Introduction to Bitcoin Regulations in Syria 🌍

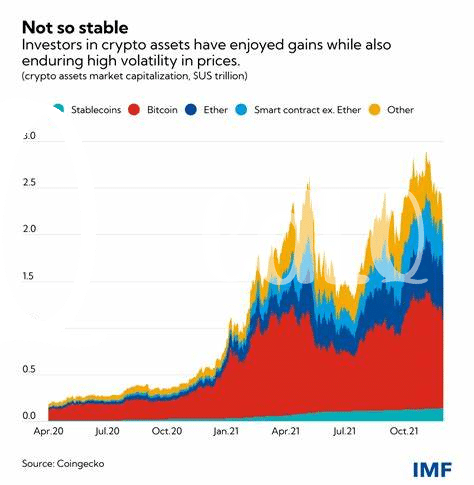

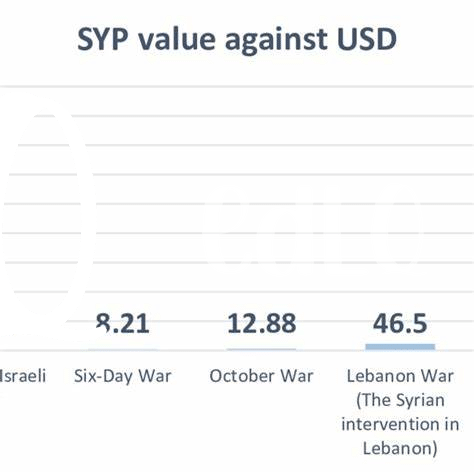

Bitcoin has made significant waves in the financial world, including in Syria where regulations are evolving to address its impact. The cryptocurrency landscape in Syria is complex, with various regulations shaping its use in the banking sector. Understanding the current regulatory framework is crucial for both financial institutions and individuals looking to participate in the burgeoning Bitcoin market in the country.

As Syria navigates these regulatory waters, the implications for the banking sector are profound. Striking a balance between fostering innovation and maintaining financial stability is a key challenge faced by regulators and banks alike. The dynamics between Bitcoin regulations and traditional banking practices are reshaping the financial landscape in Syria, setting the stage for a new chapter in economic development.

Impact of Regulations on Banking Sector 💼

The regulation of Bitcoin in Syria has significantly influenced the banking sector, shaping how financial institutions operate within the cryptocurrency landscape. These regulations have posed unique challenges to banks, requiring them to adapt to new compliance measures and adjust their services to align with legal requirements. As a result, banks have had to navigate the evolving regulatory landscape carefully to ensure they remain compliant while also exploring opportunities for growth and innovation within the constraints set by the regulations. Moving forward, the impact of these regulations on the banking sector will continue to shape the financial industry in Syria, driving banks to find innovative solutions and strategies to integrate Bitcoin services effectively.

When considering the impact of Bitcoin regulations on the banking sector in Syria, it is evident that stringent compliance measures have become essential for financial institutions to operate securely within the cryptocurrency market. Banks must prioritize regulatory adherence to avoid potential risks and ensure the safety of their operations. Additionally, the evolving regulatory environment presents opportunities for banks to explore new ways of incorporating Bitcoin services within their existing framework. By proactively addressing the challenges posed by regulations, banks in Syria can position themselves for sustainable growth and success in the digital currency space, fostering a more secure and regulated financial ecosystem for both customers and the industry as a whole.

Challenges Faced by Banks in Implementing Regulations 🤔

Banks in Syria encounter numerous hurdles when adapting to Bitcoin regulations. Financial institutions must grapple with the technological and operational changes required to comply with these new rules. Additionally, navigating the complexities of ensuring customer compliance poses a significant challenge for banks in Syria. The integration of Bitcoin regulations into existing banking frameworks demands a comprehensive reevaluation of traditional systems and processes.

Future Outlook for Bitcoin Integration in Syrian Banks 🔮

In the realm of Syrian banking, the integration of Bitcoin holds promise for a more inclusive and efficient financial landscape. The potential for digital currencies to streamline transactions and spur economic growth is a beacon of hope amid regulatory challenges. As Syrian banks navigate this uncharted territory, the future outlook for Bitcoin integration rests on fostering innovation while adhering to compliance standards and customer security protocols. The evolving dynamics between Bitcoin and traditional banking systems in Syria pave the way for a transformative financial ecosystem.

For further insights on compliance requirements for Bitcoin banking services regulations in Switzerland, visit bitcoin banking services regulations in Switzerland.

Comparison with Global Bitcoin Regulation Standards 🌐

Bitcoin regulations vary across countries, so understanding how Syria’s regulations compare to global standards is crucial. By examining the approaches adopted by other countries, Syrian banks can gain insights into best practices for navigating the evolving landscape of Bitcoin regulation. Assessing the similarities and differences helps in identifying areas where harmonization with global standards can enhance compliance and foster international collaboration within the cryptocurrency space.

Recommendations for Navigating the Regulatory Landscape 💡

When navigating the regulatory landscape concerning Bitcoin in Syria, it is crucial for banks to stay informed and adaptable. Embracing a proactive approach towards understanding and complying with evolving regulations is key. It is essential for financial institutions to establish robust compliance frameworks and engage in ongoing dialogue with regulatory bodies. Additionally, fostering partnerships with fintech companies specializing in blockchain technology can provide valuable insights and assistance in keeping up with regulatory changes. By prioritizing education, collaboration, and agility, banks can successfully navigate the complexities of Bitcoin regulations and position themselves for future growth and innovation.

Bitcoin banking services regulations in suriname can serve as a point of reference for Syrian banks looking to enhance their understanding of regulatory frameworks surrounding Bitcoin and banking services.