Current Regulatory Framework for Btc Investments in Jordan 🇯🇴

Jordan’s approach to regulating Bitcoin investments is characterized by a mix of caution and curiosity. The existing framework poses specific challenges such as clarity and consistency, leaving room for ambiguity. Despite this, recent developments indicate a growing interest in exploring innovative opportunities within the cryptocurrency space. Jordan’s regulatory landscape for Bitcoin investments navigates a delicate balance between oversight and fostering financial innovation.

Emerging Opportunities for Btc Investments in Jordan 🌱

Jordan’s evolving landscape presents a promising arena for Bitcoin investors. The progressive mindset within the financial sector opens doors to innovative investment avenues, fostering growth and diversification. With a growing market hungry for digital assets, Bitcoin investments in Jordan stand at the forefront of a flourishing ecosystem. Collaborative partnerships and strategic initiatives further catalyze the expansion, demonstrating the untapped potential awaiting savvy investors.

Challenges Faced by Investors in the Btc Market 🤔

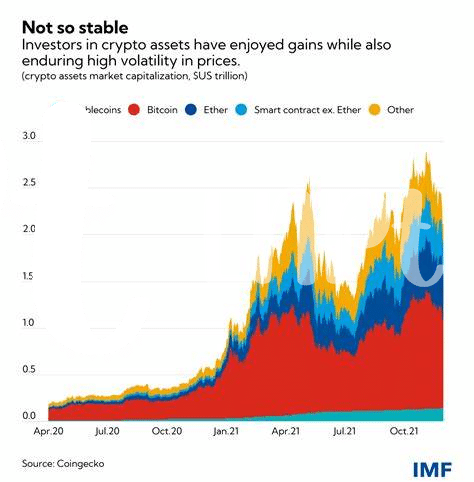

Investors in the Btc market often grapple with volatility, security concerns, and regulatory uncertainties. The fluctuating prices of Bitcoin can make it challenging for investors to predict returns accurately. Additionally, the security of digital assets remains a significant issue, with instances of hacking and fraud posing risks to investments. Moreover, varying regulatory stances on Btc investments across different jurisdictions create a complex landscape for investors to navigate, leading to uncertainty and potential legal repercussions. Balancing these factors while seeking profitable opportunities in the Btc market requires strategic planning and a thorough understanding of the risks involved.

Impact of Regulatory Changes on Btc Investment Landscape 💼

Impact of regulatory changes on the BTC investment landscape in Jordan can have profound implications on the overall market dynamics and investor sentiment. As new regulations are introduced or existing ones are amended, investors may need to adapt their strategies and compliance measures accordingly. This evolving regulatory environment can shape the level of investor participation, market liquidity, and overall stability of BTC investments in Jordan. Understanding these regulatory shifts is crucial for investors to navigate the changing landscape effectively. For more insights on the key factors influencing the regulation of bitcoin investment funds in various regions, including Italy, check out this informative resource on bitcoin investment funds regulation in Kenya.

Compliance Requirements for Btc Investors in Jordan 📝

In Jordan, the compliance requirements for investors in the Bitcoin market are evolving as regulators attempt to navigate the complexities of this emerging asset class. From Know Your Customer (KYC) procedures to reporting obligations, transparency and adherence to regulations are paramount to ensure the legitimacy and security of Bitcoin investments. As the regulatory landscape continues to develop, investors in Jordan must stay informed and compliant to navigate the ever-changing environment effectively.

Future Outlook for Btc Investments in Jordan 🚀

For the future outlook of Btc investments in Jordan, the landscape appears promising as regulatory frameworks evolve to accommodate the growing interest in digital assets. With increasing opportunities and a clearer path for investors, the market is poised for expansion and innovation. As Jordan moves towards a more supportive environment for Btc investments, stakeholders should stay informed and adapt to emerging trends to maximize their potential in this dynamic sector.

Don’t forget to check out the latest updates on bitcoin investment funds regulation in Italy to stay informed about related developments.