Adoption of Bitcoin Banking 🌐

The world of finance is evolving, and Bitcoin banking is at the forefront of this transformation. As digital currencies gain momentum globally, China is considering the adoption of Bitcoin banking. This move not only symbolizes a shift towards modern financial solutions but also signifies a potential revolution in the traditional banking sector. The future of money management could soon be reshaped by the widespread acceptance of Bitcoin.

Regulatory Challenges Ahead 🚫

In the evolving landscape of Bitcoin banking in China, regulatory challenges lie ahead as the government grapples with the implications of digital currencies. The shifting regulatory environment poses a significant hurdle for the mainstream adoption of Bitcoin as a legitimate banking medium, raising questions about security, stability, and financial oversight. As China navigates this complex terrain, stakeholders must address concerns regarding transparency, compliance, and consumer protection to ensure the sustainable integration of Bitcoin banking into the existing financial framework. Despite these challenges, the potential benefits of embracing decentralized finance could drive innovation and reshape traditional banking paradigms in the Chinese market.

Opportunities for Financial Inclusion 🤝

Opportunities for Financial Inclusion in the realm of Bitcoin banking in China are paving the way for previously underserved populations to access essential financial services. Through the decentralized nature of Bitcoin, individuals who were excluded from traditional banking systems can now participate in the global economy with greater ease. This shift not only promotes economic empowerment but also fosters a more inclusive financial landscape where everyone has the opportunity to thrive and contribute to the broader financial ecosystem.

Technological Advancements Driving Innovation 🚀

Technological advancements in the field of Bitcoin banking are propelling unprecedented levels of innovation, revolutionizing the way financial transactions are conducted. From secure blockchain technology to streamlined payment processes, these advancements are driving efficiency and accessibility for users. As more sophisticated tools and platforms emerge, the landscape of Bitcoin banking in China is poised to undergo significant transformations, shaping the future of financial services in the digital age. To delve deeper into the regulatory perspectives shaping Bitcoin banking services, particularly in Cambodia, explore this insightful article on bitcoin banking services regulations in Cambodia.

Impact on Traditional Banking Systems 💸

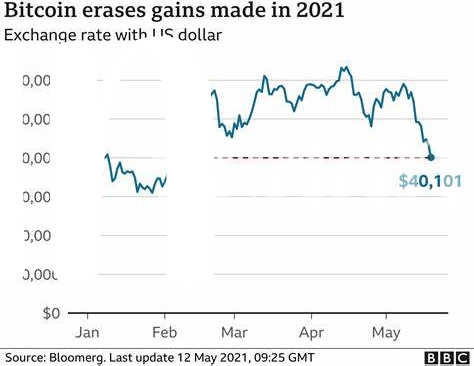

Bitcoin banking is poised to disrupt traditional banking systems in China, introducing a new era of financial transactions and decentralized currency management. As more individuals and businesses shift towards utilizing Bitcoin for their financial needs, traditional banks may face challenges in adapting to this evolving landscape. The transparency and efficiency offered by Bitcoin could overshadow the cumbersome processes and fees associated with traditional banking, potentially prompting them to reconsider their approach to customer service and operational strategies. This shift towards cryptocurrency banking poses both threats and opportunities for the traditional banking sector, requiring them to innovate and evolve to stay relevant in the dynamic financial ecosystem.

Future Outlook for Bitcoin Banking in China 🇨🇳

The future of Bitcoin banking in China holds great potential for revolutionizing the financial landscape. With evolving regulations and increasing adoption rates, there is a growing sense of optimism within the industry. As technology continues to advance, innovative solutions and opportunities for financial inclusion are expected to emerge. While traditional banking systems may face challenges, the overall outlook for Bitcoin banking in China appears promising.

Bitcoin banking services regulations in Canada