Understanding Bitcoin Investment Funds 📈

Bitcoin investment funds offer individuals a way to partake in the crypto market without managing assets themselves. 📈 These funds pool money from multiple investors to buy and hold cryptocurrencies. Investors benefit from professional management and diversified portfolios. Understanding the mechanisms and risks involved is crucial before diving into this investment vehicle.

Investing in Bitcoin through funds provides exposure to digital assets without the complexities of holding them directly. The fluctuating nature of the cryptocurrency market requires a thorough comprehension of fund strategies and market dynamics to make informed investment decisions. Exploring the workings of Bitcoin investment funds empowers investors to navigate the crypto landscape pragmatically and potentially capitalize on market opportunities.

The Regulatory Landscape in Papua New Guinea 🌏

Papua New Guinea’s regulatory environment concerning Bitcoin investment funds is a complex yet crucial aspect to consider as an investor or fund manager. Navigating through the legal requirements and compliance standards in this region requires a comprehensive understanding of the local laws and regulations. It is essential to stay informed and proactive to ensure a successful and compliant investment journey. The evolving landscape presents both challenges and opportunities for those looking to engage in Bitcoin investments.

Compliance Challenges for Investors and Funds 🚧

Navigating the world of Bitcoin investment funds presents a set of complexities that investors and funds must navigate. From staying compliant with evolving regulations to ensuring transparency and security in transactions, these challenges require a delicate balance between innovation and adherence to legal frameworks. The dynamic nature of the cryptocurrency market adds another layer of complexity, making it crucial for investors to stay informed and adaptable in order to mitigate risks and maximize opportunities. Balancing compliance requirements with the fast-paced nature of Bitcoin investments remains a key challenge for both seasoned and new market participants.

Risks and Benefits of Investing in Bitcoin 💰

When it comes to investing in Bitcoin, there are both risks and benefits that potential investors should consider. On one hand, the volatility of the cryptocurrency market can lead to significant price fluctuations, resulting in potential losses for investors. However, the decentralized nature of Bitcoin offers a level of independence from traditional financial systems, making it an attractive option for those seeking alternative investment opportunities. Understanding these factors is crucial for making informed investment decisions.

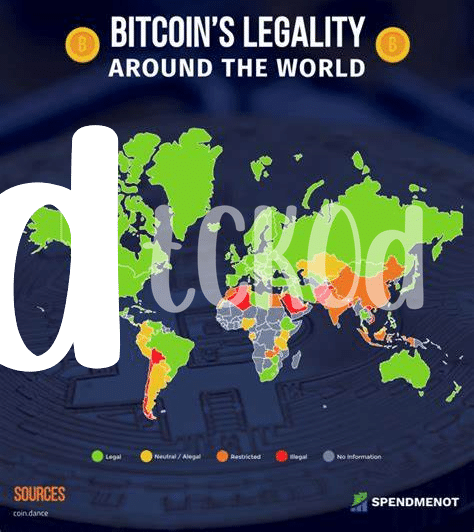

For a more detailed perspective on how different countries approach the regulation of Bitcoin investment funds, you can explore Palau’s approach in regulating these funds in Paraguay through this informative article: bitcoin investment funds regulation in Paraguay.

Impact of Regulations on Fund Performance 📉

Regulations play a crucial role in shaping the performance of Bitcoin investment funds. By creating a framework within which funds operate, regulations can impact the overall stability and reliability of these investments. They can also influence investor confidence, which in turn can affect the fund’s performance. Striking a balance between compliance and flexibility is key for funds to adapt to regulatory changes while maximizing their potential for growth and returns. It’s essential for investors and fund managers to stay informed and proactive in navigating these regulatory landscapes to ensure a successful investment journey.

Navigating Legalities for a Successful Investment Journey ⚖️

Navigating the legalities in the world of Bitcoin investment funds requires a keen understanding of regulations and compliance measures. Being equipped with the knowledge of the regulatory landscape not only ensures a smooth investment journey but also mitigates potential risks. Successful navigation through these legalities involves staying updated on evolving laws and implementing robust strategies to adhere to them effectively. By proactively addressing compliance challenges and leveraging the regulatory framework to one’s advantage, investors can pave the way for a successful and fruitful investment experience. Bitcoin Investment Funds Regulation in Palau.