Legal Status of Bitcoin in Bangladesh 🇧🇩

In Bangladesh, the legal status of Bitcoin remains a complex and evolving issue. The government has not yet officially recognized Bitcoin as a legal form of currency, leading to uncertainties in its usage and regulation within the country. While there is no specific ban on Bitcoin, its unregulated nature has posed challenges for both authorities and users alike. This ambiguous legal stance has resulted in a lack of clarity regarding the rights and responsibilities of individuals engaging in Bitcoin transactions in Bangladesh, creating a cautious atmosphere around its adoption and integration into the existing financial system.

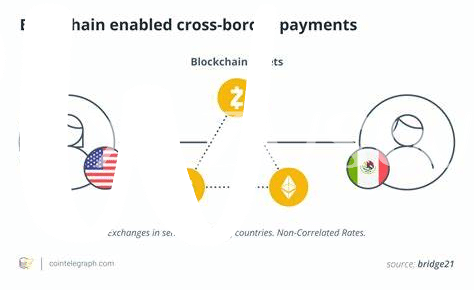

As the popularity and use of Bitcoin continue to rise globally, Bangladesh faces a critical decision on how to approach the regulation of this digital currency within its borders. Establishing a clear legal framework for Bitcoin will be essential in providing guidance to users, businesses, and regulatory bodies, ensuring that transactions are conducted securely and in compliance with existing laws. The evolving nature of technology and finance necessitates a proactive approach from Bangladeshi authorities to adapt to the changing landscape of cross-border money transfers using cryptocurrencies.

Regulatory Challenges for Cross-border Transactions ✈️

Cross-border transactions involving Bitcoin present a myriad of regulatory challenges that necessitate a delicate balance between innovation and compliance. Ensuring seamless money transfers across borders while adhering to legal frameworks and regulations poses a significant hurdle for both businesses and individuals in Bangladesh. From fluctuating exchange rates to differing regulations in various jurisdictions, navigating the complex landscape of cross-border transactions demands vigilance and adaptability. The evolving nature of technology and financial laws further complicates the regulatory environment, requiring continuous monitoring and updates to stay compliant. Despite these challenges, efforts to improve transparency and security in cross-border Bitcoin transfers are crucial for fostering trust and sustainability in the global financial ecosystem.

Compliance Obligations for Money Transfer Services 💼

Compliance obligations for money transfer services in Bangladesh encompass a range of requirements aimed at ensuring transparency and security in cross-border transactions. Companies engaging in these services are expected to adhere to strict regulations to prevent money laundering and illicit activities. This includes thorough customer due diligence processes, reporting suspicious transactions, and maintaining detailed transaction records to facilitate regulatory oversight.

Additionally, money transfer services must stay updated on the evolving regulatory landscape surrounding cryptocurrencies like Bitcoin. This entails implementing robust compliance programs that align with both local laws and international standards. By proactively addressing compliance obligations, money transfer services can build trust with regulators, protect against financial crime, and foster a more secure environment for cross-border Bitcoin transfers.

Aml/cft Requirements in Cross-border Bitcoin Transfers 💰

Amid the evolving landscape of cross-border Bitcoin transfers, ensuring compliance with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations has emerged as a critical focal point. The increasing scrutiny on AML/CFT requirements in these transactions underscores the importance of transparency and accountability in the realm of digital currency. Regulators are actively refining guidelines to address potential risks associated with cross-border Bitcoin transfers, seeking to strike a balance between fostering financial innovation and mitigating illicit activities. This ongoing regulatory framework aims to safeguard against money laundering and terrorist financing while embracing the potential benefits of decentralized currencies. By adhering to AML/CFT protocols, stakeholders can contribute to a more secure and resilient financial ecosystem that accommodates the burgeoning prominence of cross-border Bitcoin transactions. An insightful exploration of how these regulations intersect with the dynamics of Bitcoin transnational flows offers valuable perspectives on the future trajectory of digital currency in the global money transfer landscape. For further insights on this topic, you can refer to bitcoin cross-border money transfer laws in Belarus.

Impact of Central Bank Policies on Bitcoin Transactions 🏦

The policies set forth by the Central Bank play a crucial role in shaping the landscape of Bitcoin transactions within Bangladesh. These policies can directly impact the accessibility, legality, and acceptance of Bitcoin for cross-border transfers. Depending on the stance taken by the Central Bank, it can either facilitate or hinder the smooth flow of Bitcoin transactions across borders. Clear and supportive regulations can foster a favorable environment for the growth and integration of Bitcoin into the traditional financial system. On the other hand, stringent or restrictive policies may create barriers and uncertainties for both individuals and businesses engaging in cross-border Bitcoin transfers. Therefore, the Central Bank’s decisions and guidelines regarding Bitcoin have a significant influence on the overall dynamics of cross-border money transfers in Bangladesh.

Future Outlook for Bitcoin Cross-border Transfers 🚀

The advancement of regulatory frameworks around the globe is pivotal for shaping the future of Bitcoin cross-border transfers. As countries like Bangladesh navigate through the complexities of integrating cryptocurrencies into their financial systems, the outlook for cross-border Bitcoin transactions is evolving. Embracing a proactive approach to regulatory guidelines and compliance standards will be crucial in fostering a conducive environment for seamless cross-border money transfers using Bitcoin. The synergy between technological innovation and regulatory clarity is expected to drive greater efficiency and security in cross-border Bitcoin transactions, paving the way for enhanced financial inclusivity and global economic connectivity.

To explore the legal landscape of Bitcoin cross-border money transfer laws in other countries, consider looking into the regulations governing such transactions in Bangladesh and Bahrain through this link: bitcoin cross-border money transfer laws in bahrain. Understanding the nuances of diverse regulatory frameworks can provide valuable insights into the broader implications for Bitcoin cross-border transfers on a global scale.