Regulatory Landscape 📜

In Sri Lanka, the regulatory landscape surrounding the use of Bitcoin is evolving as authorities seek to understand and adapt to the complexities of digital currencies. Various regulatory bodies are exploring ways to monitor and regulate the use of Bitcoin to ensure transparency and compliance with existing laws. This dynamic environment requires continuous dialogue between policymakers, industry stakeholders, and the public to create a balanced framework that fosters innovation while addressing potential risks.

Taxation Considerations 💸

Taxation considerations when using Bitcoin in Sri Lanka can be complex due to the evolving nature of virtual currencies. Individuals and businesses need to be aware of how profits from Bitcoin transactions are treated for tax purposes, including potential capital gains taxes. This requires a thorough understanding of the tax laws and regulations in Sri Lanka to ensure compliance and avoid any penalties. Seeking professional advice from tax experts is advisable to navigate the taxation landscape effectively.

Consumer Protection Measures 🔒

Consumer protection measures are essential in the realm of Bitcoin transactions to safeguard individuals from potential fraud or misuse of funds. Ensuring transparency and accountability in transactions, as well as educating consumers on best practices for secure use of digital assets, can help mitigate risks. Implementing clear dispute resolution mechanisms and promoting awareness campaigns on safe digital currency usage further enhance consumer protection in the evolving landscape of cryptocurrency. Collaboration among stakeholders, including regulatory bodies and industry players, is crucial in establishing effective measures to build trust and confidence among Bitcoin users in Sri Lanka.

Money Laundering Risks 💰

Money laundering risks associated with Bitcoin usage in Sri Lanka are a critical concern for regulatory authorities. The anonymity and decentralized nature of Bitcoin transactions make it attractive for individuals seeking to hide illicit funds through a complex network of transactions. As a result, there is a heightened risk of money laundering activities going undetected within the Bitcoin ecosystem. To address these risks, regulatory bodies in Sri Lanka have been actively working on implementing stricter anti-money laundering measures in line with global standards and guidelines.

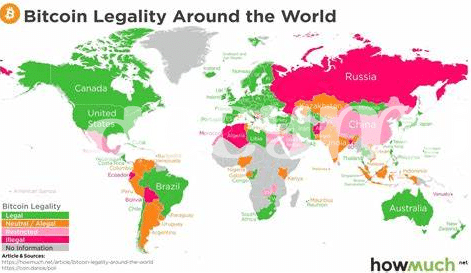

The evolving landscape of Bitcoin regulation and enforcement actions underscores the importance of staying informed and vigilant against potential money laundering risks. For further insights on the benefits and risks of Bitcoin in a global context, including its legal recognition in different countries, you can explore this detailed article: is bitcoin recognized as legal tender in Spain?.

Legal Status of Bitcoin 🏛️

Bitcoin’s legal status in Sri Lanka is a topic that remains ambiguous in the current regulatory framework. The country lacks specific legislation addressing the legality or illegality of Bitcoin and other cryptocurrencies. This lack of clarity creates uncertainty for users and businesses engaging with Bitcoin within the country. While there have been no explicit bans on Bitcoin usage, the absence of clear guidelines raises questions about its acceptance as a legitimate form of digital currency in the eyes of the law.

As the global community continues to navigate the evolving landscape of digital currencies, Sri Lanka faces the challenge of adapting its regulatory framework to accommodate innovations like Bitcoin. Establishing clear legal status for Bitcoin is crucial for providing a stable and secure environment for its usage within the country. Policymakers and regulatory authorities need to address this gap to foster innovation while ensuring compliance with existing legal frameworks.

Future Outlook and Recommendations 🚀

In considering the future outlook for Bitcoin in Sri Lanka, it is crucial to anticipate the evolving regulatory landscape and its impact on the cryptocurrency’s adoption. Recommendations for stakeholders include fostering dialogue between government bodies and industry players to create a balanced framework that supports innovation while addressing potential risks. Moreover, educating consumers about the benefits and risks of using Bitcoin is essential for building trust and confidence in its usage. Embracing emerging technology trends and collaborating with international partners can position Sri Lanka at the forefront of the digital economy.

Is Bitcoin recognized as legal tender in Sudan?