Bitcoin’s Emergence 💡

The inception of Bitcoin brought a new era in the financial landscape, introducing decentralized digital currency that transcends geographical boundaries. Its emergence sparked a wave of curiosity and innovation, captivating the imagination of both tech enthusiasts and traditional financial institutions. The concept of a peer-to-peer electronic cash system challenged conventional notions of money, paving the way for a paradigm shift in financial transactions and investments globally.

Digital Banking Evolution 🚀

The evolution of digital banking has significantly transformed the way financial transactions are conducted, making processes faster, more convenient, and accessible to a wider audience. With the advancement of technology, traditional brick-and-mortar banks are increasingly embracing digital platforms to enhance customer experience and streamline operations. This shift towards digital banking not only revolutionizes the financial sector but also paves the way for innovative services and products that cater to the changing needs of consumers.

Regulatory Challenges in Qatar 🧐

In the landscape of digital banking in Qatar, navigating regulatory challenges presents a unique set of hurdles. The evolving nature of digital currencies like Bitcoin adds complexity to existing frameworks, requiring policymakers to adapt swiftly to ensure stability and security. Striking a balance between fostering innovation and safeguarding against potential risks is a delicate task. Regulatory clarity is essential to establish a conducive environment for financial institutions and customers alike. Embracing a forward-thinking approach can pave the way for sustainable growth in the digital banking realm.

Impact on Traditional Banking 🏦

Bitcoin’s integration into traditional banking systems has sparked a wave of innovation and disruption in the financial sector. As traditional banks grapple with the decentralized nature of cryptocurrencies, they are forced to adapt their services to meet the needs of tech-savvy customers. This shift towards digital assets challenges the established norms of banking, pushing institutions to reevaluate their strategies to stay relevant in the rapidly evolving landscape. Discover more about bitcoin banking services regulations in Russia on Wikicrypto News.

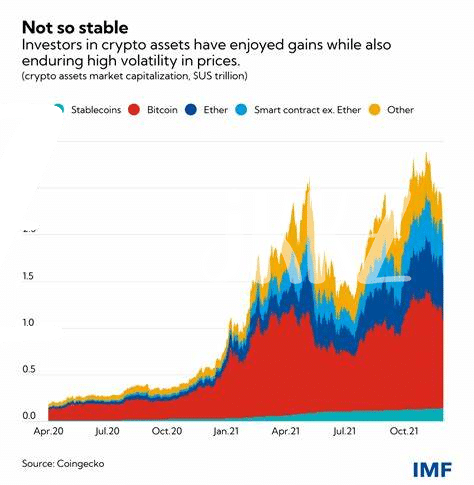

Future Adoption Trends 📈

In recent years, the financial landscape has been witnessing a gradual shift towards embracing digital currencies, with Bitcoin leading the charge. The future adoption trends indicate a growing acceptance of Bitcoin as a legitimate payment method and store of value. This shift is not only reshaping the traditional banking sector but also compelling financial institutions to explore innovative ways to incorporate Bitcoin into their service offerings. As more individuals and businesses begin to adopt Bitcoin, its influence on the financial ecosystem in Qatar is set to play a crucial role in shaping the future of digital banking.

Enhancing Financial Inclusion 🌍

Financial inclusion is a crucial aspect of economic development, ensuring that individuals and businesses have access to essential financial services. Through the integration of Bitcoin into digital banking systems in Qatar, the potential for enhancing financial inclusion is immense. By leveraging the innovative capabilities of Bitcoin, traditional barriers to banking can be overcome, empowering underserved populations to participate in the financial ecosystem effectively. This inclusive approach has the power to create a more equitable and prosperous society for all.

Bitcoin banking services regulations in Philippines with anchor bitcoin banking services regulations in Romania.