Introduction to Bitcoin’s Influence in Bahrain 💡

Bitcoin’s influence in Bahrain has been steadily growing, reshaping the landscape of financial transactions in the region. As a decentralized digital currency, Bitcoin offers a new paradigm for cross-border money transfers, disrupting traditional banking systems and regulatory frameworks. Its borderless nature and peer-to-peer technology enable faster and more cost-effective transactions, challenging the status quo in the financial sector. In Bahrain, this disruptive force is prompting both regulators and financial institutions to reassess their policies and adapt to the changing dynamics of the digital economy. The increasing acceptance of Bitcoin among businesses and individuals in Bahrain reflects a shift towards more efficient and transparent cross-border transactions, paving the way for a future where cryptocurrencies play a significant role in the international transfer of funds.

Evolution of Cross-border Money Transfer Laws 🌍

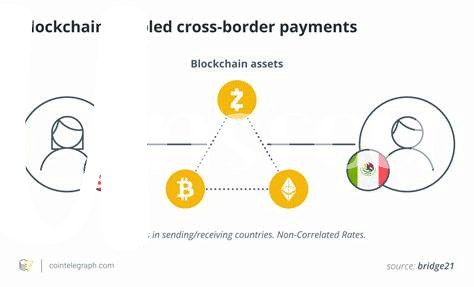

The evolution of cross-border money transfer laws has been a dynamic process shaped by the advancements in technology and the changing global economic landscape. As the world becomes increasingly interconnected, the need for efficient and secure cross-border payment systems has become paramount. Traditional methods of transferring money across borders have faced challenges in terms of speed, cost, and transparency. In response to these challenges, governments and regulatory bodies have been compelled to revisit and modernize existing laws to accommodate the growing demand for seamless cross-border transactions. This evolution has been marked by a shift towards more flexible regulatory frameworks that are inclusive of innovative financial technologies, such as blockchain and cryptocurrencies, like Bitcoin. These new laws aim to strike a balance between fostering financial inclusion and safeguarding against illicit activities, ensuring a more seamless and secure global financial system for all stakeholders involved.

Please insert the provided link with the specified anchor within the text according to the instructions given.

Impact of Bitcoin on Financial Regulations 📈

Bitcoin’s emergence has significantly impacted financial regulations worldwide, including those in Bahrain. As a decentralized digital currency, Bitcoin operates independently of traditional banking systems, challenging the existing regulatory frameworks. The decentralized nature of Bitcoin poses a unique challenge to regulators, as it blurs the lines between national boundaries and traditional financial institutions. This disruption demands a reevaluation of current financial regulations to ensure they can effectively govern this new form of currency. Regulators in Bahrain and around the world are grappling with how to monitor and regulate Bitcoin transactions while maintaining the privacy and security of users. The rapid rise of Bitcoin has prompted regulatory bodies to adapt quickly to the evolving financial landscape, seeking to strike a balance between innovation and consumer protection. This shift underscores the need for a flexible regulatory approach that can accommodate the growing influence of Bitcoin on the financial sector.

Challenges Faced by Traditional Money Transfer 💳

Traditional money transfer methods have encountered a myriad of challenges in the face of advancing technologies like Bitcoin. High fees, lengthy processing times, and lack of transparency are just some of the issues that users face. Additionally, the reliance on intermediaries for cross-border transactions often results in additional costs and complexities. As a result, users are increasingly turning to digital currencies like Bitcoin for their cross-border money transfer needs. The decentralized nature of Bitcoin offers lower fees, faster transaction times, and increased security, making it an attractive alternative to traditional methods. Embracing these new technologies presents an opportunity for the financial sector to streamline processes and improve overall efficiency in cross-border money transfers. For further tips on secure Bitcoin money transfers, check out this informative article on bitcoin cross-border money transfer laws in Azerbaijan.

Adaptation of Bahrain’s Regulations to Bitcoin 💼

Bahrain is navigating the intricate landscape of financial regulations to accommodate the emergence of Bitcoin. The country is proactively evaluating its existing frameworks to determine how they can be adapted to encompass the decentralized nature of cryptocurrencies. The regulatory bodies in Bahrain are engaging in dialogue with industry experts and stakeholders to formulate guidelines that strike a balance between promoting innovation and ensuring consumer protection. The adaptation process involves careful consideration of the potential implications on cross-border money transfers, with a focus on transparency, security, and efficiency. By embracing the opportunities presented by Bitcoin while addressing associated risks, Bahrain aims to position itself as a progressive hub for digital transactions in the region.

Future Prospects for Cross-border Transactions 💱

The advancement of technology, particularly the rise of Bitcoin, is reshaping the landscape of cross-border transactions globally. With the increasing acceptance and adoption of cryptocurrencies like Bitcoin, the future prospects for cross-border transactions appear promising. Traditional banking systems are encountering disruptions as digital currencies offer more efficient and cost-effective alternatives to move money across borders. As countries like Bahrain navigate through these changes, the need for robust regulatory frameworks that accommodate the use of cryptocurrencies is becoming evident. This shift towards embracing digital assets in cross-border transactions signifies a potential transformation in how money is transferred internationally.

For more insights on the impact of Bitcoin on cross-border money transfer laws in different countries, including the Bahamas and Australia, you can explore the detailed analysis provided in the article: Bitcoin Cross-border Money Transfer Laws in Australia.