Historical Background 📜

The history of Bitcoin banking laws in Comoros is a fascinating journey filled with changes and challenges. Understanding the historical context provides valuable insights into the evolving regulatory landscape and its impact on the adoption of digital currencies. This background sets the stage for exploring how legislative changes have shaped the current banking environment in Comoros.

Initial Banking Regulations 🏦

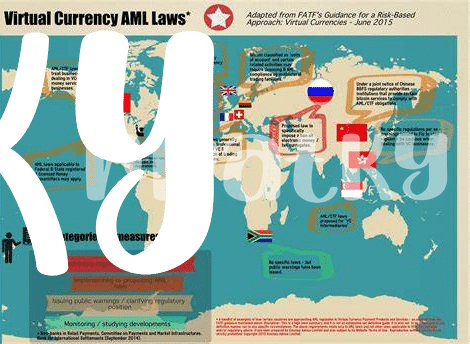

Throughout the development of banking regulations in Comoros, the focus has been on balancing innovation with security to create a conducive environment for financial activities. The initial banking regulations aimed to establish a robust framework for traditional financial institutions, yet there was limited guidance on emerging technologies like Bitcoin. This led to uncertainties and challenges in integrating digital currency services within the existing banking landscape.

Impact on Bitcoin Adoption 📈

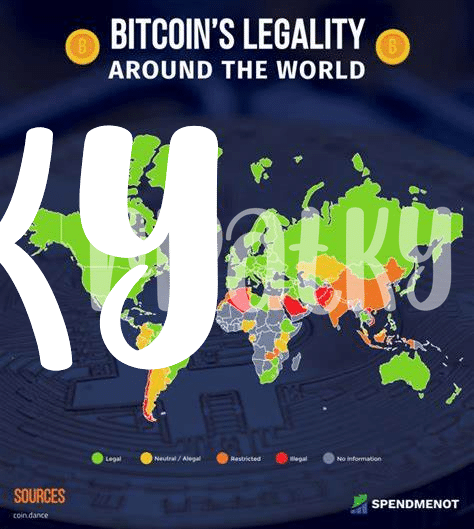

Bitcoin adoption in Comoros has had a significant impact on the financial landscape, with individuals and businesses turning to digital currencies for various transactions. The ease of use and decentralized nature of Bitcoin have appealed to many in the country, paving the way for innovative payment solutions and financial inclusion opportunities. As more people embrace Bitcoin, traditional banking institutions are also exploring ways to adapt and incorporate these digital assets into their services, signaling a shift towards a more dynamic and inclusive financial ecosystem in Comoros.

Recent Legislative Changes 🔄

Comoros has witnessed a series of recent legislative changes that have significantly impacted the landscape of Bitcoin banking within the country. These changes reflect the evolving attitudes towards digital currencies and aim to provide a more structured regulatory framework for their use. The new regulations signal a proactive approach by the government to adapt to the growing role of cryptocurrencies in the global financial ecosystem.

For a deeper insight into the future possibilities of Bitcoin banking regulations in other regions, explore the developments in Congo-Brazzaville by visiting bitcoin banking services regulations in Congo (Congo-Brazzaville).

Challenges and Opportunities Ahead 💡

In navigating the evolving landscape of Bitcoin banking laws in Comoros, various challenges and opportunities lie ahead. Adapting to the dynamic regulatory environment, striking a balance between innovation and compliance, and addressing concerns related to security and consumer protection present hurdles. However, the potential for increased financial inclusion, technological advancement, and economic growth create promising avenues for the future development of Bitcoin banking in Comoros.

Future Outlook and Potential Developments 🔮

In the rapidly evolving landscape of banking laws and digital currencies, the future outlook for Bitcoin banking in Comoros presents a blend of challenges and opportunities. Regulatory clarity and frameworks are expected to shape the path forward, influencing the level of adoption and integration of Bitcoin in traditional financial systems. Potential developments include further refinement of regulations to accommodate the digital currency ecosystem effectively, fostering innovation while ensuring consumer protection and financial stability. Additionally, collaborations with international entities and observing trends from other jurisdictions can contribute to a holistic approach towards embracing the potential of Bitcoin banking services in Comoros.

Bitcoin banking services regulations in Chile with anchor “bitcoin banking services regulations in China” will serve as a critical reference point for Comoros officials looking to navigate the complexities and opportunities of digital asset banking within their own jurisdiction.