in comoros