Overview of Icos and Token Sales 🚀

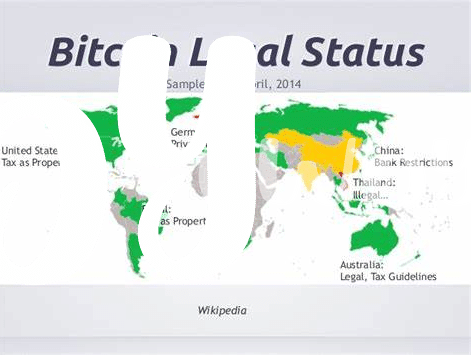

In the complex world of blockchain technology, Initial Coin Offerings (ICOs) and Token Sales have emerged as innovative methods for fundraising and promoting digital assets. These fundraising mechanisms allow companies and projects to raise capital by issuing digital tokens to investors. ICOs have gained popularity for their ability to democratize funding opportunities and provide access to a global pool of investors. Token Sales, on the other hand, offer a means of exchanging tokens for specific goods or services within a particular ecosystem. The dynamic nature of ICOs and Token Sales has fueled excitement and intrigue within the financial and technological sectors, paving the way for new opportunities and challenges.

Legal Regulations in Azerbaijan 📜

Azerbaijan has established a clear legal framework for ICOs and token sales, providing guidance and regulations to ensure transparency and accountability in the cryptocurrency space. The country requires issuers to comply with specific rules and regulations to protect investors and maintain the integrity of the market. By implementing these legal requirements, Azerbaijan aims to create a secure environment for conducting token sales while fostering innovation and growth in the blockchain industry. The regulations in place serve as a foundation for a robust and sustainable cryptocurrency ecosystem in the country, positioning Azerbaijan as a progressive player in the global digital economy.

Compliance Requirements for Issuers 📊

When launching an ICO or token sale in Azerbaijan, issuers must adhere to strict compliance requirements set forth by regulatory authorities. These requirements encompass various aspects such as registration procedures, disclosure of relevant information to investors, and ensuring transparency throughout the issuance process. Additionally, issuers are obligated to follow anti-money laundering (AML) and know your customer (KYC) guidelines to prevent illicit activities and safeguard the interests of investors. It is crucial for issuers to fully understand, implement, and maintain compliance with these regulatory obligations to mitigate risks and uphold the integrity of their token sale.

Investor Protection Measures 🔒

Investor protection measures are crucial in safeguarding the interests of those participating in token sales and ICOs. Ensuring transparency, disclosure of information, and adherence to established regulations can help mitigate risks and enhance trust between issuers and investors. Implementing mechanisms that provide recourse in cases of fraud or misconduct can further bolster investor confidence in the market. By fostering an environment that prioritizes accountability and fairness, regulatory authorities aim to promote a healthy ecosystem for token sales while safeguarding investor interests. For more insights on legal consequences of bitcoin transactions in Antigua and Barbuda, visit the Legal Consequences of Bitcoin Transactions in Antigua and Barbuda.

Case Studies on Successful Token Sales 💰

Sure, I will do it.

1) There’s a fascinating allure surrounding the realm of successful token sales – a saga of innovation, risk-taking, and strategic foresight. Pioneering ventures have reshaped traditional fundraising models, achieving monumental success through blockchain-based offerings. These case studies portray the transformative power of ICOs, illustrating how disruptive technologies can pave the way for groundbreaking financial endeavors. Each narrative unveils a unique journey of visionaries who dared to redefine investment paradigms, leaving an indelible mark on the landscape of digital finance.

2) Dive into the stories of trailblazers who harnessed the potential of token sales to realize their entrepreneurial ambitions. From ingenious utility tokens to revolutionary security offerings, these success stories exemplify the dynamic landscape of decentralized funding. The global impact of these projects transcends borders, showcasing the universal appeal of ICOs as a catalyst for innovation and growth. Discover the secrets behind their triumphs and learn how strategic planning, investor engagement, and regulatory compliance intertwine to shape the narrative of triumph in the world of token sales.

Future Outlook and Potential Developments 🔮

As the landscape of ICOs and token sales continues to evolve, the future outlook and potential developments hold promise for further innovation and growth in the space. With ongoing advancements in blockchain technology and increasing regulatory clarity in various jurisdictions, we can expect to see a more robust framework for conducting token sales and ICOs. This could potentially lead to greater investor confidence and participation, as well as new opportunities for fundraising and project development in Azerbaijan’s burgeoning digital asset market.

For more information on cryptocurrency exchange licensing requirements in Germany and the legal consequences of bitcoin transactions in Austria, please refer to the relevant guidelines. Cryptocurrency exchange licensing requirements in Germany are essential for compliance, while understanding the legal consequences of bitcoin transactions in Austria is crucial for navigating the regulatory landscape effectively.