The Rise of Bitcoin in Suriname 🚀

Bitcoin’s presence in Suriname has been steadily gaining momentum, with a growing number of individuals and businesses embracing this digital currency as a means of financial transactions. The convenience and potential for borderless transactions have sparked interest and adoption within the Surinamese community. From online purchases to investment opportunities, Bitcoin’s rise in Suriname reflects a global trend towards digital currencies and decentralized financial systems. As more people explore the possibilities of Bitcoin, its impact on the local economy and financial landscape continues to unfold.

Legal Status and Acceptance in Suriname 💼

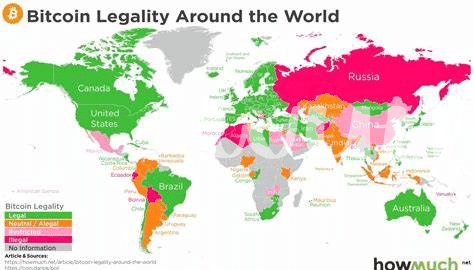

The legal status and acceptance of Bitcoin in Suriname have been a topic of growing interest and discussion in recent years. As with many countries around the world, Suriname is grappling with how to regulate and integrate Bitcoin into its existing financial framework. The decentralized nature of Bitcoin poses both challenges and opportunities for the traditional banking systems in the country. While some see the potential benefits of Bitcoin in terms of financial inclusivity and innovation, others remain skeptical about its long-term implications for the economy.

Government regulations play a crucial role in shaping the future outlook of Bitcoin in Suriname. As policymakers navigate this new terrain, there is a delicate balance to strike between fostering innovation and mitigating risks associated with digital currencies. Embracing this technological advancement could pave the way for a new era of transactions in Suriname, offering a glimpse into the evolving landscape of the country’s financial ecosystem.

Impact on Traditional Banking Systems 🏦

Bitcoin’s impact on traditional banking systems in Suriname has sparked discussions and prompted banks to reassess their operations. Many banks are now exploring ways to integrate blockchain technology into their processes to enhance efficiency and security. This shift also raises questions about the future role of banks as intermediaries in financial transactions and the need to adapt to the changing landscape. As more people turn to Bitcoin for transactions, traditional banks are under pressure to innovate and stay relevant in a rapidly evolving financial environment, signaling a potential transformation in the banking sector in Suriname.

Challenges and Skepticism Surrounding Bitcoin 🤔

When it comes to Bitcoin in Suriname, there are various challenges and skepticism that surround its adoption. Many individuals and institutions question the stability and reliability of a decentralized currency like Bitcoin, especially in a traditional setting. The lack of centralized control and the volatile nature of cryptocurrencies raise concerns among investors and regulators. Addressing these apprehensions and building trust in the potential of Bitcoin as a secure form of financial transaction is essential for its wider acceptance and integration into the local economy.

To further explore the legal implications of using Bitcoin in Suriname, you can read more about “is Bitcoin recognized as legal tender in Suriname?” on Wikicrypto.News.

Government Regulations and Future Outlook 🌐

Bitcoin’s increasing presence in Suriname has sparked discussions on government regulations and the future outlook for the digital currency landscape. As authorities navigate the challenges and opportunities presented by Bitcoin, there is a growing need to establish clear guidelines to ensure its secure utilization within the existing financial framework. The evolving regulatory environment will likely play a significant role in shaping how Bitcoin is integrated into the country’s economy and financial system. With a forward-looking perspective, Suriname aims to strike a balance between fostering innovation in transactions and safeguarding against potential risks associated with the decentralized nature of cryptocurrencies.

Embracing Innovation: the Future of Transactions 💡

The evolution of transactions is undergoing a profound transformation as Suriname embraces innovation in the realm of digital currency. With Bitcoin leading the charge, the future promises a decentralized and efficient payment landscape that transcends geographical boundaries. As traditional banking systems face disruption, this wave of change opens up new opportunities for individuals and businesses alike to partake in a financial revolution that prioritizes accessibility and inclusivity. Embracing this shift signifies not just a change in currency, but a fundamental shift in how we perceive and engage with money.

Link to the content: is bitcoin recognized as legal tender in sri lanka?