Current Regulations 📜

Bitcoin investment funds are subject to a dynamic regulatory landscape that is constantly evolving. Governments and financial authorities worldwide are scrutinizing the cryptocurrency market, leading to a variety of regulatory approaches. These regulations aim to provide investor protection, prevent illicit activities, and ensure market stability. Understanding and complying with the current regulations is crucial for Bitcoin investment funds to operate legally and sustainably in this rapidly changing environment. By staying abreast of the latest developments and engaging with regulatory bodies, investment funds can navigate the complexities of the regulatory framework while maximizing opportunities for growth and innovation.

Impact on Investment Decisions 💰

Bitcoin investment funds are no longer operating in a regulatory vacuum; rules and guidelines now shape how these funds operate and attract investors. Understanding the impact of regulations on investment decisions is crucial in navigating this evolving landscape. Compliance requirements play a significant role in shaping the investment strategies and risk considerations for Bitcoin investment funds, influencing everything from fund structure to asset allocation. Ensuring alignment with regulatory frameworks is key to building trust and credibility with investors, as well as mitigating potential legal risks and liabilities along the way.

For fund managers and investors alike, staying informed about regulatory developments and compliance obligations is essential for making sound investment decisions in the dynamic world of digital assets. The interplay between regulations and investment choices underscores the importance of adapting strategies to meet evolving legal requirements. Leveraging a proactive approach to compliance can not only enhance investor confidence but also pave the way for sustainable growth and success in the increasingly regulated field of Bitcoin investment funds.

Regulatory Challenges Ahead 🛑

Navigating the evolving landscape of regulations surrounding Bitcoin investment funds requires a proactive approach. As the cryptocurrency market continues to expand, regulatory bodies are faced with the challenge of keeping up with emerging technologies and adapting existing frameworks to address potential risks. Striking a balance between fostering innovation and protecting investors will be crucial in shaping the future of Bitcoin fund regulations.

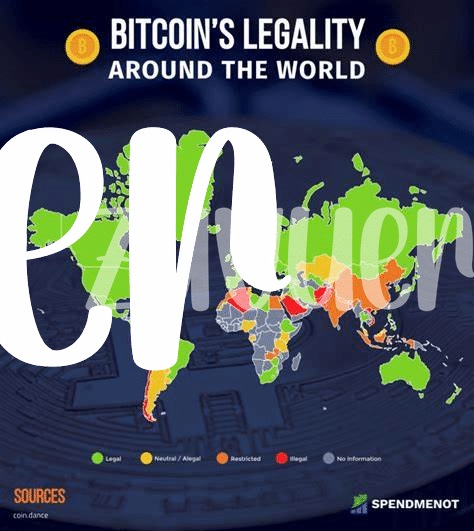

Global Perspectives 🌍

Bitcoin investment funds face a diverse landscape of regulatory frameworks worldwide, each with its own set of challenges and opportunities. From the progressive approach of countries like Malta and Bermuda to the cautious stance of regulatory bodies in the US and China, the global perspective on Bitcoin investment fund regulations is ever-evolving. Understanding these varying viewpoints is crucial for investors and fund managers seeking to navigate the complex regulatory environment effectively. For a deeper exploration of regulatory considerations in specific regions, including Papua New Guinea, visit [Wikicrypto.News’ legal considerations for investing in Bitcoin funds in Palestine](https://wikicrypto.news/legal-considerations-for-investing-in-bitcoin-funds-in-palestine) and gain insights into the intricacies of bitcoin investment funds regulation in Papua New Guinea.

Future Trends in Compliance 📈

In the evolving landscape of regulations, a shift towards greater transparency and accountability is expected to shape the future of compliance in Bitcoin investment funds. Embracing technology-driven solutions, such as blockchain analytics and AI-powered monitoring tools, will be key for firms to stay ahead and meet stringent regulatory requirements. Moreover, proactive engagement with regulatory bodies and a nimble approach to adapting to changing compliance standards will be crucial for ensuring long-term sustainability in the digital asset investment space.

Navigating Uncertainty Strategically 🧭

In navigating uncertainty strategically, it is essential for Bitcoin investment funds to remain adaptable, proactive, and well-informed. Embracing a flexible approach to regulatory changes and market dynamics can help ensure resilience and sustainability in the ever-evolving landscape. Building a robust network of legal counsel, regulatory experts, and industry peers can provide valuable insights and perspectives that aid in making informed decisions and anticipating potential challenges. By staying agile and well-prepared, investment funds can position themselves to effectively navigate uncertainties and capitalize on emerging opportunities.

Bitcoin investment funds regulation in Palestine is an essential aspect to consider in global investment strategies. Stay informed about the regulatory framework to make well-informed investment decisions.