Current Bitcoin Aml Regulations in Indonesia 🇮🇩

In Indonesia, the current Bitcoin AML regulations aim to address money laundering risks associated with cryptocurrency transactions. These regulations require cryptocurrency exchanges and other virtual asset service providers to implement robust KYC (Know Your Customer) procedures and report suspicious activities to relevant authorities. Additionally, compliance with AML/CFT (Anti-Money Laundering/Counter Financing of Terrorism) measures is mandatory to ensure transparency and accountability in the evolving digital financial landscape.

These regulations play a crucial role in safeguarding the integrity of the financial system and protecting investors from illicit activities. Indonesia’s proactive approach in implementing Bitcoin AML regulations reflects its commitment to fostering a secure environment for digital asset transactions within the country.

Challenges Faced by Indonesia in Bitcoin Regulation 🤔

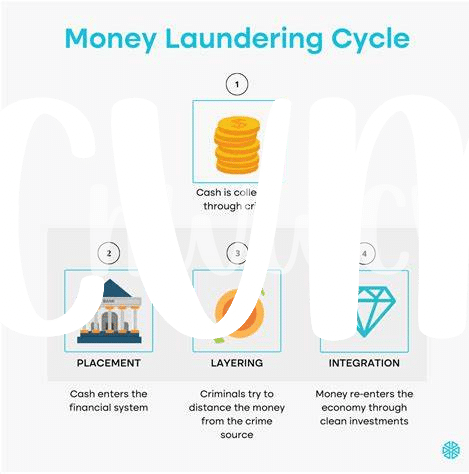

Indonesia faces various challenges in regulating Bitcoin due to the dynamic nature of cryptocurrencies and their global accessibility. One key hurdle is the evolving technology behind cryptocurrencies, making it difficult for traditional regulatory frameworks to keep pace. Additionally, the decentralized nature of Bitcoin transactions poses challenges for authorities in monitoring and enforcing AML regulations effectively. Balancing the need for regulatory oversight with the innovation and privacy features of cryptocurrencies presents a delicate task for Indonesia.

The complexity of cross-border transactions further complicates the enforcement of Bitcoin regulations in Indonesia. The anonymous nature of digital currencies can be exploited for illicit activities, raising concerns about money laundering and terrorist financing. Collaborating with international partners to address these challenges and leveraging technological solutions will be crucial in strengthening Indonesia’s AML framework for Bitcoin. By understanding and adapting to these obstacles, Indonesia can better navigate the evolving landscape of cryptocurrency regulation.

Impact of Bitcoin Aml Regulations on Cryptocurrency Market 💰

The introduction of Bitcoin Aml regulations in Indonesia has significantly impacted the cryptocurrency market, influencing the way individuals and businesses engage in digital asset transactions. These regulations have brought a level of transparency and security to the market, increasing trust among users and investors. As a result, more participants are entering the cryptocurrency space, contributing to its growth and stability.

Furthermore, the implementation of Bitcoin Aml regulations has led to a more regulated and compliant ecosystem, reducing the risks associated with money laundering and illegal activities. This has not only enhanced the credibility of cryptocurrencies but also attracted institutional investors who were previously hesitant to enter the market. Overall, the impact of these regulations has been instrumental in shaping the future of the cryptocurrency market and fostering its legitimacy on a global scale.

Future Outlook: Potential Changes in Bitcoin Aml Rules 🔮

The future outlook for Bitcoin AML regulations in Indonesia suggests the potential for significant changes in the rules governing cryptocurrency transactions. As the landscape continues to evolve, it is expected that regulatory authorities will adapt and refine their approach to mitigate risks associated with money laundering and illicit activities in the digital currency space. These changes could impact how businesses and individuals engage with Bitcoin, as compliance requirements may become more stringent to uphold the integrity of the financial system and protect investors.

For more insights on bitcoin anti-money laundering (AML) regulations in Guinea, visit bitcoin anti-money laundering (AML) regulations in Guinea and learn about the evolving regulatory landscape in the region.

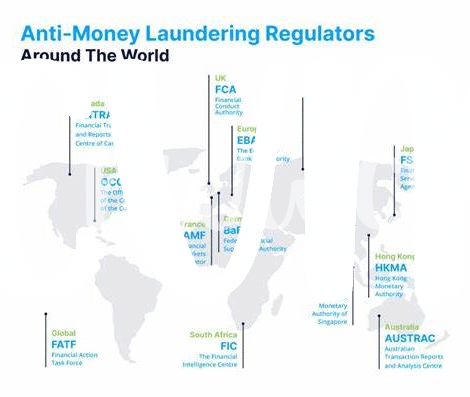

Comparing Indonesia’s Approach to Other Countries 🌍

In the realm of Bitcoin AML regulations, various countries around the world have taken diverse approaches, each with its own set of priorities and challenges. Indonesia’s approach, while focused on combating money laundering and illicit activities, also aims to foster innovation and growth within the cryptocurrency sector. By analyzing and comparing Indonesia’s strategies to those of other nations, we gain valuable insights into the global landscape of Bitcoin regulation. Some countries prioritize strict compliance measures, while others emphasize fostering a conducive environment for cryptocurrency adoption. Understanding these differing approaches can provide a holistic view of the direction in which Bitcoin AML regulations may evolve on a worldwide scale.

Recommendations for Improving Bitcoin Aml Compliance 📈

To enhance Bitcoin Aml compliance, it is crucial for Indonesia to focus on strengthening regulatory frameworks, fostering a culture of transparency and accountability within the cryptocurrency space, and promoting collaboration between relevant stakeholders. Implementing robust KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures, along with continuous monitoring of transactions, can help mitigate risks associated with illicit activities and enhance the overall integrity of the market. Furthermore, investing in education and awareness programs to educate users about the importance of compliance and security measures can play a significant role in improving the overall AML landscape in the country.

Don’t forget to check out the bitcoin anti-money laundering (aml) regulations in Honduras for additional insights.