📈 the Big Waves: How News Moves Bitcoin Prices

Imagine a ship sailing on a vast ocean, where sudden storms or sunny days can change its course. That’s a lot like Bitcoin’s journey, influenced by the daily news. When a major news outlet drops a story about Bitcoin—whether it’s a country’s new policy, a tech giant’s investment, or a financial expert’s prediction—the price can soar sky-high or dive deep down. It’s all about how people perceive this news. If the story sparks hope or excitement, more folks might buy Bitcoin, pushing the price up. But if the news is worrisome, some might sell off their Bitcoin, causing the price to drop.

This connection between news and Bitcoin’s value isn’t just guesswork; it’s visible in the numbers. Let’s break it down with a simple example.

| Date | Event | Bitcoin Price Movement |

|---|---|---|

| January 1 | Tech Billionaire Endorses Bitcoin | 📈 Rapid Increase |

| February 10 | Government Considers Bitcoin Regulation | 📉 Sharp Decline |

As seen in the table, a positive endorsement from a well-known figure can send Bitcoin’s value soaring, while talk of government regulation might have the opposite effect. Each news story is like a wave in the ocean, capable of moving Bitcoin’s price in dramatic ways. This relationship shows just how interconnected the world of finance and media really is, with every headline holding the potential to stir the waters.

🗞️ Headline Hype: Deciphering Fact from Fiction

In the buzzing world of Bitcoin, every headline feels like a gust of wind capable of pushing prices into a new direction. Imagine you’re on a boat in the middle of the ocean; news stories are the winds, and Bitcoin prices the waves they create. Some headlines are like gentle breezes, nudging prices ever so slightly, while others are stormy gusts, sending prices soaring or crashing down. It’s essential, however, to hold a compass in this sea of information. Sometimes, what looks like a reliable news source might just be echoing rumors, not facts. Separating truth from hype is like navigating through fog — challenging but necessary to avoid getting lost at sea.

Moreover, in a landscape constantly shaped by new information, it’s useful to dive deeper and understand the underlying currents. For those looking to grasp the bigger picture behind these price movements, exploring the impact of Bitcoin and Ethereum mining on the environment can be an enlightening starting point. To get a well-rounded understanding of what’s driving the conversation, consider reading here. This resource offers insights beyond the daily churn of news, helping enthusiasts see past the immediate waves of hype to the more profound shifts taking place beneath the surface.

📊 Charts & Chatter: Social Media’s Power Play

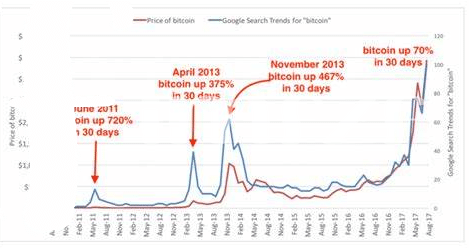

In today’s world, where almost everyone has a smartphone glued to their hand, the whispers and shouts from social media can really stir things up, especially in the Bitcoin garden. Think of it like this: When someone with a lot of followers talks about Bitcoin going up or down, it’s like they’re watering the plants. Suddenly, everyone wants to grow the same plant in their garden, or they’re rushing to protect what they’ve already got. This isn’t just about big names tweeting; it’s about how these messages spread like wildfire, making people act fast, pushing the Bitcoin price this way and that.

Then, there’s the magic of the graphs and doodles that pop up on our screens, showing how Bitcoin’s doing. It’s wild how these pictures can make us feel so many things! 🚀 Sometimes, they make us want to jump in and ride the wave, or maybe they scare us into waiting for another day. The big takeaway? Social media and those flashy charts don’t just share news; they’re like the drummers in the band, setting the pace for how fast or slow the Bitcoin dance goes. 🕺💃 And in this dance, staying in rhythm with the beat can help you not trip over your own feet.

🌍 Global Events: Connecting Dots to Price Swings

Imagine waking up to news of political upheaval on the other side of the globe and by lunchtime, the impact of this event has already rippled through the Bitcoin market. This isn’t fiction but a reality in today’s digital age where global events, from elections to economic sanctions, have a direct link to Bitcoin’s value swings. These events can either send it soaring or crashing down, much like a leaf caught in a storm. This connection between world happenings and Bitcoin’s price is intricate, yet not entirely unpredictable. For those interested in diving deeper into the world of cryptocurrency, including insights on how to mine bitcoin versus ethereum, understanding this link can offer a strategic advantage. It’s fascinating to see how discussions and decisions in conference rooms and parliaments can steer the market sentiment, influencing even the savviest of investors. The influence is so potent that a mere hint of regulatory change or financial instability can trigger a swift response from the Bitcoin community. Grasping this dynamic is essential for anyone looking to navigate the Bitcoin market successfully, reminding us that in the world of cryptocurrency, global events are more than just news—they’re potential game-changers.

🎢 Emotional Roller Coaster: the Fomo Effect

Imagine you’re at the fair, walking towards the biggest, wildest roller coaster you’ve ever seen. That flutter of excitement you feel? It’s a lot like what many folks experience when they watch Bitcoin’s price. It zooms up, then swoops down, and suddenly, you’re caught in the thrill of it all. The Fear of Missing Out, or FOMO, as we call it, has a mighty grip. It convinces people they need to jump on the ride before it’s too late, pushing them to make hurried decisions based on what everyone else seems to be doing. This rush is powered by stories we hear and the buzz that builds around us, making the ups and downs of Bitcoin feel even more intense.

Here’s a look at how FOMO plays out for different people:

| Person | Feeling | Action |

|---|---|---|

| Joe | Excitement from news of a price surge | Invests without research |

| Sarah | Anxiety from seeing friends profit | Joins the trend, fearing loss |

| Alex | Curiosity from social media buzz | Starts following Bitcoin news |

In essence, the FOMO effect shows us just how contagious emotions can be, especially when amplified by social media and news. It’s a reminder that, in the whirlwind of Bitcoin’s volatility, staying grounded and making informed decisions is crucial. This way, we can enjoy the ride without getting swept away by the wave of excitement.

🚀 Beyond the Buzz: Long-term Views Vs. Daily News

Diving into the world of Bitcoin, it’s easy to get caught up in the daily highs and lows spurred by the latest headlines. Yet, there’s a bigger picture that often gets lost amidst the buzz. For those curious about the foundation of their investments, understanding the core principles is key, such as those outlined in when was bitcoin created investment strategies. This insight offers a clear contrast between fleeting news pieces and the enduring principles underpinning Bitcoin. Think of it like weather versus climate; the daily news represents momentary weather patterns that can be wildly unpredictable and driven by emotion, often leading to a FOMO (fear of missing out) mindset. In contrast, long-term views are akin to climate, guided by fundamental principles and broader economic trends that shape the trajectory over years, not days. By focusing on these enduring strategies, investors can navigate the choppy waters of cryptocurrency with a steadier hand, making informed decisions that look beyond the immediate to the horizon ahead, where true value and potential often lie.