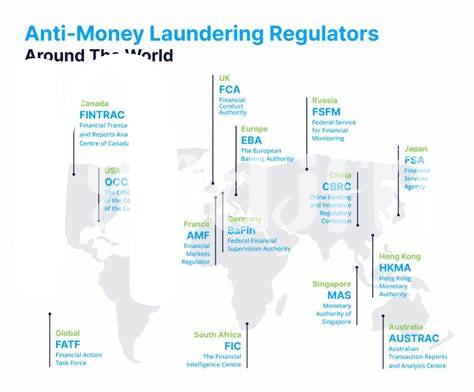

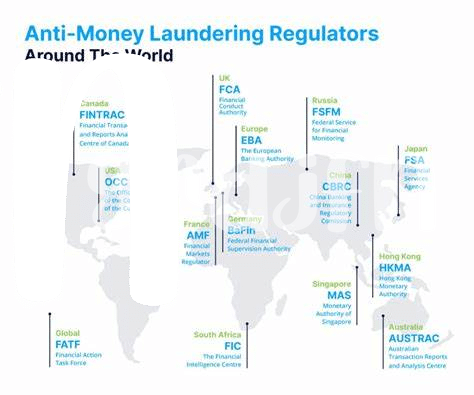

Understanding the Regulatory Landscape 🌍

In order to successfully navigate the complex world of AML policies in the Iraqi Bitcoin sector, it is crucial to have a deep understanding of the regulatory landscape that governs these operations. By staying informed about the laws, guidelines, and compliance requirements set forth by relevant authorities, businesses can proactively mitigate risks and ensure adherence to legal standards. This knowledge serves as the foundation upon which effective AML strategies can be built, empowering organizations to make informed decisions and safeguard against potential threats. As the regulatory environment continues to evolve, maintaining a thorough understanding of these dynamics is essential for long-term success in the industry.

Building a Strong Compliance Team 🤝

When it comes to establishing a robust compliance team, it’s crucial to bring together individuals who are dedicated to upholding regulatory standards and conducting thorough due diligence. Each team member should have a comprehensive understanding of AML policies and procedures, as well as a strong commitment to ensuring adherence within the organization. By fostering a culture of compliance and accountability, the compliance team plays a vital role in safeguarding the integrity of operations and protecting against illicit activities.

Implementing Robust Kyc Procedures 🛡️

Implementing robust Know Your Customer (KYC) procedures is a crucial step for any entity operating in the Iraqi Bitcoin sector. By establishing thorough KYC protocols, businesses can verify the identities of their customers, assess the potential risks associated with each client, and ensure compliance with regulatory requirements. These procedures typically involve collecting identification documents, verifying the authenticity of the information provided, and conducting ongoing monitoring to detect any suspicious activities. Emphasizing the importance of KYC not only enhances the security of the platform but also builds trust with customers who seek a transparent and accountable service provider.

Utilizing Effective Transaction Monitoring Tools 📊

Effective transaction monitoring tools are crucial for ensuring compliance with anti-money laundering regulations in the Iraqi Bitcoin sector. By utilizing sophisticated software, companies can track and analyze cryptocurrency transactions in real-time, flagging any suspicious activities or patterns that may indicate potential money laundering or illegal behavior. These tools provide a layer of security and transparency, allowing businesses to stay ahead of regulatory challenges and safeguard their operations.

To delve deeper into the importance of transaction monitoring tools in the context of AML policies, you can explore a comprehensive guide on bitcoin anti-money laundering (AML) regulations in Hungary on bitcoin anti-money laundering (AML) regulations in Hungary. With the right tools in place, companies in the Iraqi Bitcoin sector can enhance their compliance efforts and contribute to a safer and more trustworthy environment for digital asset transactions.

Educating Staff on Aml Best Practices 🎓

Ensuring that your staff are well-versed in AML best practices is crucial for the success of your compliance efforts. By providing comprehensive training and regular updates on the latest regulatory requirements, you empower your team to confidently navigate potential risks and make informed decisions. Encouraging a culture of compliance within your organization not only enhances operational efficiency but also strengthens your reputation within the industry. Remember, a well-educated workforce is your front line of defense against money laundering and other illicit activities. Through continuous education and reinforcement of AML principles, you are equipping your staff with the knowledge and skills needed to uphold the integrity of your operations.

Regular Audits and Reviews for Compliance 🕵️♂️

Regular audits and reviews are essential for ensuring compliance with AML policies in the Iraqi Bitcoin sector. By conducting these regular checks, companies can identify any potential issues or gaps in their procedures, allowing them to take corrective actions promptly. Audits provide an opportunity to review the effectiveness of existing measures and make necessary improvements to strengthen the overall AML framework.

Additionally, regular reviews help in staying abreast of any changes in regulations or emerging trends in the sector. By staying proactive and constantly evaluating their compliance practices, companies can better mitigate risks and protect their operations from potential threats. This continuous cycle of audits and reviews demonstrates a commitment to maintaining a robust AML program in the Iraqi Bitcoin sector.

Bitcoin Anti-Money Laundering (AML) Regulations in Ghana