🌐 Understanding Bitcoin: a Quick Dive into Digital Currency

Imagine walking into a digital store where instead of paying with coins or paper money, you use virtual coins. That’s essentially what Bitcoin is – a digital form of money. Created in 2009, it’s like sending an email; instead of words, you send and receive money over the internet. This might sound like something from a sci-fi movie, but it’s real and used by millions around the world. Bitcoin operates on a technology called blockchain, which keeps a secure and transparent record of all transactions.

The appeal of Bitcoin lies not just in its novelty, but in its simplicity and efficiency. With it, you can buy goods, invest, or send money to someone across the globe without the need for a middleman, like a bank. The currency is decentralized, meaning no single entity controls it, making it incredibly appealing to those who prefer a measure of financial anonymity and autonomy. Here’s a quick look at how it has grown over the years:

| Year | Significant Event |

|---|---|

| 2009 | Bitcoin is created |

| 2010 | First real-world transaction using Bitcoin |

| 2013 | Price of Bitcoin hits $1,000 for the first time |

| 2017 | Bitcoin’s price reaches an all-time high of around $20,000 |

| 2021 | Widespread institutional adoption begins |

Whether for buying a cup of coffee or securing a nest egg for the future, Bitcoin represents a fascinating shift in how we think about and use money.

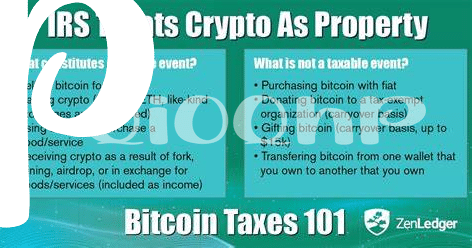

📃 the Basics of Irs Rules on Bitcoin and Cryptocurrencies

When it comes to the IRS and your digital money, think of it like this: if you’ve got Bitcoin or any other cryptocurrency, the IRS wants to know about it. Imagine you’re playing a video game and you score some points – the IRS is kind of like that friend who wants to make sure they write down every score you get. Whether you’re buying a cup of coffee or selling some Bitcoin because the value went up, these are activities that can affect your taxes. The IRS considers cryptocurrencies as property, which means just like your house or car, you have to report when you make money or lose money with it. If you’re stashing your digital coins and hoping the IRS won’t notice, think again. They’re paying close attention and expect you to share your transaction details, kind of like showing your math on a test. It might sound complicated, but keeping a clear record of your buys, sells, and trades will make tax time much less stressful. Plus, understanding these rules can sometimes work in your favor, letting you spot ways to save on your tax bill. To get a sense of how governments are shaping the future of digital currency beyond just taxes, take a look at https://wikicrypto.news/the-role-of-government-regulations-in-bitcoin-price-fluctuations, highlighting initiatives that could change the game not just for miners, but for all of us holding onto those digital coins.

💡 How Your Bitcoin Activities Affect Your Taxes

When you dip your toes into the world of Bitcoin, it’s not just about buying low and selling high. Every time you make a move, Uncle Sam is peeking over your shoulder, interested in his share. Think of it this way: if you sell your Bitcoin and make some money, that’s great, but it also means you might owe taxes on your gains. Even if you’re just swapping Bitcoin for another cryptocurrency, it’s considered a taxable event in the eyes of the IRS. It’s kind of like selling an old comic book to buy another one; the government still wants to know about the transaction.

Now, if your Bitcoin loses value and you decide to sell it, you’re not off the IRS’s radar either. In this scenario, you might have the opportunity to claim a loss, which could help lower your tax bill for the year. It’s similar to getting a small consolation prize for a not-so-great investment outcome. To keep everything smooth sailing with your taxes, remember to keep detailed records of all your cryptocurrency transactions. This way, when tax season rolls around, you’ll be ready to report your activities accurately, potentially saving yourself from a headache later on.

🧾 Reporting Bitcoin Income: Tips for a Smooth Process

Filing your taxes doesn’t have to be a headache, even when you’re dealing with something as new-age as Bitcoin. Think of it this way: every time you buy, sell, trade, or spend your digital coins, it’s akin to handling traditional money with a digital twist. Keep detailed records of all your transactions – how much you paid, the value of Bitcoin at the time of the transaction, and what you received in return. This is your golden ticket to an easier time come tax season. Just like keeping a diary of your daily adventures, this log will help you remember the specifics, ensuring accuracy when reporting to Uncle Sam.

Of course, navigating the complex world of cryptocurrency taxes doesn’t have to be a solitary quest. Tools and resources abound for those willing to use them. A must-read is the section on sustainable bitcoin mining practices for the future market trends, providing essential insights for anyone looking to stay ahead in the ever-evolving landscape of digital currencies. With the right preparation and a bit of savvy, managing your Bitcoin taxes can be as smooth as your morning coffee, setting you on a path toward hassle-free compliance and financial peace of mind.

🔍 Deductions and Credits: Saving Money on Crypto Taxes

Just like hunting for hidden treasure, finding ways to save money on your Bitcoin taxes can feel quite rewarding. When you dive into the world of cryptocurrency taxes, you might discover that there are actually opportunities to reduce what you owe to the IRS. For example, if you’ve sold Bitcoin at a loss, this isn’t just a sad day for your wallet; it could also be a silver lining for your taxes. These losses can sometimes offset other gains you might have, reducing the total amount of tax you need to pay. It’s a bit like having a coupon for your taxes, where your financial ups and downs can actually work in your favor.

Furthermore, if you’ve spent money on things like transaction fees or maybe even educational courses to better understand the crypto market, keep those receipts. In some cases, these costs could be written off, acting as a “discount” on your tax bill. It’s all about keeping good records and knowing what the IRS allows you to deduct. Here’s a simple table to help you understand better:

| Type of Expense | Can it be deducted? |

|---|---|

| Transaction fees | Yes, in certain cases |

| Educational courses on cryptocurrency | Yes, if related to investment activity |

| Losses from selling Bitcoin | Yes, can offset other gains |

Remember, navigating cryptocurrency taxes doesn’t have to feel like a maze. With the right knowledge and strategy, you can turn what seems like a chore into an opportunity to save money. Keep an eagle eye on your activities and expenses, and you might just find ways to lighten your tax load.

⚖ Avoiding Audits: Best Practices for Cryptocurrency Tax Compliance

Navigating the world of cryptocurrency taxes doesn’t have to be a journey through a maze. With the right knowledge and preparation, you can steer clear of the IRS’s radar while remaining fully compliant. It’s about keeping detailed records of your transactions, understanding the tax implications of your trading, mining, and spending activities, and staying up-to-date with IRS guidelines. An organized approach not only simplifies your tax reporting but acts as your first line of defense against unwanted scrutiny.

Moreover, integrating smart tax-saving strategies, such as tracking your holding periods for long-term capital gains benefits, can significantly reduce your tax bill. It’s also wise to educate yourself further on the nuances of cryptocurrency taxation. For example, knowing the ins and outs of Bitcoin’s price fluctuations can be incredibly beneficial. You might want to look into best practices for securing your bitcoin against theft explained, which can give you a deeper understanding of how to protect your investments and stay compliant with IRS regulations. This proactive approach is key to avoiding audits and ensuring that your cryptocurrency journey is both profitable and stress-free.