Understanding the Basics of Bitcoin Transactions 💡

Bitcoin transactions are a digital marvel, where value moves swiftly across the internet, navigating a decentralized network of computers. Each transaction is a unique cryptographic puzzle, securely recorded on a public ledger known as the blockchain. Unlike traditional banking systems, Bitcoin operates without a central authority, relying instead on consensus among users to validate and confirm transactions. This fundamental shift in approach gives Bitcoin its revolutionary potential, enabling peer-to-peer transactions across borders with minimal fees and no intermediary intervention. The underlying technology of Bitcoin, blockchain, ensures transparency and immutability, making it a fascinating innovation in the world of finance.

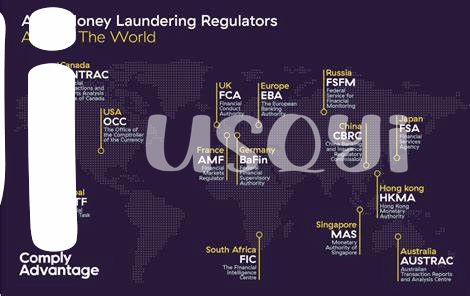

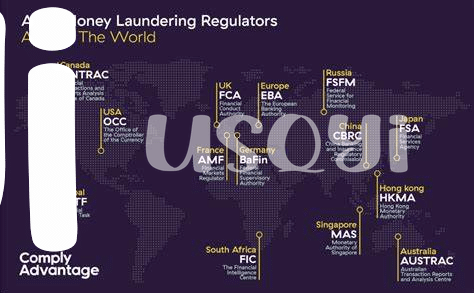

Exploring the Regulatory Landscape in Brunei 🌏

The regulatory landscape in Brunei concerning Bitcoin transactions is a crucial aspect to grasp for users navigating through the digital currency space. Understanding the legal framework and requirements set forth by authorities is essential to ensure compliance and mitigate risks associated with money laundering and other illicit activities. By exploring the specific regulations and guidelines in place, individuals can make informed decisions when engaging in Bitcoin transactions within the region.

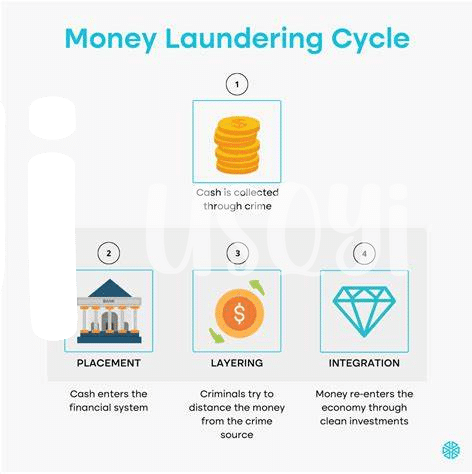

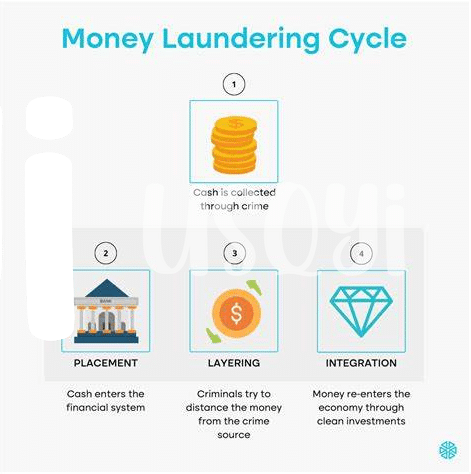

Key Anti-money Laundering (aml) Requirements 🔒

Key Anti-money Laundering (AML) requirements play a crucial role in the use of Bitcoin in Brunei. These requirements are designed to prevent illicit activities such as money laundering and terrorist financing. In Brunei, individuals and businesses engaging in Bitcoin transactions must adhere to strict AML regulations, including conducting customer due diligence, maintaining transaction records, and reporting suspicious activities to the authorities. Compliance with these requirements is essential for the safe and legal use of Bitcoin in Brunei.

Implementing Aml Compliance Measures Effectively 🛡️

When it comes to implementing effective Anti-money Laundering (AML) compliance measures for Bitcoin usage, one key aspect is thorough customer due diligence. This involves verifying the identities of users and monitoring their transactions for any suspicious activities. Additionally, establishing robust internal controls and training programs for staff members to increase awareness of AML requirements are essential steps. Regularly updating and adapting these measures to align with evolving regulations and industry best practices is crucial in maintaining compliance. Ensuring clear communication channels for reporting any potential AML risks or violations within the organization is also vital. For more detailed strategies on AML compliance for individuals holding Bitcoin, you can refer to the comprehensive guide on **[bitcoin anti-money laundering (AML) regulations in Botswana](https://wikicrypto.news/compliance-strategies-for-individuals-holding-bitcoin-in-brazil)**.

Challenges and Limitations for Bitcoin Users 🚧

Bitcoin users in Brunei face various challenges and limitations when it comes to utilizing this digital currency. One prominent issue is the fluctuating regulatory environment, which can create uncertainty and compliance hurdles for individuals and businesses. Moreover, the lack of widespread acceptance of Bitcoin in traditional financial systems poses obstacles in terms of liquidity and accessibility for users. These factors can deter potential adopters and hinder the seamless integration of Bitcoin into everyday transactions in Brunei.

Tips for Seamless and Compliant Bitcoin Usage 🌟

Bitcoin users in Brunei can navigate the complex landscape of anti-money laundering requirements by following some key tips. Security measures, such as using reputable wallets and keeping private keys secure, are essential for seamless and compliant usage. Additionally, staying informed about the latest regulatory updates and seeking guidance from experts can help users stay on the right side of the law. Embracing transparency in transactions and conducting due diligence before engaging in large transactions can further enhance compliance with AML regulations. By following these tips, Bitcoin users in Brunei can safely and confidently navigate the regulatory requirements while harnessing the potential of digital currencies.

To learn more about Bitcoin anti-money laundering (AML) regulations in Brunei, visit the official documentation on Bitcoin anti-money laundering (AML) regulations in Brazil.