Understanding the Impact of Bitcoin on Aml 🌍

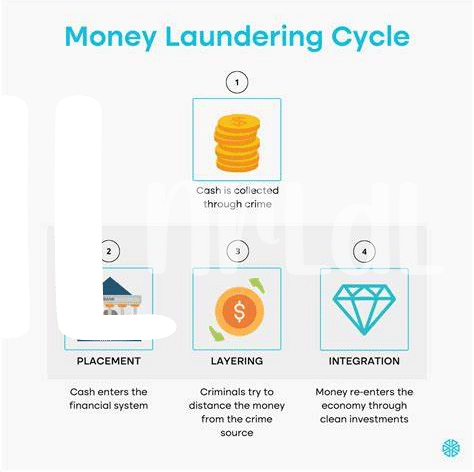

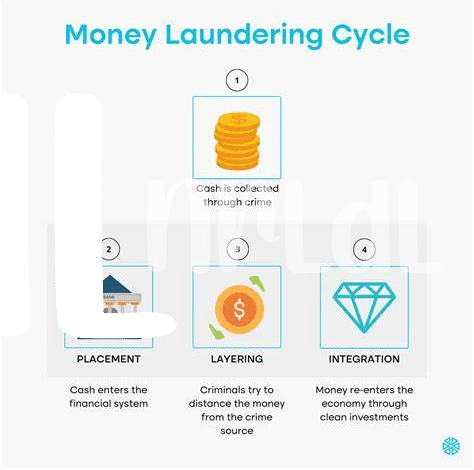

Bitcoin’s rise has not only revolutionized the financial landscape but also posed unique challenges for Anti-Money Laundering (AML) practices worldwide. The decentralized nature of Bitcoin transactions makes tracking and monitoring more complex, requiring innovative approaches to ensure compliance with AML regulations effectively.

As governments and regulatory bodies grapple with the implications of Bitcoin on AML, a deeper understanding of its impact is crucial. From anonymous transactions to cross-border transfers, the evolving nature of cryptocurrency necessitates a proactive stance in safeguarding against illicit activities. Stay tuned as we explore the intricate relationship between Bitcoin and AML, shedding light on the transformative forces shaping financial security measures globally.

Current Regulatory Environment in Central African Republic 📜

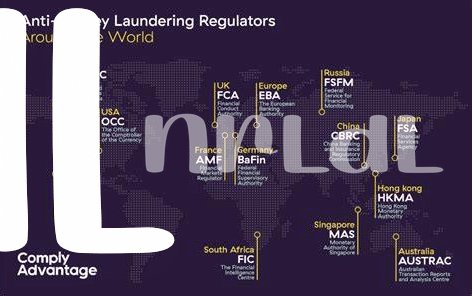

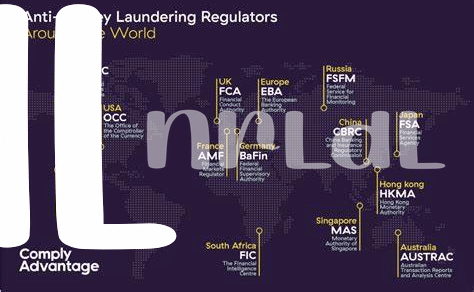

The regulatory landscape in Central African Republic presents unique challenges and opportunities for Bitcoin AML compliance. With a focus on fostering innovation while ensuring financial security, regulatory bodies in the region are continuously evolving their approach to cryptocurrency transactions. Establishing a clear framework that balances regulatory requirements with the flexibility needed to support growth is essential. By understanding the current regulatory environment and proactively engaging with authorities, businesses can navigate this dynamic landscape effectively.

Key Challenges in Implementing Aml Rules ⚖️

Navigating the legal landscape in Central African Republic poses various challenges when it comes to implementing AML rules. One significant hurdle is the lack of awareness and understanding among stakeholders about the importance and implications of AML regulations in the context of Bitcoin transactions. This necessitates extensive education and training programs to bridge the knowledge gap and ensure effective compliance strategies are in place.

Moreover, the decentralized and pseudonymous nature of Bitcoin transactions presents unique challenges for law enforcement agencies and regulatory bodies in monitoring and tracking potential illicit activities. Developing robust technological solutions and collaborative efforts between public and private sectors are essential to overcome these obstacles and enhance the effectiveness of AML measures in the Central African Republic.

Strategies for Compliance with Bitcoin Aml Regulations 💡

The strategies for compliance with Bitcoin AML regulations involve implementing robust monitoring systems, conducting thorough customer due diligence, and staying updated on regulatory changes. By creating a culture of compliance within organizations and fostering partnerships with regulatory authorities, businesses can navigate the evolving landscape of AML requirements effectively. Additionally, leveraging technological solutions such as blockchain analytics tools can enhance the detection and prevention of suspicious activities, ensuring adherence to AML guidelines while maintaining operational efficiency. Emphasizing training and awareness among staff members on AML best practices is crucial in fostering a strong compliance framework and mitigating potential risks.

For more insights on Bitcoin anti-money laundering (AML) regulations in Cambodia, you can explore the comprehensive guide provided by WikiCrypto News at bitcoin anti-money laundering (aml) regulations in Cambodia.

Importance of Aml Measures in Safeguarding Financial Systems 💰

Amidst the evolving landscape of financial transactions, the incorporation of robust Anti-Money Laundering (AML) measures stands as a critical element in safeguarding the integrity of financial systems. AML measures act as a shield against illicit activities, ensuring that transactions are conducted ethically and transparently. By implementing stringent AML regulations, financial institutions and regulatory bodies can track, monitor, and deter suspicious activities within the realm of Bitcoin transactions, thereby fortifying the stability of the financial ecosystem.

In the realm of financial systems, the significance of AML measures cannot be overstated. Not only do these measures enhance the reliability and credibility of transactions, but they also serve as a foundational pillar in preserving the trust and security within the financial infrastructure. As the dynamics of financial technologies continue to reshape transaction norms, the adherence to AML regulations emerges as a pivotal mechanism in upholding the integrity and resilience of financial systems in the digital era.

Future Outlook for Bitcoin Aml Rules in Central African Republic 🔮

In considering the future outlook for Bitcoin AML rules in Central African Republic, it is imperative to anticipate potential shifts in regulatory frameworks and enforcement mechanisms. The landscape of AML regulations is ever-evolving, necessitating adaptability and vigilance from stakeholders in the cryptocurrency sphere. Looking ahead, collaborations between governmental bodies, financial institutions, and technological innovators may pave the way for more robust AML measures tailored to the unique challenges posed by digital assets. By proactively engaging with industry best practices and international standards, Central African Republic can position itself as a proactive player in combating illicit activities within the cryptocurrency ecosystem.

bitcoin anti-money laundering (aml) regulations in brunei