Starting Line: What’s the Buzz about Bitcoin? 🐝

Bitcoin has captured the world’s attention, sparking excitement and curiosity in equal measure. Think of it as digital gold, a form of money that exists only in the virtual realm but holds real value. It’s not controlled by any bank or government, which makes it truly unique. Its rise from an obscure internet experiment to a global phenomenon has been swift and full of drama – with skyrocketing values, sudden drops, and everything in between. People love it for many reasons: it can be a way to invest, sending its value soaring; it’s a new way of transferring money across the globe quickly and without hefty fees; and for some, it’s a beacon of financial freedom. Yet, it’s not just about making money or transferring it; it’s the technology behind Bitcoin, blockchain, that’s truly revolutionary. It securely records transactions across multiple computers in such a way that the records cannot be altered retroactively. As Bitcoin continues to evolve, it’s this blend of innovation, finance, and technology that keeps everyone buzzing with possibilities.

| Feature | Description |

|---|---|

| Decentralization | Bitcoin operates on a decentralized network, meaning it isn’t controlled by any single institution. |

| Blockchain Technology | The backbone of Bitcoin, allowing secure and transparent record-keeping of transactions. |

| Investment Potential | Its value can significantly increase, making it an attractive option for investors. |

| Global Transactions | Enables fast and cost-effective transactions worldwide, without the need for traditional banks. |

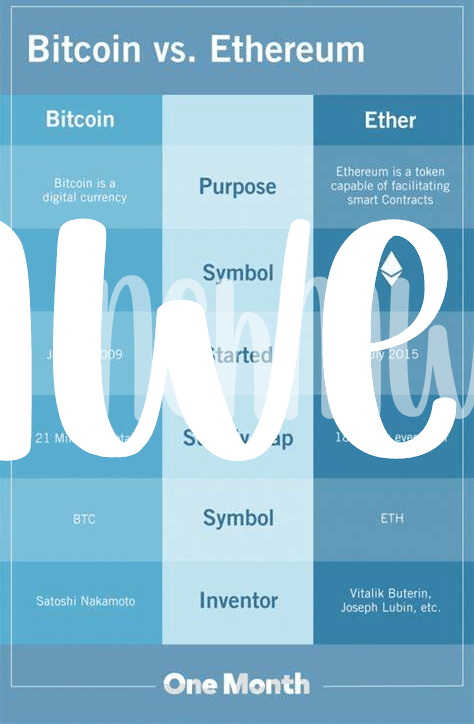

Ethereum Explained: More Than Just Digital Money 🌐

Imagine a world where your money does more than just sit in a bank. That’s the vision behind Ethereum. Unlike Bitcoin, which is often seen as digital gold, Ethereum takes things a step further. It’s not just about sending or receiving money; it’s a platform for building applications that can execute contracts automatically without any need for a middleman. These applications, powered by what’s called “smart contracts,” have the potential to revolutionize industries by making transactions more secure, transparent, and efficient.

In a way, Ethereum can be seen as a vast, global computer. It’s a network where developers can create their own operations, powered by Ethereum’s own currency, Ether. Beyond financial transactions, it supports a wide range of applications, from games and social networks to complex data storage. This broader capability has captured the imagination of innovators worldwide, seeking to harness Ethereum’s power to create new, decentralized services that could change how we interact with the internet and each other.

The Maze of Laws: Navigating through Regulations 🗺️

Imagine you’re in a giant maze, and each turn represents a new rule or law you have to follow. That’s kind of what it’s like for Bitcoin and Ethereum enthusiasts trying to keep up with the constantly shifting landscape of regulations. From one country to another, and even from one state or province to the next, the rules can change dramatically. But why does it matter so much? Well, for starters, understanding these laws is crucial for anyone looking to invest, trade, or even just use these digital assets in their daily life. It’s not just about avoiding trouble with the authorities; it’s also about protecting your investments. After all, in a world where a single new regulation can shake the entire market, being informed is your best defense. So, as you navigate this complex world, think of it as a journey through a labyrinth, where each carefully considered step brings you closer to your goal. 🌐🗺️🚦

Global Patchwork: Country by Country Stances 🌍

Imagine taking a trip around the world, but instead of exploring landscapes, you’re journeying through a kaleidoscope of rules and expectations about Bitcoin and Ethereum. It’s like every country has its own recipe for dealing with these digital currencies. Some are embracing them with open arms, seeing them as the future of money, while others are more cautious, putting up barriers to protect their financial systems. This patchwork of approaches shows just how diverse opinions can be when it comes to the digital financial revolution.

For anyone dipping their toes into the world of cryptocurrencies or looking to deepen their involvement, understanding this global patchwork is crucial. It’s not just about knowing where digital currencies bloom but also about grasping where they face hurdles. This knowledge can guide your decisions, especially if you’re eyeing international borders. For insights on navigating these waters, including how to buy bitcoin investment strategies, staying informed is key. As the landscape shifts, the savvy will find ways to weave through regulations, ensuring compliance while seizing opportunities. 🌐🚦🔮

Staying Ahead: the Importance of Compliance 🚦

In the dynamic world of digital currencies, keeping afloat with the ever-changing tide of rules and regulations is not just wise; it’s essential. Think of the crypto environment as a busy city street. As a savvy pedestrian, you wouldn’t jaywalk especially if you see the ‘Watch Out’ signs everywhere. Similarly, in the crypto universe, compliance is your crosswalk. It ensures you reach your destination without unnecessary hiccups. Just as every country has its road rules, each jurisdiction has its unique take on crypto regulations. It’s vital for individuals and businesses alike to stay informed and adapt, ensuring they operate within legal boundaries. This approach not only safeguards investments but also fosters trust with users and authorities, paving the way for smoother transactions and future growth opportunities.

| Why Compliance Matters | Benefits |

|---|---|

| Legal Safeguarding | Protects against potential legal issues and fines. |

| Trust Building | Enhances credibility with users and regulatory bodies. |

| Market Stability | Contributes to a more stable and predictable market environment. |

Embracing compliance is like setting up your sail according to the wind; it ensures you navigate through the vast ocean of digital currencies with confidence. While it might seem like a daunting task, especially with regulations evolving rapidly, the long-term benefits are undeniable. By staying informed and proactive, businesses and individuals not only secure their operations but also contribute to shaping a more transparent, reliable, and user-friendly crypto ecosystem. As the landscape continues to evolve, those who prioritize compliance will undoubtedly be better positioned to capitalize on new opportunities, setting a solid foundation for success in the tumultuous seas of cryptocurrency. 🚀🌊

Future Trends: What’s Next for Crypto Regulations? 🔮

Peering into the crystal ball to discern the trajectory of crypto regulations, one can’t help but notice that change is on the horizon. The world of Bitcoin, Ethereum, and other digital currencies is moving at a rapid pace, and so too must the frameworks that govern them. As governments and financial institutions become more familiar with the underlying technologies, we’re likely to see a shift towards more standardized regulations. This means rules that make it easier to understand what’s allowed and what’s not, providing a clearer path for innovation and investment in the crypto space. One intriguing aspect of this evolution is how anonymity and transparency in transactions are balanced, highlighting the need for robust yet flexible regulatory approaches. For those curious about how Bitcoin’s open yet pseudonymous system compares to Ethereum’s slightly different mechanics, insight can be found in discussing what determines bitcoin’s price investment strategies. As countries adapt their stances, staying updated on these changes will be crucial for anyone looking to remain compliant while exploring the vast potential of cryptocurrencies. The future promises a landscape where navigating the regulatory environment may become as seamless as sending a digital coin across the globe. 🌍🔮🚦