Understanding the Risks 🚨

Understanding the Risks 🚨

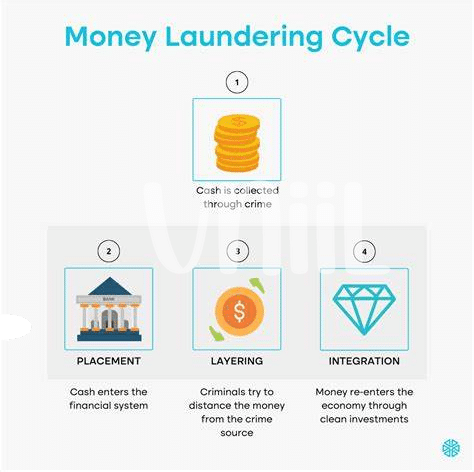

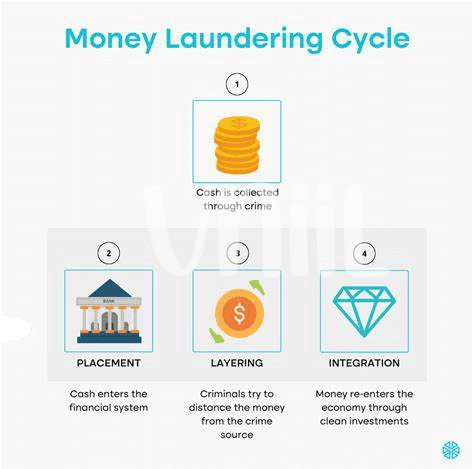

Bitcoin users must be aware of the potential risks associated with using cryptocurrency. The decentralized nature of Bitcoin means that transactions cannot be reversed, making it a target for scammers and hackers. Risks also involve volatile price fluctuations, regulatory uncertainties, and the possibility of funds being lost due to human error. By understanding these risks, users can take proactive measures to protect their investments and navigate the evolving landscape of digital currency with caution and awareness.

Due Diligence in Transactions 💼

When engaging in Bitcoin transactions, conducting due diligence is paramount. It involves thoroughly verifying the parties involved, understanding the nature of the transaction, and ensuring compliance with regulatory requirements. By performing due diligence, Bitcoin users can mitigate the risk of unwittingly facilitating money laundering activities and protect themselves from potential legal consequences. It is crucial to adopt a vigilant approach, staying informed about best practices and continuously assessing the legitimacy of transactions to safeguard against illicit activities in the digital currency space.

Identifying Suspicious Activity 🧐

The ability to identify suspicious activity plays a vital role in safeguarding your Bitcoin transactions. By staying vigilant and recognizing unusual patterns or behaviors, you can protect your assets from potential threats. Keep an eye out for any red flags such as sudden large transfers, unexplained sources of funds, or frequent transactions to unfamiliar addresses. Reporting any suspicious activity promptly to the appropriate authorities can help maintain the integrity of the Bitcoin network and uphold its security standards.

Secure Storage and Wallet Management 🔒

When it comes to safeguarding your digital assets, ensuring secure storage and effective wallet management are paramount. By implementing robust encryption measures and utilizing hardware wallets for added layers of protection, you can minimize the risk of unauthorized access or theft. Regularly backing up your wallet data offline and enabling multi-signature authentication can further fortify your defenses against potential threats. Being proactive in staying informed about the latest security practices and technologies will empower you to navigate the evolving landscape of cryptocurrency security with confidence and peace of mind. 🛡️

Bitcoin Anti-Money Laundering (AML) regulations in Iran

Compliance with Regulatory Requirements 📝

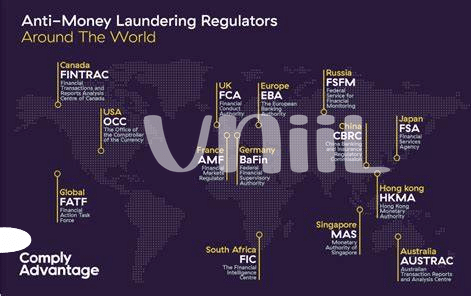

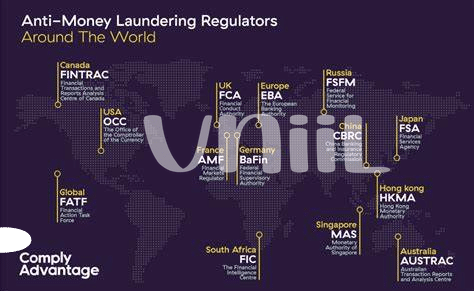

Ensuring compliance with regulatory requirements is crucial when dealing with cryptocurrencies like Bitcoin. By staying up-to-date on the ever-evolving laws and regulations, users can protect themselves from potential legal issues and ensure the legitimacy of their transactions. It is important to be aware of the reporting obligations and guidelines set forth by regulatory bodies to maintain a transparent and accountable approach to handling digital assets. Embracing compliance not only safeguards users from potential risks but also contributes to the overall credibility and sustainability of the cryptocurrency ecosystem.

Educating Yourself and Others 🌟

Ensuring that you and others are well-informed about the risks and best practices surrounding Bitcoin transactions is paramount in combating money laundering. By educating yourself on the latest trends and regulations, you can stay on top of any potential threats and protect your investments. Sharing this knowledge with others in your network can also help create a safer environment for everyone involved in the cryptocurrency space.

For more information on Bitcoin anti-money laundering (AML) regulations in Ghana, please visit bitcoin anti-money laundering (AML) regulations in Ghana, and for details on regulations in Indonesia, check out bitcoin anti-money laundering (AML) regulations in Indonesia. Stay informed and educated to safeguard against money laundering risks in the Bitcoin ecosystem.