🌍 the Big Picture: Why Bitcoin Rules Are Changing

Imagine you’ve entered a rapidly changing world where something as simple as digital money, or Bitcoin as it’s widely known, is redefining how we think about finances. This isn’t a sci-fi movie; it’s the reality of today, and it’s the reason rules around Bitcoin are evolving. Picture governments worldwide, much like parents trying to set bedtime rules for a kid that just discovered coffee, scurrying to update regulations to keep pace with innovations and ensure everyone plays fair. Why the sudden need for change, you ask? Well, as Bitcoin’s popularity skyrockets, it’s become crucial to tackle some big issues: ensuring it’s safe to use, keeping bad actors at bay, and making sure it doesn’t mess with a country’s financial stability. This balancing act isn’t simple, as each country has its own ideas – some see Bitcoin as the future and want to support its growth, while others are a bit wary and prefer a more cautious approach. The table below gives a little peek into this complex world:

| Reason for Regulation Change | Goals of Governments |

|---|---|

| Ensure safety and security | Protect citizens from fraud and theft |

| Maintain financial stability | Prevent market manipulation and volatility |

| Adapt to innovation | Support technological growth while ensuring compliance |

In essence, these changes aim to make the Bitcoin world a safer place to explore and invest in, ensuring that this digital frontier can be both a land of opportunity and security for everyone.

📈 Analysing 2023’s Top Bitcoin Regulation Trends

As we sail through 2023, the waters of Bitcoin regulation are showing new currents and winds, shaping how we navigate in the vast ocean of cryptocurrency. Governments around the world are waking up to the reality of Bitcoin’s power and potential, drafting new maps of rules and guidelines. This change isn’t just about tightening the ropes; it’s also about opening new gateways for growth and innovation in the digital currency space. Some countries are setting the scene with green lights, welcoming Bitcoin with open arms and clear, friendly regulations. Meanwhile, others flash red, signaling a halt with strict rules or outright bans. This colorful mosaic of global regulations is painting a complex picture for Bitcoin enthusiasts and investors alike. To remain afloat and thrive, it’s crucial to be armed with the right tools of knowledge and adaptability. Understanding these trends helps not just in staying compliant but also in foreseeing future shifts in the regulatory landscape. For a deeper dive into how Bitcoin’s decentralization challenges traditional controls and opens up opportunities, check out this insightful piece on https://wikicrypto.news/smart-contracts-in-bitcoin-opportunities-and-challenges. It’s a guiding light in navigating the evolving realms of Bitcoin and its impact on broader cryptocurrency regulations.

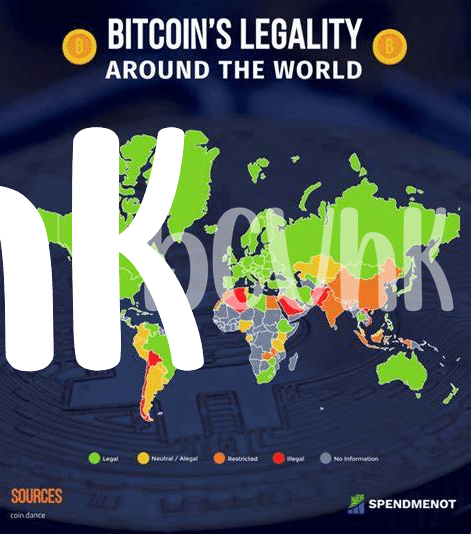

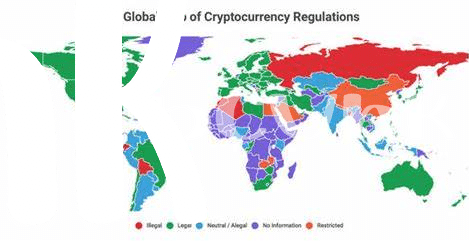

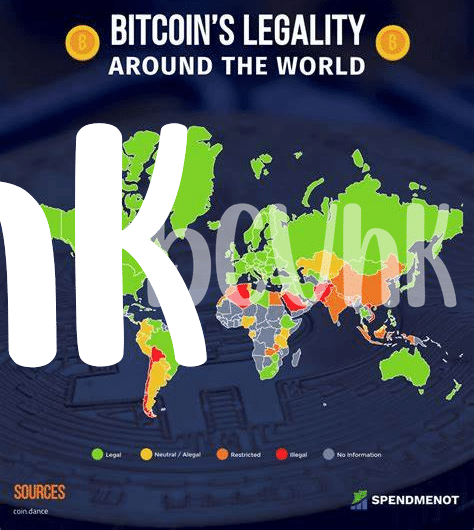

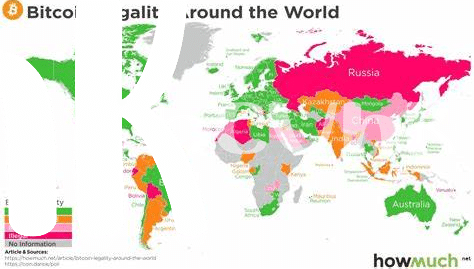

🚦 Red and Green Lights: Countries’ Diverse Approaches

Around the world, countries are taking a mix-and-match approach to bitcoin, much like deciding between red and green at a traffic stop. Some places are welcoming bitcoin with open arms, seeing it as a shiny new tool for economic growth. They’re giving it the green light, creating friendly rules that help people use bitcoin easily and safely. On the other hand, a few countries are pressing the red light, worried about risks like fraud or loss of control over the financial system. They’ve set up strict rules or even said a firm “no” to bitcoin, trying to steer clear of these problems.

Navigating these diverse approaches can feel like a globe-trotting adventure, with each country offering unique scenery. What works in one place might not fly in another, making it crucial for bitcoin fans to stay informed. Whether a country sees bitcoin as the digital version of gold or a potential troublemaker, understanding these perspectives helps in making smarter decisions. The key is to keep an eye on this ever-changing map, ready to switch lanes as needed to stay on the right side of the law.

🛠️ Tools of the Trade: How to Stay Compliant

Keeping up with the fast-paced world of Bitcoin and its regulations might seem daunting, but think of it as mastering a new game where the rules are constantly evolving. In this dynamic landscape, your best allies are knowledge and adaptability. Envision yourself as a digital explorer, armed with a map that highlights the legal pathways and potential pitfalls. A crucial part of this map involves understanding how Bitcoin interacts with the world of traditional money. For an in-depth dive, you can explore bitcoin versus traditional fiat currencies: a comprehensive comparison explained, which sheds light on this intricate relationship and its impact on regulations. Keeping abreast of the latest regulatory changes means regularly checking in with authoritative sources and perhaps even setting alerts for updates in countries that are key to your crypto activities. Engage with a network of fellow enthusiasts where you can share insights and advice. Remember, in this rapidly changing environment, being informed and flexible is your ticket to navigating the rules of the game successfully.

🚀 Bitcoin and Beyond: Implications for Other Cryptos

When rules around Bitcoin shift, it’s not just Bitcoin itself that feels the ripple – other digital currencies, or cryptos, are in the boat too. Think of Bitcoin as the big sibling whose every move is closely watched. As countries adjust their stances on Bitcoin, these changes signal what might come for the likes of Ethereum, Ripple, and others. It’s like a domino effect; the treatment of Bitcoin can set a precedent for all its digital brothers and sisters. This doesn’t mean all cryptos will face the same exact rules, but the overarching themes of security, transparency, and consumer protection often extend to the wider crypto family.

Navigating this evolving landscape asks for a bit of savvy. Staying ahead means keeping an eye on the broader impacts of Bitcoin’s regulatory changes. Here’s a simple way to see it:

| Crypto | Impact of Bitcoin Regulations |

|---|---|

| Ethereum | May face similar scrutiny on security and transparency |

| Ripple | Potential increased demands for user protection mechanisms |

| Litecoin | Could see changes in cross-border transaction rules |

As we tread into this new era, understanding that what happens to Bitcoin may extend to the entire crypto universe is key. Adapting to these changes not only helps in staying compliant but also opens up new opportunities for growth and innovation in the dynamic world of cryptocurrencies.

💡 Bright Ideas: Navigating Future Regulatory Landscapes

In a world where the rules of the game are constantly evolving, keeping pace with regulatory changes in the Bitcoin and broader crypto universe requires both agility and foresight. Think of it like being on a shifting chessboard – to win, you need to think several moves ahead. As regulations shape up across different territories, it’s essential to be proactive, embracing strategies that ensure compliance while still seizing opportunities for growth and innovation. This approach not only shields you from potential pitfalls but also positions you as a leader in a future where digital currencies play a central role. In essence, it’s about blending caution with creativity, ensuring that your moves within the crypto space are both safe and strategic.

To thrive in this dynamic environment, consider diving deep into resources like navigating bitcoin taxation: a global perspective explained, which shed light on intricate aspects such as smart contracts within the Bitcoin network. By arming yourself with knowledge and understanding the global landscape, you can navigate the complexities of regulations with confidence. Remember, in the ever-evolving world of cryptocurrencies, being well-informed is your strongest asset. It enables you to adapt to regulatory changes effectively, ensuring that your journey in the crypto space is both compliant and successful.