Saint Lucia’s Bitcoin Banking 🌴

In recent years, Saint Lucia has embraced the world of digital finance with the introduction of Bitcoin banking. This innovative approach has opened up new possibilities for residents and businesses on the sun-kissed island. By integrating Bitcoin into its financial landscape, Saint Lucia is not only keeping up with global trends but also positioning itself as a forward-thinking player in the digital economy. Amidst palm trees and sandy beaches, Saint Lucia’s venture into Bitcoin banking signifies a significant step towards a more interconnected and tech-savvy financial future.

Regulatory Changes in Banking Sector 🔄

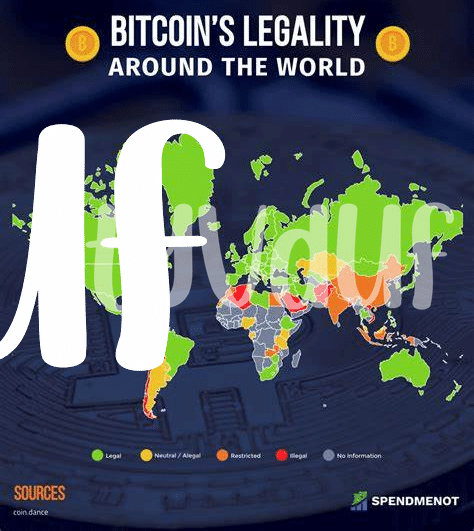

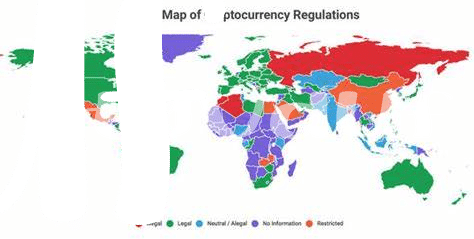

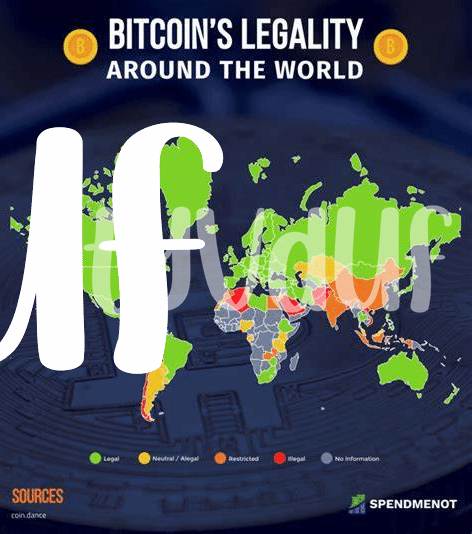

In recent years, the banking sector has undergone significant transformations to adapt to the evolving regulatory landscape. These changes have been crucial in ensuring compliance with new laws and regulations, enhancing transparency, and strengthening the overall stability of the financial system. Embracing these regulatory shifts presents both challenges and opportunities for financial institutions, paving the way for a more resilient and efficient banking ecosystem.

Inserted link: https://wikicrypto.news/the-role-of-regulations-in-shaping-the-bitcoin-banking-industry-in-panama

Impact of Bitcoin Adoption on Economy 💸

Bitcoin adoption in Saint Lucia signifies more than just a technological shift; it’s a catalyst for economic evolution. As digital currencies reshape traditional financial landscapes, the economy embraces newfound efficiencies and opportunities for growth. The transparency and decentralization inherent in Bitcoin transactions promote financial inclusion and foster innovation. This trend not only revolutionizes how transactions are conducted but also how wealth is generated and distributed, positioning Saint Lucia at the forefront of progressive economic adaptation.

Challenges Faced by Financial Institutions 🤔

Financial institutions in the landscape of evolving technologies face various hurdles in embracing Bitcoin banking. Implementing robust security measures to safeguard digital assets is a top priority, as the decentralized nature of cryptocurrencies poses unique challenges for traditional banking systems. Moreover, ensuring compliance with shifting regulatory frameworks demands agile adaptation strategies and continuous monitoring to mitigate risks effectively. The need for enhanced transparency and accountability in transactions further complicates the operational landscape for financial institutions navigating the complexities of digital currencies. Partnering with tech-savvy experts and investing in cutting-edge solutions are essential steps for banks to overcome these obstacles and flourish in the dynamic ecosystem of Bitcoin banking services.

To explore further insights on the future of digital banking and Bitcoin’s role in Rwanda’s regulatory framework, check out this informative article on bitcoin banking services regulations in Rwanda.

Future Trends in Banking Regulations 🚀

The innovative landscape of traditional banking regulations is continuously shifting towards embracing digital advancements and international standards. Emerging technologies, such as blockchain and artificial intelligence, are driving the evolution of regulatory frameworks. Increased focus on cybersecurity measures and data privacy laws are shaping the future trends in banking regulations. Collaborative efforts between regulatory authorities and financial institutions are essential in navigating the complexities of a rapidly changing financial landscape. Embracing agility and proactive adaptation will be crucial for stakeholders to thrive in the evolving regulatory environment.

Opportunities for Innovation and Growth 💡

In the rapidly evolving landscape of banking regulations, there lies a promising path for innovation and growth. As financial institutions navigate the changes brought about by the adoption of Bitcoin, new opportunities emerge for them to explore creative solutions and expand their services. Embracing technological advancements and digital integration can pave the way for enhanced customer experiences and operational efficiencies, ultimately driving the sector towards a more dynamic and resilient future.

For further insights into the regulatory frameworks governing Bitcoin banking services in different regions, refer to the bitcoin banking services regulations in Panama and explore the nuances of bitcoin banking services regulations in Qatar.